Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tether has announced that the entire Tether group is going to be relocating and will now be HQ'd in El Salvador.

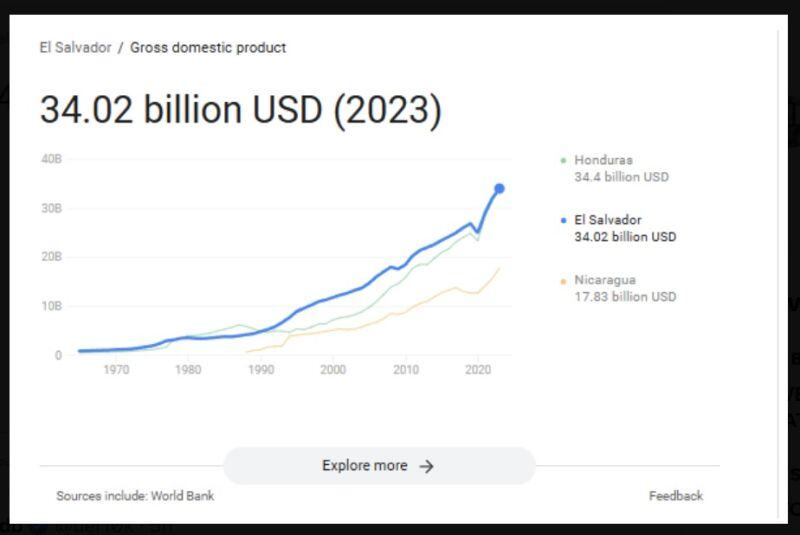

This has to have a massive impact on El Salvador. I mean the estimated GDP of ElSalvador was $34 billion in 2023 according to the World Bank. Tether had a net PROFIT of $10 billion in 2024... Source: James Seyffart @JSey

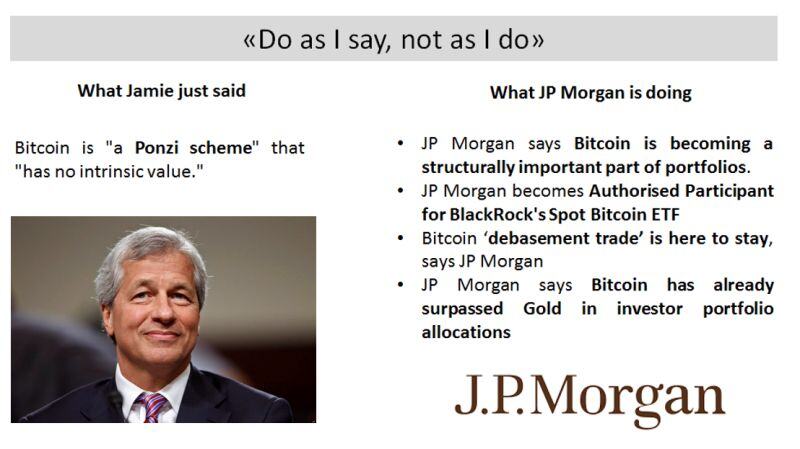

$JPM CEO Jamie Dimon just said that $BTC is "a Ponzi scheme" that "has no intrinsic value."

Meanwhile, the bank he runs is progressively adopting cryptos… Jamie Dimon, CEO of JPMorgan Chase, reiterated his harsh criticism of bitcoin. Despite his negative stance, Dimon concedes that cryptocurrencies might have a role in the future of finance. His views on Bitcoin have fluctuated over time, highlighting a pattern of inconsistency. And his own bank seems to be ignoring what he is saying...

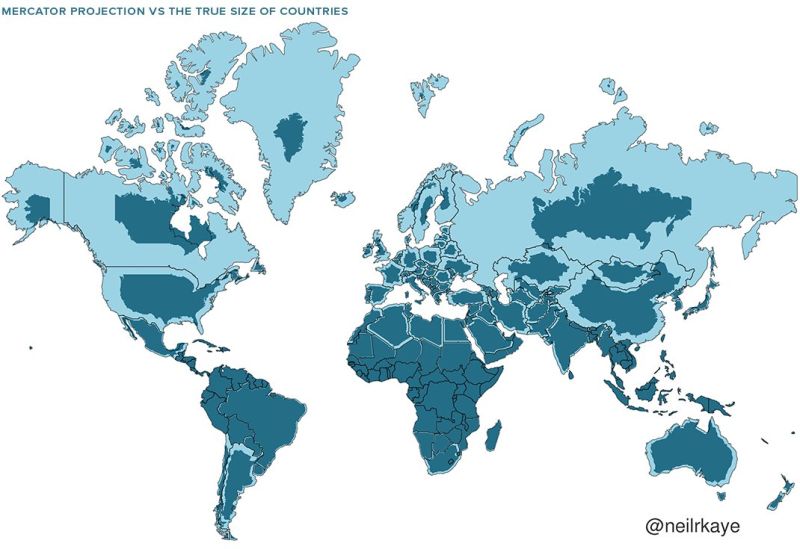

Map of the actual size of each country

Source: Epic Maps 🗺️ @theepicmap

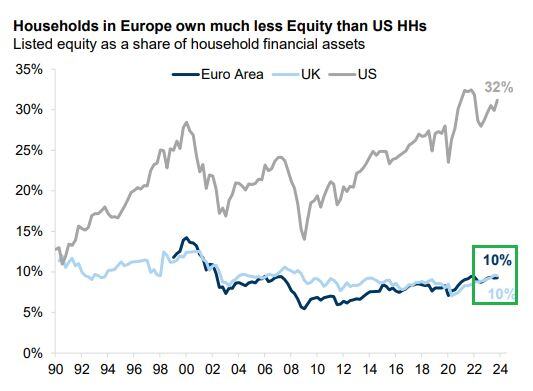

Europeans own much less stocks than those in the US

Source: GD, Mike Zaccardi, CFA, CMT, MBA

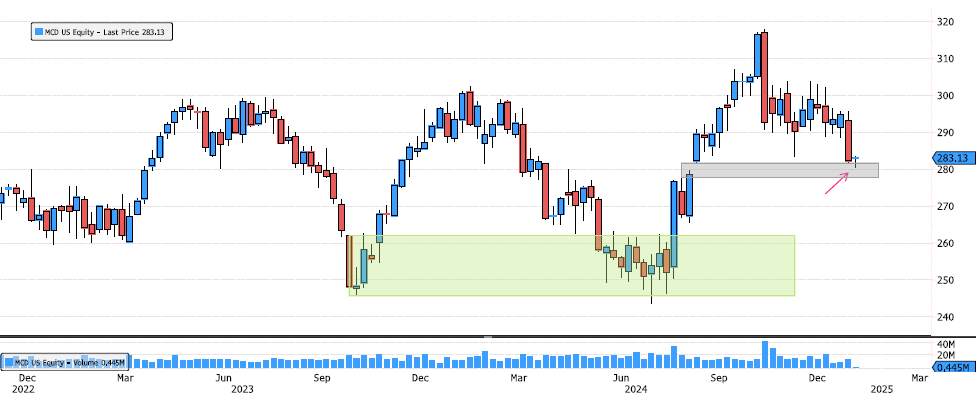

McDonald's Reached First Key Level

McDonald's (MCD) has consolidated 12% since its October highs. It has just reached a key level, the 50% Fibonacci retracement at 280.715, as well as the imbalance zone between 277.87-281.72. Keep an eye on the price action at this level for potential opportunities. Source: Bloomberg

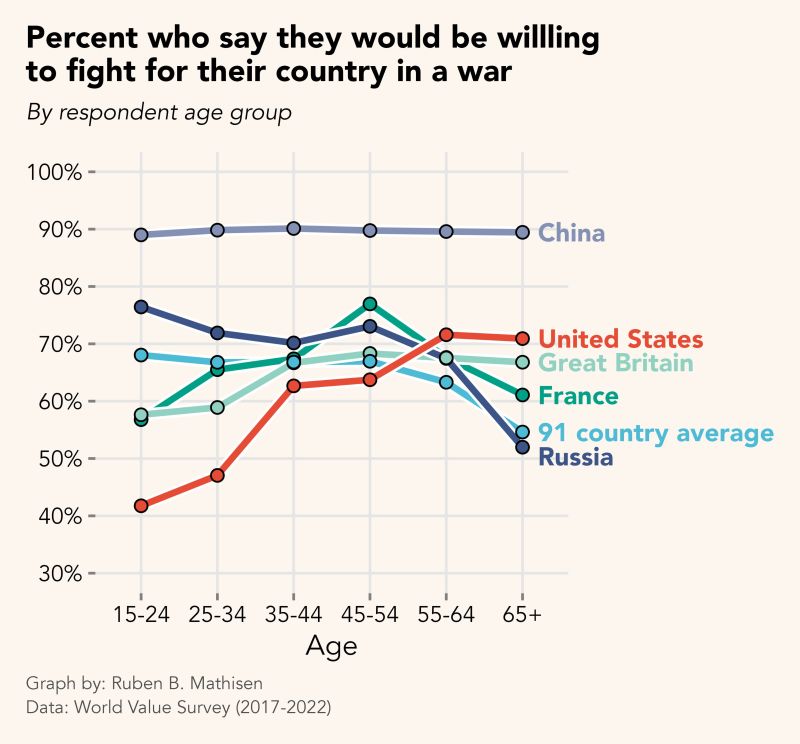

An interesting Graph📈

The US has a big generational divide on willingness to fight for their country if it came to a war. The young are considerably less willing to do so than the old. This is different from most other countries. Source: @rubenbmathisen on X

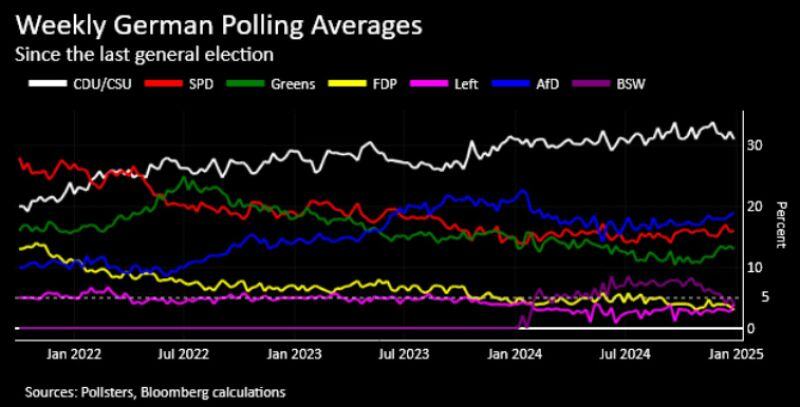

In Germany, Chancellor Scholz attempts to boost his campaign by appealing to anti-American sentiment.

He steps up criticism of Trump’s expansionist rhetoric. Currently, Scholz's SPD is trailing in third place, behind the CDU/CSU and AfD. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks