Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

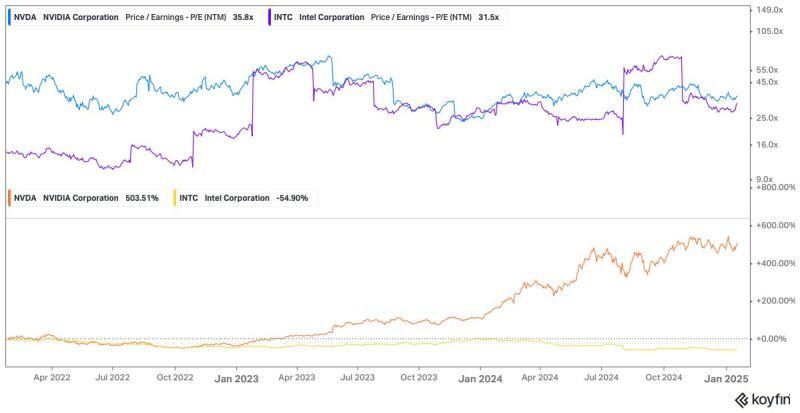

Three years ago, you could have invested in $INTC at just 14x forward earnings or $NVDA at 45x forward earnings.

The returns: $NVDA: +503% $INTC: -55% As Terry Smith said, "Owning good companies is more important than owning undervalued companies." Source: Wolf of Harcourt Street @wolfofharcourt

Some very suspicious activity on $TRUMP meme when it was launched on Friday.

At 6:00 PM ET, President Trump says "I don't know very much about it" regarding his memecoin, $TRUMP. 3 minutes later, at 6:03 PM ET, $TRUMP fell over -33% and a wallet purchased $5.09 MILLION worth of it at the EXACT bottom. This is one of the biggest single purchases since the coin launched. 14 minutes later and this trader is now up $2.4 MILLION on this purchase. Did someone know? Source: The Kobeissi Letter

Signs of the time... German Chancellor Olaf spoke in front of a half-empty congress hall at wef25 in davos.

Source : @schuldensuehner on X

New research published in the The Journal of Cleaner Production reports

"The findings of this study show that bitcoin mining can be used as an efficient alternative to extract added profits from various planned renewable energy facilities in the US." Source: Documenting ₿itcoin

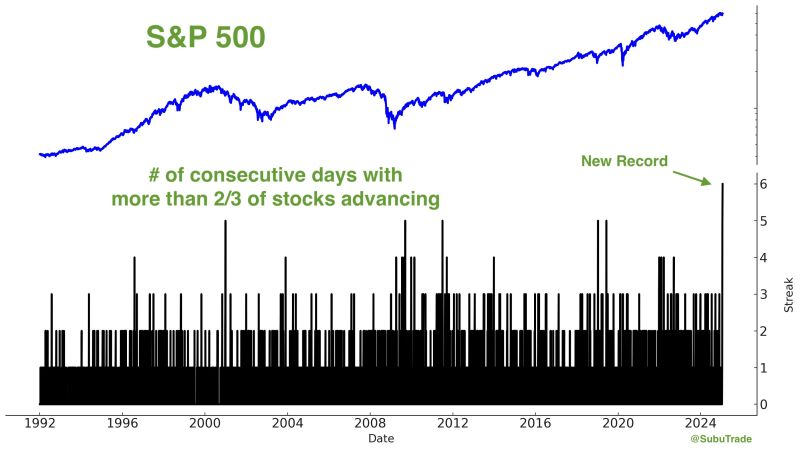

Record strong breadth!

Yesterday was the 6th consecutive day that more than 2/3 of the S&P advanced. First time this has happened in 30+ years. h/t @FrankCappelleri

U.S. SEC announces new task force to create a "clear regulatory framework for crypto assets” lead by Commissioner Hester Peirce.

Cryptos are moving up Source: Documenting Bitcoin

JUST IN: 🚨TRUMP TO ANNOUNCE $500 BILLION AI INFRASTRUCTURE INVESTMENT

Trump is set to unveil a private sector-backed AI project called Stargate, led by OpenAI, SoftBank, and Oracle. The companies will invest $100 billion initially, with plans to reach $500 billion over 4 years, starting with a massive data center in Texas. SoftBank CEO Masayoshi Son, OpenAI’s Sam Altman, and Oracle’s Larry Ellison will join Trump at the White House for the announcement. Source: CBS News, Mario Nawfal

Investing with intelligence

Our latest research, commentary and market outlooks