Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Markets are heating up Nasdaq just posted its single largest daily volume in HISTORY with 13.4 BILLION shares traded yesterday.

This beats the previous record of 11.9 billion shares on May 16th, 2024. Source: Barchart

A classic Meta to End Fact-Checking Program in Shift Ahead of Trump Term

Source: TrendSpider

Today's market chaos was brought to you by strong eco data (ISM Services headline and JOLTS), a scary Prices Paid print (two year high), and the return of Trump press conference-driven vol.

Source: www.zerohedge.com, Trend Spider

How much longer can this continue before the crocodile's mouth snaps shut?

(S&P 500 in green vs. US 10-year inverted in RED) Source: Bloomberg, www.zerohedge.com

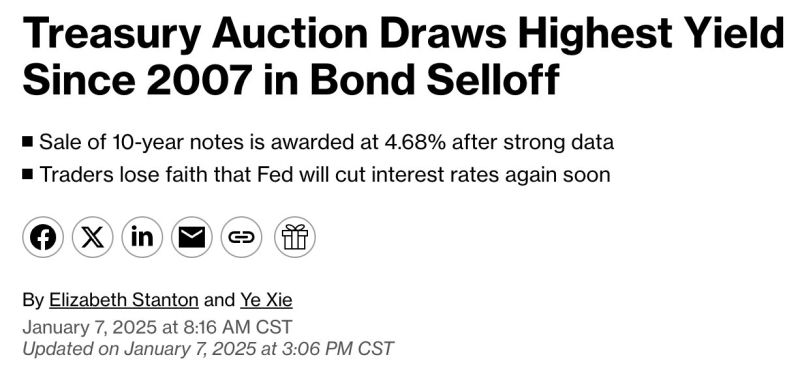

10-Year Treasury Auction was awarded a 4.68% yield, the highest since 2007 🚨

Source: Barchart

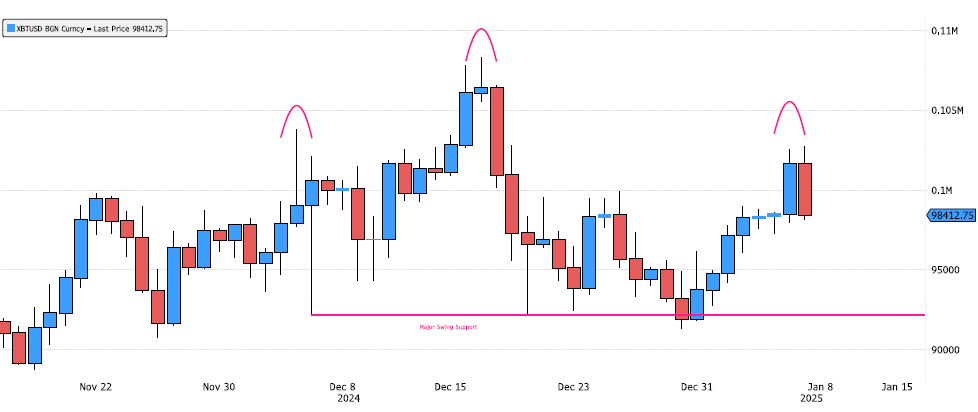

Bitcoin Head & Shoulders Pattern?

Bitcoin is showing signs of a strong reversal candlestick today (keep an eye on the close). A Head & Shoulders pattern is starting to form, though it's not confirmed yet. The recent close below 92,143 suggests some weakness, and the level to watch is the 91,306-92,14 zone. If this level breaks, fasten your seatbelt! Source: Bloomberg

Yields on 10-yr Treasuries are now the highest vs 2-year rates since 2022.

It's unclear whether this is a healthy normalization - a reversion back to the typical relationship of long-term yields being higher than short-term ones - or a sign of stickier inflation and deficit fears. Souce: Bloomberg, Lisa Abramowicz

Canadian Prime Minister Justin Trudeau announces resignation

Justin Trudeau’s popularity has been at a historic low after voters and members of his own party turned against him following a turbulent period of speculation about his ability to govern the G7 country. Source: FT

Investing with intelligence

Our latest research, commentary and market outlooks