Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

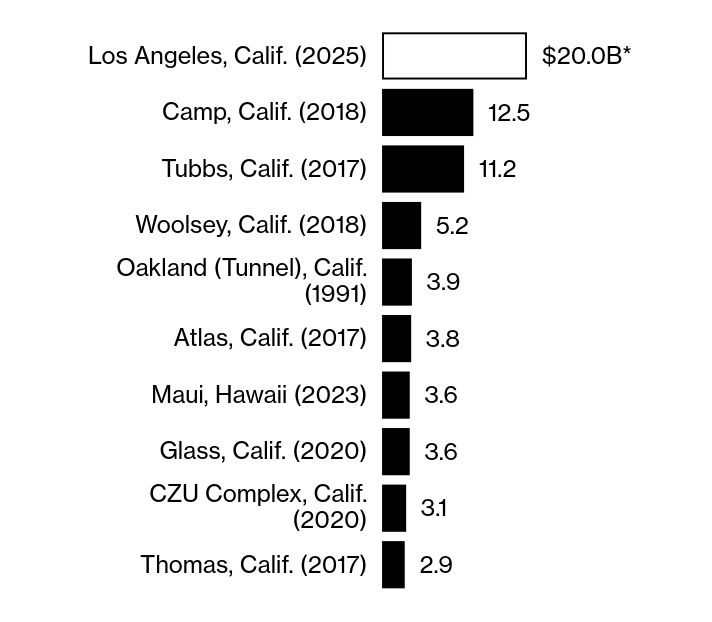

Insured losses from the California wildfires are estimated to be the highest ever

Source: Markets & Mayhem

One of Morgan Stanley 2025 Theme is the Future of energy:

"In 2025, our focus shifts from hashtag#decarbonization to the wide range of factors driving the supply, demand, and delivery of hashtag#energy across geographies. The common thread is the potential for rapid evolution. Four key dynamics: (1) an increasing focus on energy security; (2) the massive growth in energy demand driven by trillions of dollars of hashtag#AI hashtag#infrastructure spend, to be met by both fossil fuel-powered plants and hashtag#renewables; (3) innovative hashtag#energy hashtag#technologies such as carbon capture, energy storage, nuclear power, and power grid optimization; and (4) increased electrification across many industries. Relatedly, we continue to believe that carbon emissions will likely exceed the targets in various nations’ climate pledges. Hence, we expect focus to shift toward climate adaptation and resilience technologies/business models". Source: Morgan Stanley, zerohedge

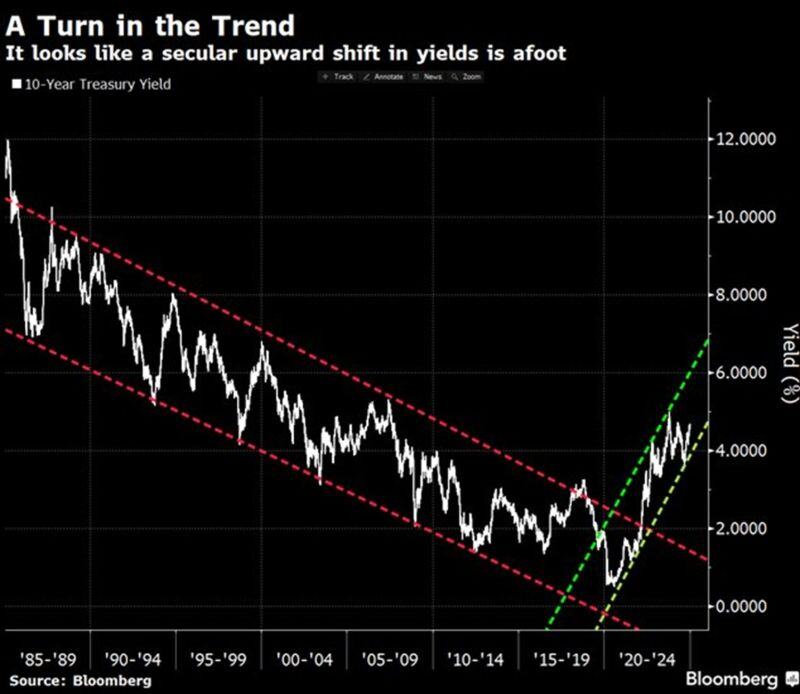

A turn in the trend? US 10-year Treasury yield has risen ~440 basis points over the last 5 years to 4.76%.

If this trend continues that will materially shift the investing landscape with many investors being caught off guard. Source. Bloomberg, Global Markets Investor

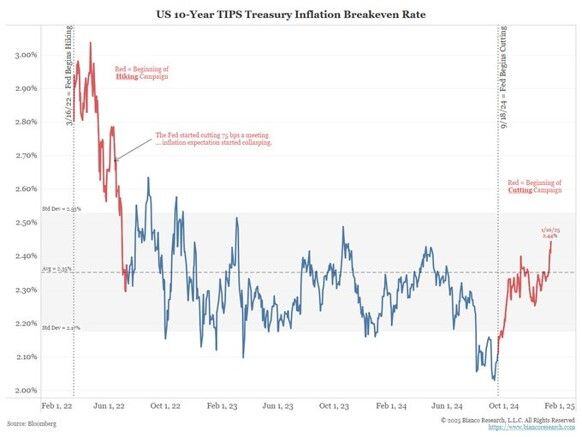

🚨 Great chart and post by James Bianco about US 10-year TIPS breakeven during inflationary time.

👉 The chart below shows the 10-year TIPS breakeven. The LEFT part of the line in RED shows the first 115 days after the Fed started HIKING in 2022. Expectations went straight DOWN. See the RIGHT part of the line in RED, the first 115 days after the Fed started CUTTING in September. Expectations are going straight UP and are at a 15-month high. 👉 Restated, the Fed hikes and inflation expectations GO DOWN. The Fed cuts and inflation expectations GO UP. This is classic "inflationary environment" behavior. 👉Markets were disappointed that the Fed did not cut enough is a previous cycle (pre-2020) reaction. This cycle (post-2020) is about dealing with inflation, and cutting is NOT dealing with inflation. Source: Bianco Research

This chart is $IEI iShares 3-7 years Treasury Bond ETF / $HYG iShares iBoxx $ High Yield Corporate Bond ETF

Clearly not indicating any major credit risk! Maybe the market isn’t pricing in a credit crisis because there isn’t one to price in... Source: @cfromhertz on X

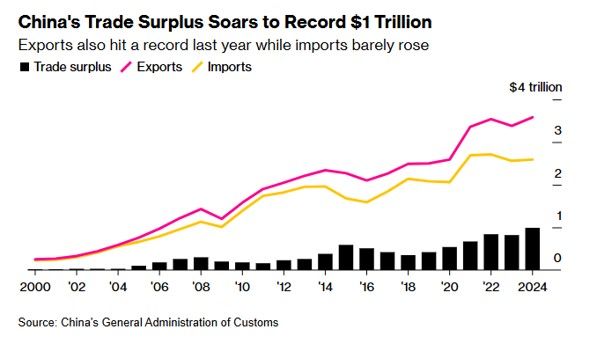

China trade surplus soared to $1 Trillion on Pre-Trump exports

👉 China’s trade data in December beat expectations by a large margin, with exporters continuing to frontload shipments as worries over additional tariffs mount, while the country’s stimulus measures appear to be supporting demand in the industrial sector. 👉 Exports in December jumped 10.7% in U.S. dollar terms from a year earlier, beating expectations of a 7.3% growth in a Reuters poll. That compares with a 6.7% growth in November and a spike of 12.7% in October. 👉Imports rose 1.0% last month from a year earlier, reversing from the contraction in the preceding two months. Analysts had forecast imports to fall 1.5% on year. That compares with a bigger drop of 3.9% in November and 2.3% in October. Source: Bloomberg, CNBC

The $TLT chart shows a significant 52% decline from its peak, highlighting the harsh effects of increasing rates.

Investing in long-duration US Treasuries is advisable only under specific circumstances: - When a recession is on the horizon. - When inflation is quickly slowing down. Currently, neither of these scenarios is unfolding. Source: Kurt S. Altrichter, CRPS® on X

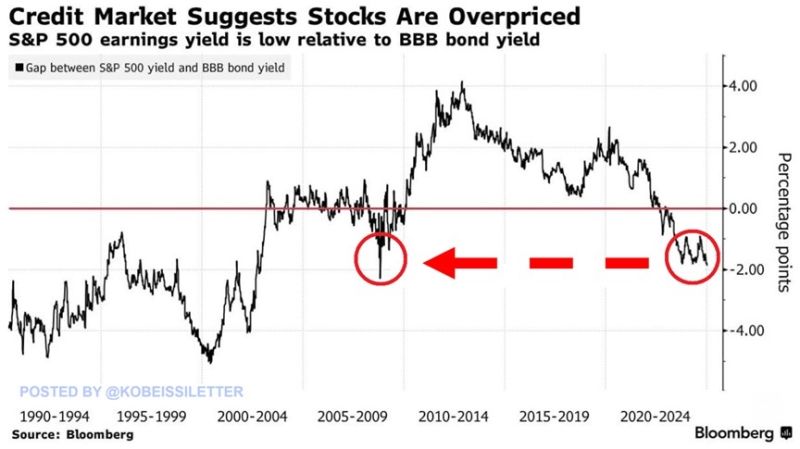

BREAKING: The difference between the S&P 500’s earnings yield and BBB-rated corporate bond yield has dropped to -1.9%, the lowest in 15 years.

Excluding a brief period in 2009, this is the lowest level in 23 years. The gap has fallen by 4 percentage points over the last 5 years as US interest rates have risen sharply. In other words, less risky investment-grade corporate bonds now pay a higher yield than S&P 500 companies' profits relative to their stock prices. This metric suggests the market may be overvalued. Can this gap continue to widen? Source: Bloomberg, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks