Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Investing in technology and specifically artificial intelligence (AI) also seemed to be front and center in the early days of the new administration.

President Trump signed an executive order to "make America the world capital in Artificial Intelligence." The order calls for agencies to craft policy to ensure U.S. dominance in AI. In addition, the new administration has proposed backing a private-sector investment of up to $500 billion to fund infrastructure for AI. The new venture, called Stargate, aims to build data centers – a huge need to support AI computing power – and potentially create up to 100,000 jobs. The investments in data centers and electricity are critical for the U.S. to maintain leadership and be a driver for AI technology and applications. The chart below shows the energy requirements measured in terawatt hours for U.S. datacenters is expected to rise over the coming years. Source: Edward Jones

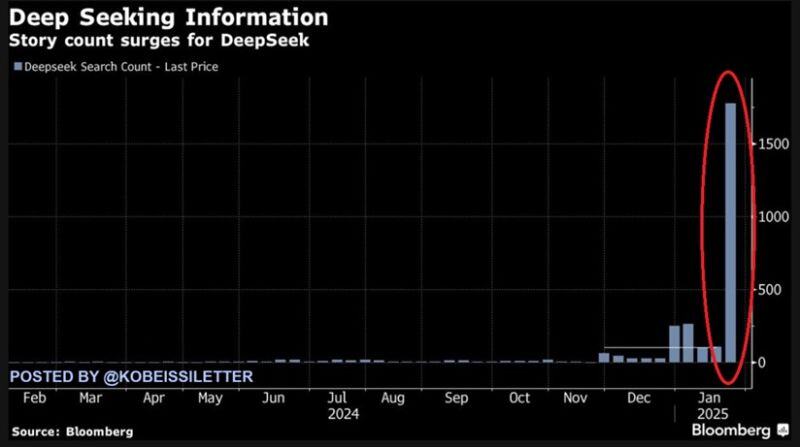

DeepSeek has completely taken over media with nearly 2,000 news articles published today.

Source: Bloomberg, Adam Kobeissi

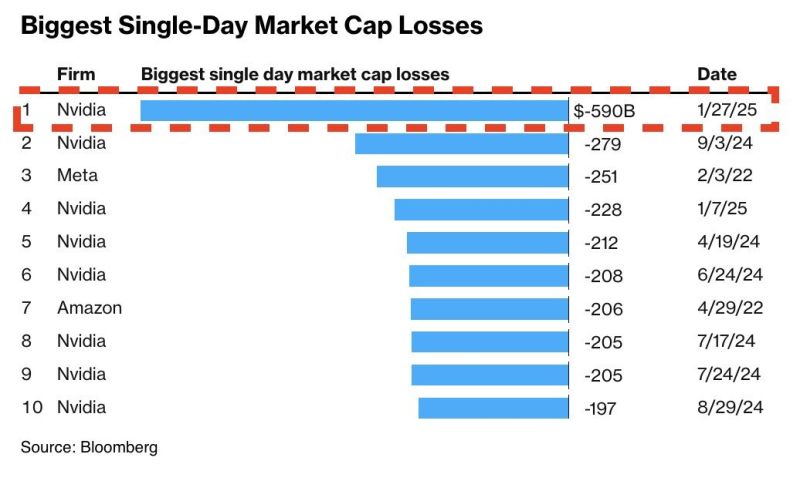

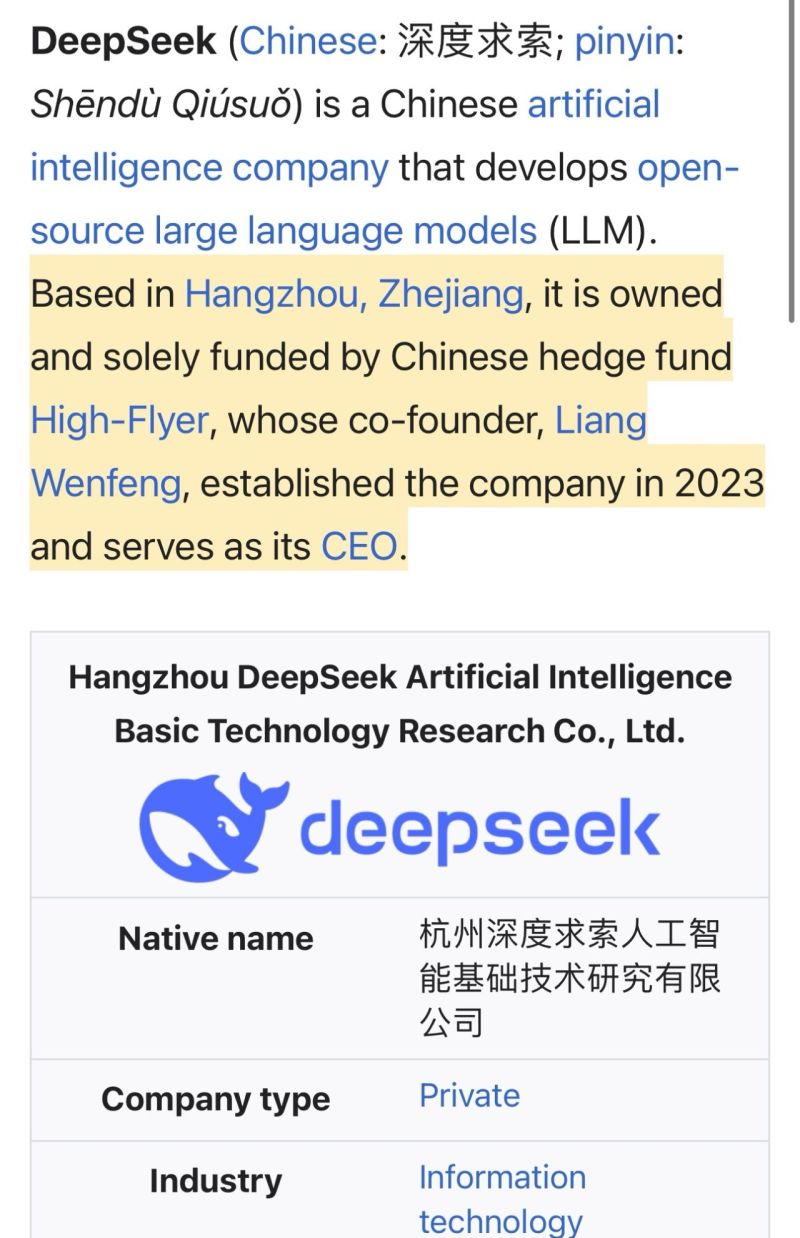

Interesting to see that DeepSeek is owned by a hedgefund …

Did they short nvidia before announcing the world - through a paper authored by their lab - that the DeepSeek-R1 model outperforms cutting-edge models such as OpenAI’s o1 and Meta’s Llama AI models across multiple benchmarks?

The point of making money is not so you can buy everything.

Source: Seek Wiser

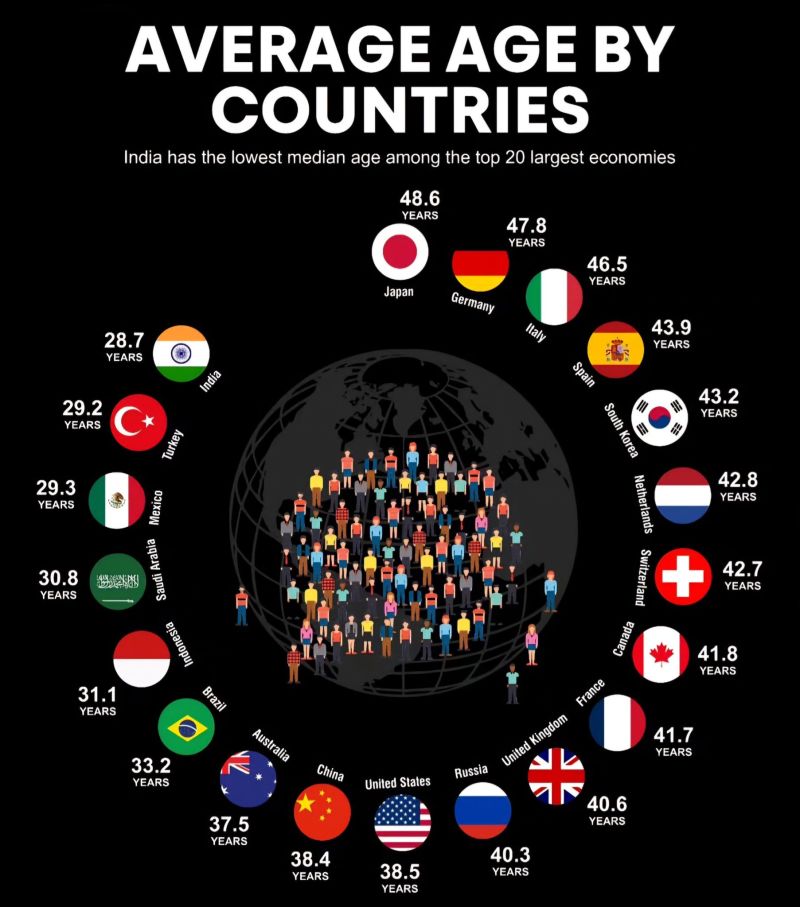

Everyone knows that Japan is getting old, but look what is happening in major European countries.

Who is supposed to pay for pensions and healthcare entitlements in Germany, Italy and Spain in few years? Source: Michael A. Arouet

Investing with intelligence

Our latest research, commentary and market outlooks