Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

European natural gas prices are between three and four times higher than in the US, providing a critical handicap to the continent's companies.

Brussels is weighing new powers to temporarily cap EU gas prices, which have recently hit record levels compared with the US. European natural gas prices traded at the highest in more than two years this week, in part because of low temperatures and a lack of wind that has hampered renewable energy production. They are between three and four times higher than in the US, providing a critical handicap to European companies. The European Commission is considering a cap as part of discussions about a “clean industrial deal” policy document to be presented next month, said three people with knowledge of the talks. The strategy paper should outline ways to shore up the EU’s heavy industries as businesses grapple with multiple challenges including US President Donald Trump’s aggressive trade measures and the EU’s own ambitious green transition. Talks around mechanisms to cap prices, though still at an early stage, have drawn a backlash from industry groups which warn against damaging “trust” in the European market. Link to artivcle >>> https://lnkd.in/eJbxpaKf Source: FT

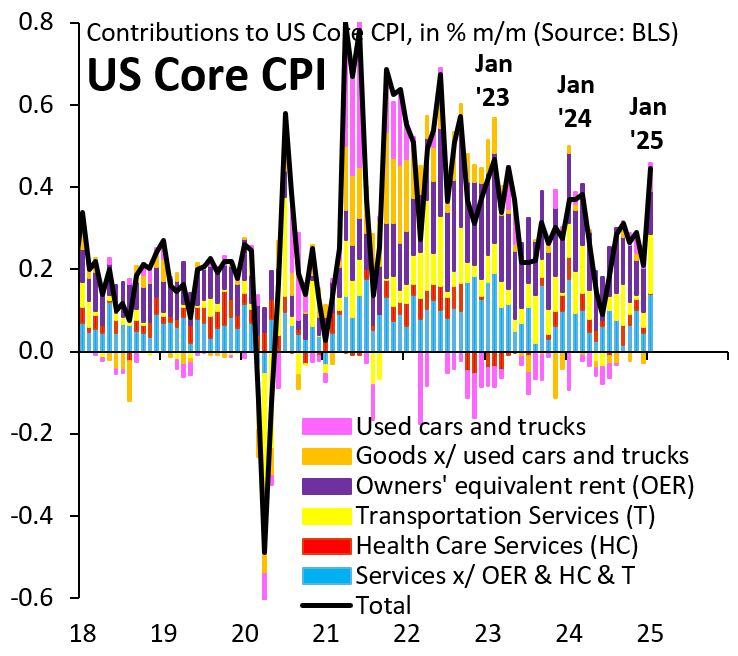

Ever since COVID, January inflation has come in "hot."

Today's core CPI is no different. A proxy for underlying inflation is "core" services (in blue on the chart below courtesy of Robin Brooks) and that looks well-behaved. So it could be that this "hot" reading is largely about noise and residual seasonality, as in 2023 and 2024... Source: Robin Brooks

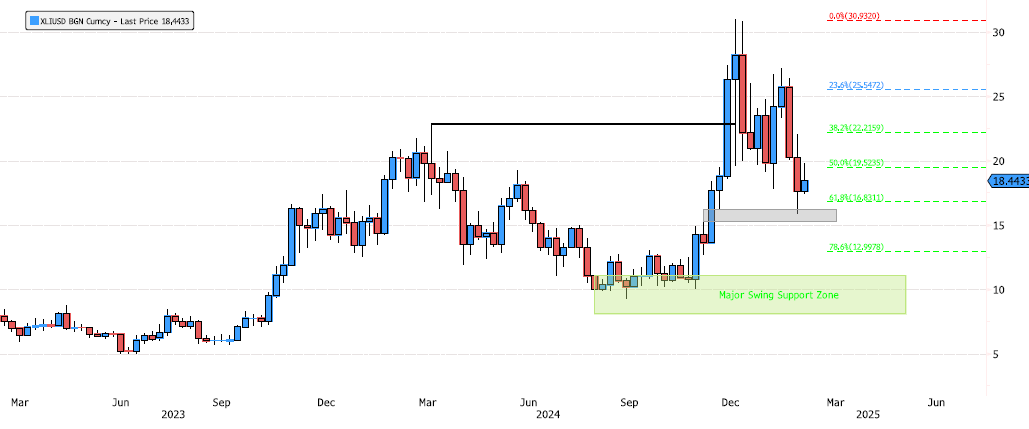

Chainlink Reaching Discount Zone

Chainlink (XLIUSD) has consolidated 48% since its December highs. It has pulled back more than 50% on the Fibonacci retracement, confirming that it has reached the discount zone. Additionally, it has rebounded from the imbalance zone between 15.35-16.20. Keep an eye on the price action for potential opportunities. Source: Bloomberg

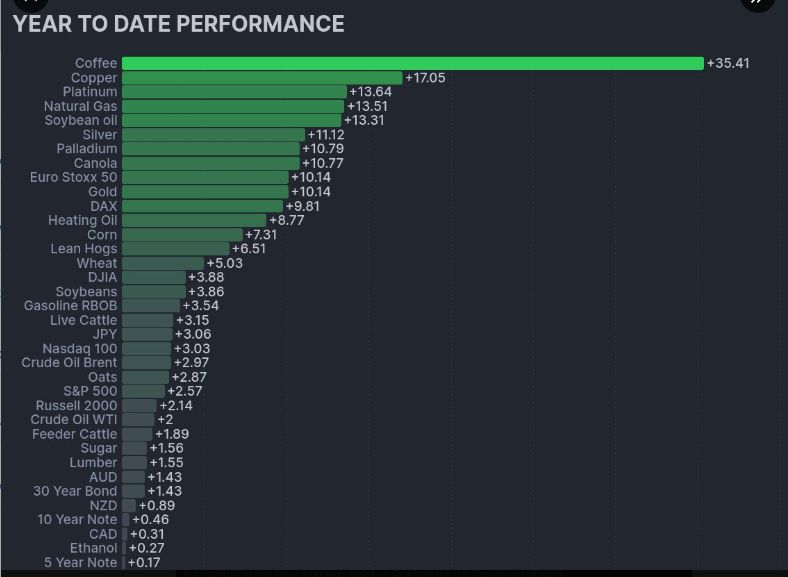

Commodities are enjoying a strong start to 2025

source : markets&mayhem

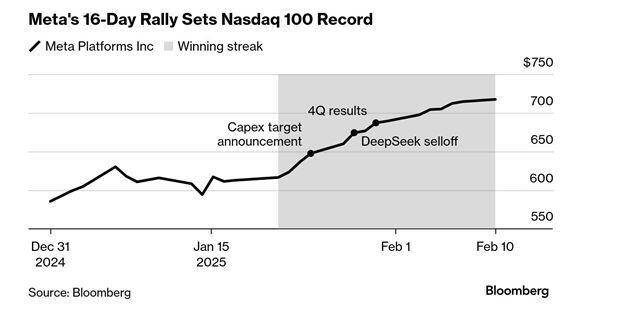

Meta's Record Run

The shares are coming off a rally of 16 straight sessions, the longest streak of any current Nasdaq 100 Index company going back to 1990. The stock added more than 17% over the surge, bringing its market capitalization above $1.8 trillion. source : bloomberg

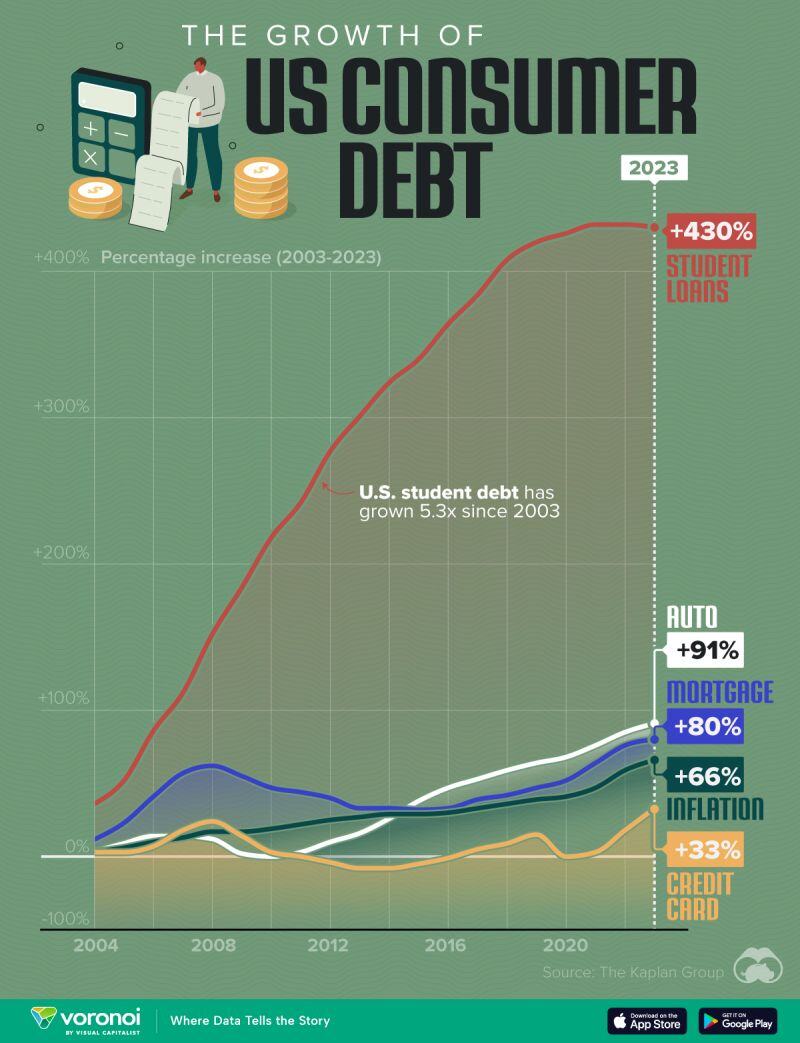

Visualizing the Growth of U.S. Consumer Debt

🚨 The Kaplan Group analyzed the State Level Household Debt Statistics from 2003 to 2023, sourced from the Federal Reserve Bank of New York. Data were retrieved for auto loans, mortgages, credit cards, and student loans since 2003. The evolution of each of these elements over the last 20 years was calculated. For inflation, the Consumer Price Index (CPI) was utilized. 👉 Key Takeaways - Student loan debt is five times larger than it was 20 years ago - Credit card debt has shown minimal growth since 2023; from 2010 to 2016, it was even lower than in 2003 - The total amount of debt has grown by 81.5% since 2003 Source: Visual Capitalist, Voronoi

US innovation & entrepreneurial spirit versus overregulation, left redistribution mindset and lack of innovation.

EU is straight on its way to become an open-air museum. Source: Michel A.Arouet, Augur infinity

Investing with intelligence

Our latest research, commentary and market outlooks