Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

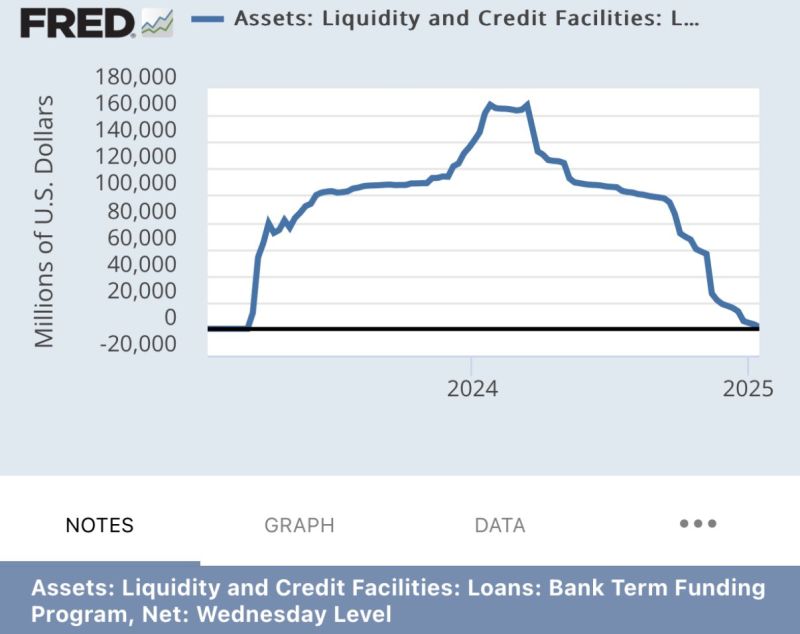

The BTFP, introduced under Biden, acted as a lifeline, letting regional banks trade toxic, low-yield debt for loans at par value, disguising their insolvency.

Now drained, what will happen to the program? Could this put the regional banking system at risk? Source: FRED, The Coastal Journal

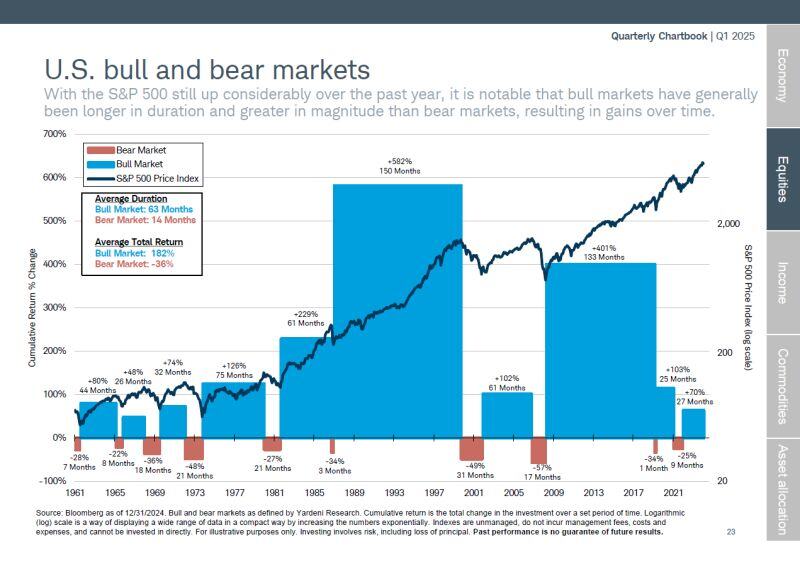

Bear markets pale in comparison to bull markets, both in market movement and duration.

Remember this chart during the next - and inevitable - correction or bear market. Source: Peter Mallouk

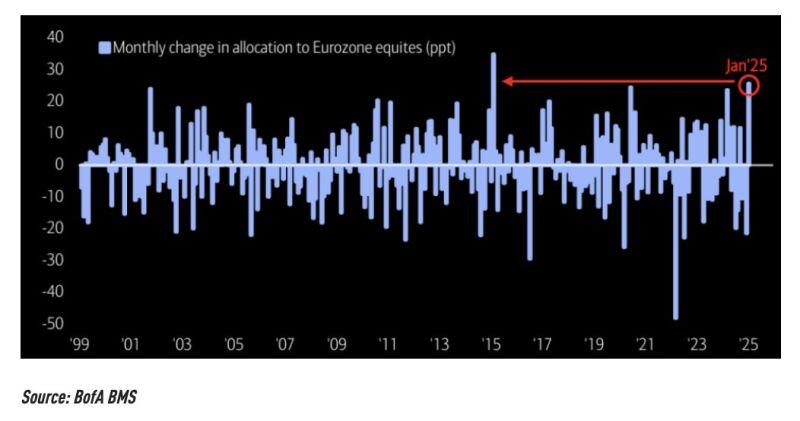

The 2nd largest rotation into european equities in the last 25 years is currently taking place.

Source: Bloomberg, Barchart

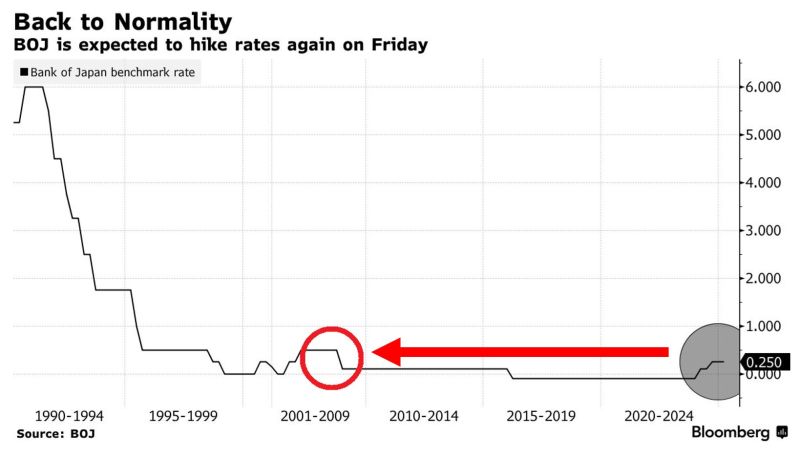

‼️The Bank of Japan is set to HIKE rates again on Friday:

The market is pricing a 90% chance that the BoJ will raise rates by 0.25% to 0.50% on Friday, the highest in 16 years. That would be the 3rd rate hike in less than 12 months, after 17 years without an increase. Source: The Kobeissi Letter, Bloomberg

Strategic Bitcoin Reserve legislation is gaining momentum.

11 states, including Florida, Wyoming, and Massachusetts, have introduced bills to secure Bitcoin as part of their state reserves. Source: TFTC @TFTC21

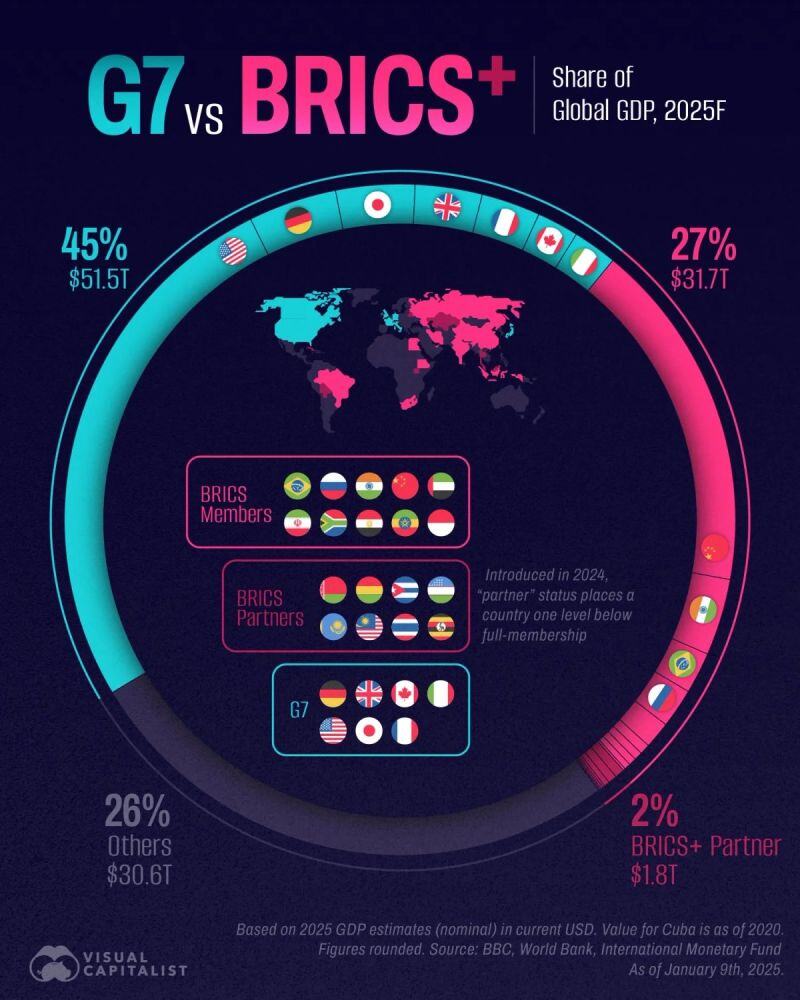

G7 vs. BRICS - Global GDP

Source: Barchart, Visual Capitalist

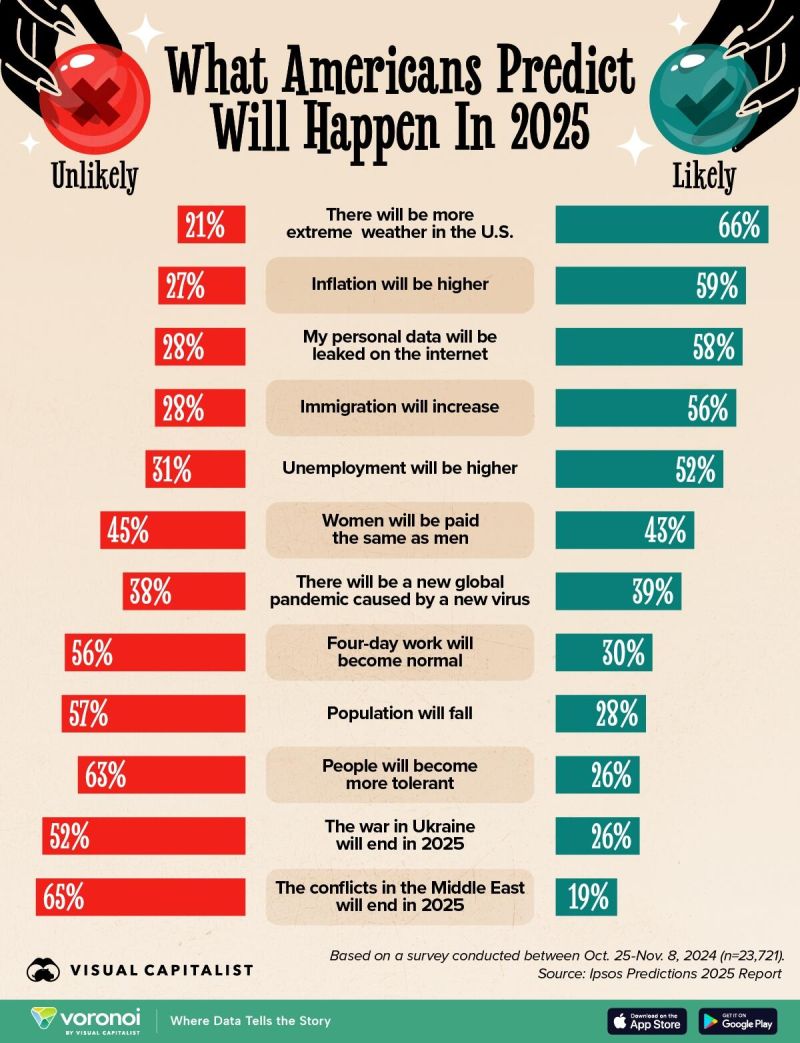

The year 2025 begins with a new president taking office, a ceasefire in Gaza, and wildfires causing extensive destruction in Los Angeles - all within the first month.

So, what can we expect from the rest of the year? This graphic, via Visual Capitalist's Bruno Venditti, presents predictions for 2025 on various topics, based on a survey conducted by Ipsos between October 25 and November 8, 2024, in the United States. Source: Visual Capitalist

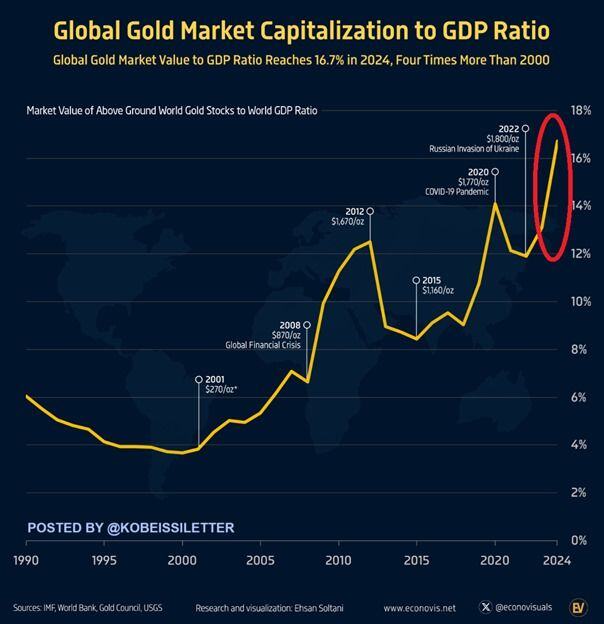

Gold is shining: Gold's global market cap to world GDP ratio reached a RECORD 16.7% in 2024.

This ratio has doubled in 10 years and quadrupled since 2001. Nominally, gold’s market value sits near an all-time high of ~$18.5 trillion. This comes as gold as posted an average annual return of +9.5% since 2000, making it one of the best performing major asset classes this century. Since the start of 2024, gold prices have hit 41 all-time highs and are up +33%. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks