Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

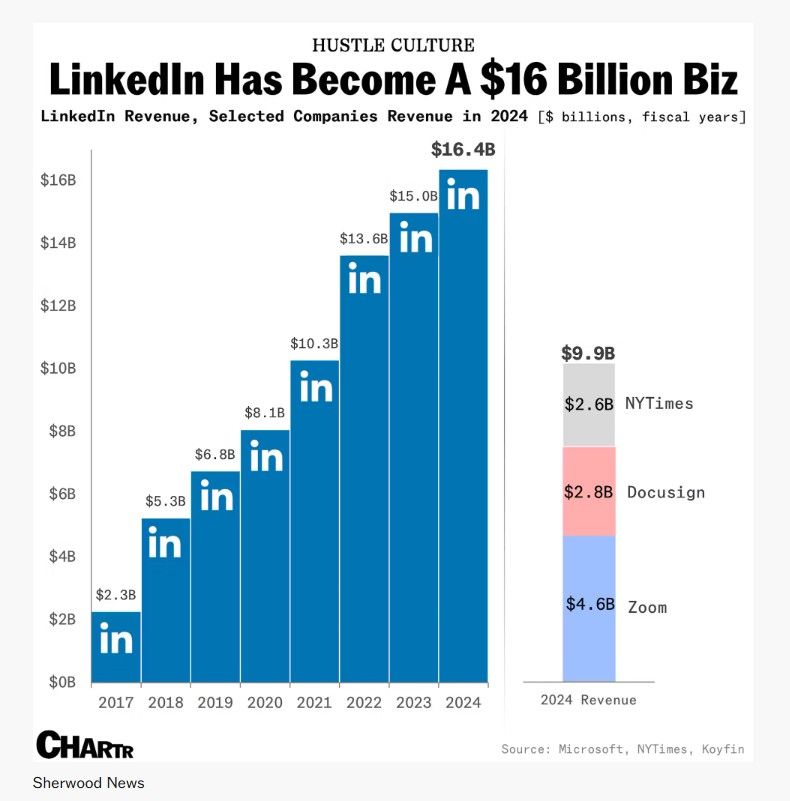

Linkedin Has Become a $16bln Biz

Last week, Microsoft revealed that the site is seeing record engagement, with comments on the platform up 37% year over year. Moreover, millions of people have now signed up for LinkedIn Premium; the company revealed that it’s earned more than $2 billion in revenue from its AI-laden premium service in the last 12 months. Indeed, LinkedIn more broadly contributes healthily to Microsoft’s bottom line — the division delivered $16 billion in revenue in 2024, more than The New York Times, Zoom, and Docusign put together. source : chartr

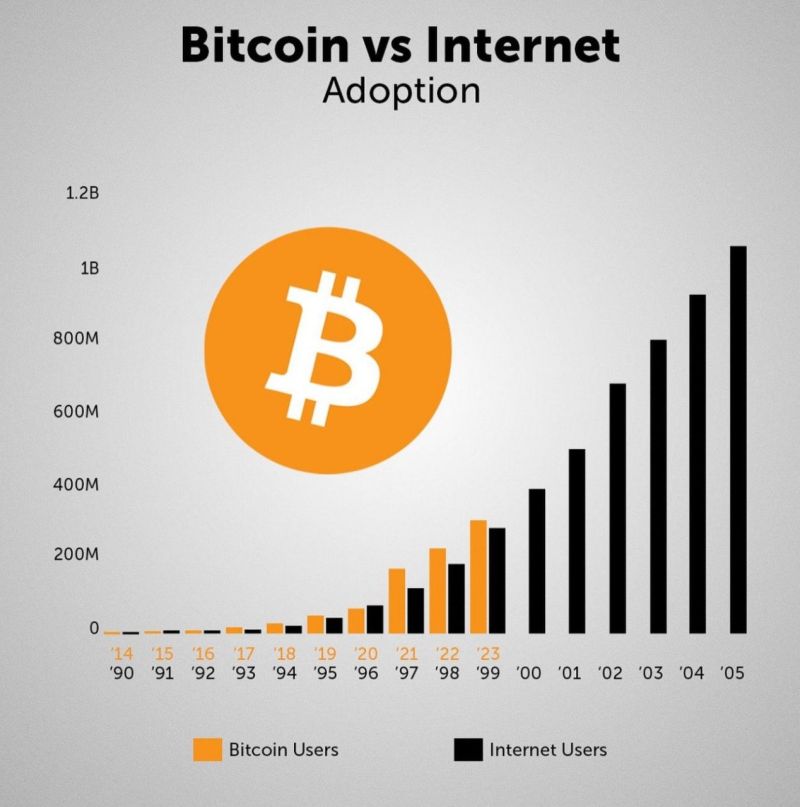

🚨CRYPTO ADOPTION 43% FASTER THAN MOBILE PHONES, 20% FASTER THAN INTERNET

Crypto has hit 300M users in just 12 years—43% faster than mobile phones and 20% faster than the internet, per BlackRock. Younger generations, inflation fears, and Trump’s pro-crypto stance are fueling the surge. With bitcoin ETFs projected to hit $250B and regulatory wins piling up, crypto’s mainstream takeover is accelerating. Source: BlackRock thru Mario Nawfal on X

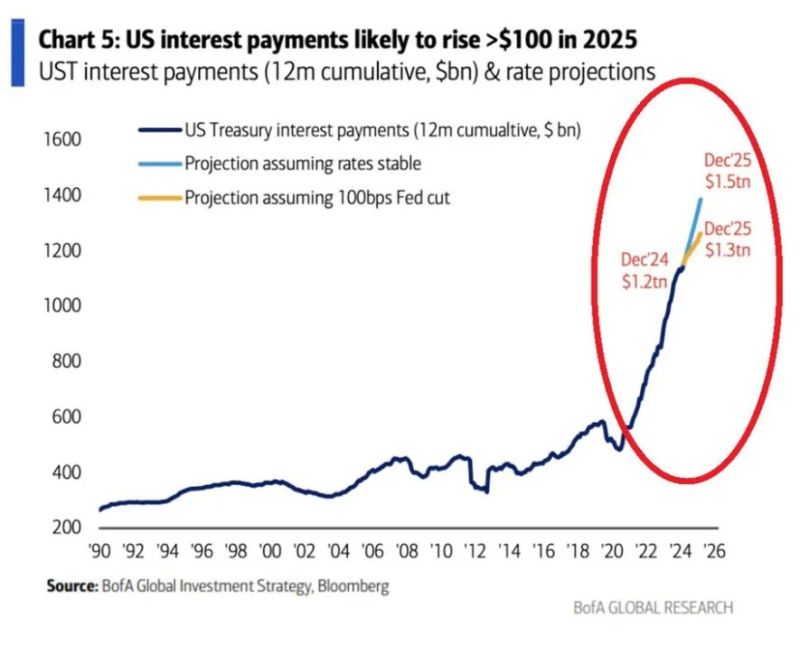

US Interest Costs Soar to $1.2 Trillion – Now Exceed Defense Spending

Over the last 12 months, US interest payments hit a record $1.2 trillion, surpassing defense spending ($900 billion) and now ranking as the second-largest government expense after Social Security. With trillions in debt maturing this year, the US government will have to refinance. If rates remain stable, total interest payments could skyrocket to $1.5 trillion by year-end. Even in a scenario where the Fed cuts rates by 100 bps (from 4.5% to 3.5%), interest costs are still projected to reach ~$1.3 trillion by the end of 2025. source : BofA

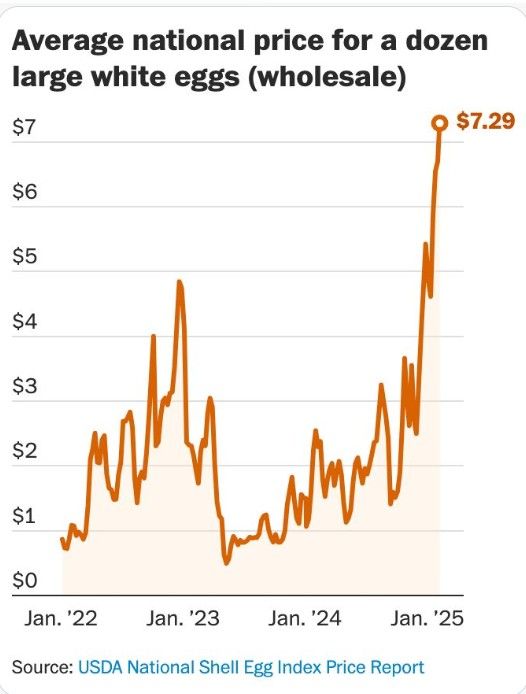

Not an AI or Tech Company 🐣

Egg prices are outperforming a lots of stocks including technology stocks, now up +700% since January 2024.

Western Biotech’s “DeepSeek Moment” – China’s Rise in Pharma Innovation.

A WSJ artivcle >>> https://lnkd.in/eSua5PBt The WSJ article opens with how Summit Therapeutics’ cancer drug, licensed from China’s Akeso, outperformed Merck’s $30B Keytruda. But apparently this isn't all that special — Chinese companies now account for 31% of major pharma licensing deals, up from just 5% in 2020. Why Chinese Biotech Is Winning ✅ Lower costs & streamlined clinical trials ✅ Lean operations with minimal bureaucracy ✅ Better drug candidates at lower prices ✅ Faster R&D with Wuxi and other CDMOs driving efficiency Source: Rui Ma 马睿 on X, WSJ

Jevons' Paradox in action: The initial response to the "DeepFreak" suggests companies are spending more, not less.

Cloud Capex is projected to grow 40% in 2025, according to @MeliusResearch Source: Holger Zschaepitz @Schuldensuehner

*TRUMP: WILL ANNOUNCE 25% TARIFFS ON STEEL, ALUMINUM MONDAY The largest exporter of steel & aluminum to the US? canada followed by mexico

What happened to the 30 day moratorium on tariffs from Canada & Mexico? Source: Vic_Turbendian

BREAKING: Beginning Monday, China will implement tariffs of up to 15% on $14 billion in U.S. exports, including LNG, coal, crude oil, farm equipment, and select vehicles.

Looks like China is fighting back against Trump's 10% tariffs on Chinese imports that he announced last week... Source: Financial Times

Investing with intelligence

Our latest research, commentary and market outlooks