Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

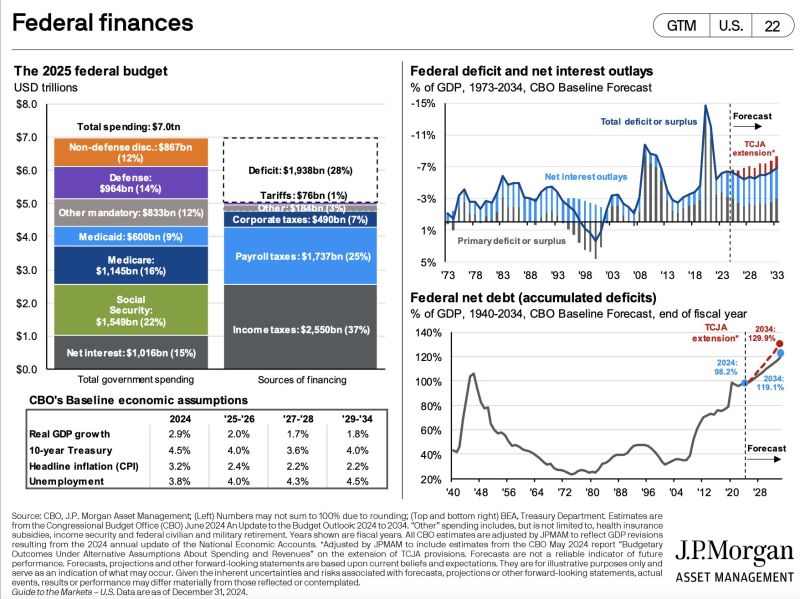

US Federal finances illustrated in one chart

Source: JP Morgan

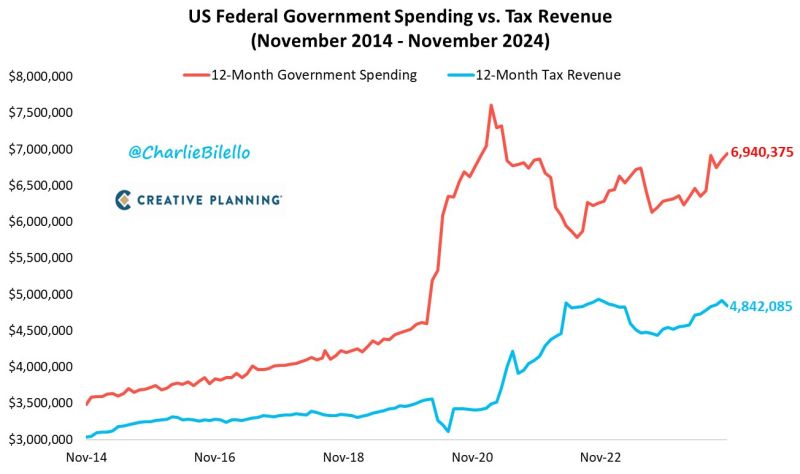

Over the last 10 years, US Federal Government Tax Revenue has increased 60% while Government Spending has increased 99%.

Does the US need higher taxes or less spending to balance the $2.1 trillion budget deficit? Source: Charlie Bilello

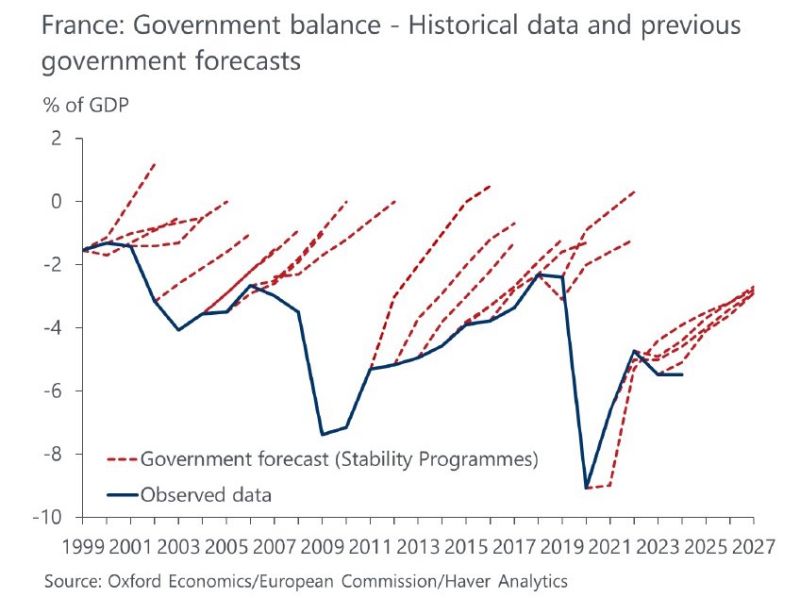

France has always missed its deficit forecasts, always.

It runs 6% fiscal deficit during good times. With the current political paralysis there will be no long overdue structural reforms, especially of pensions. It will miss current forecasts as well. Could the next Euro crisis start in France? Source: Michel A.Arouet Chart @OxfordEconomics

Italy plans $1.5 billion SpaceX telecom security services

Italy is in advanced talks with Elon Musk’s SpaceX for a deal to provide secure telecommunications for the nation’s government — the largest such project in Europe, people with knowledge of the matter said Sunday. Discussions are ongoing, and a final agreement on the five-year contract hasn’t been reached, said the people, who asked not to be identified citing confidential discussions. The project has already been approved by Italy’s Intelligence Services as well as Italy’s Defense Ministry, they said. The negotiations, which had stalled until recently, appeared to move forward after Italian Prime Minister Giorgia visited President-elect Donald Trump in Florida on Saturday.

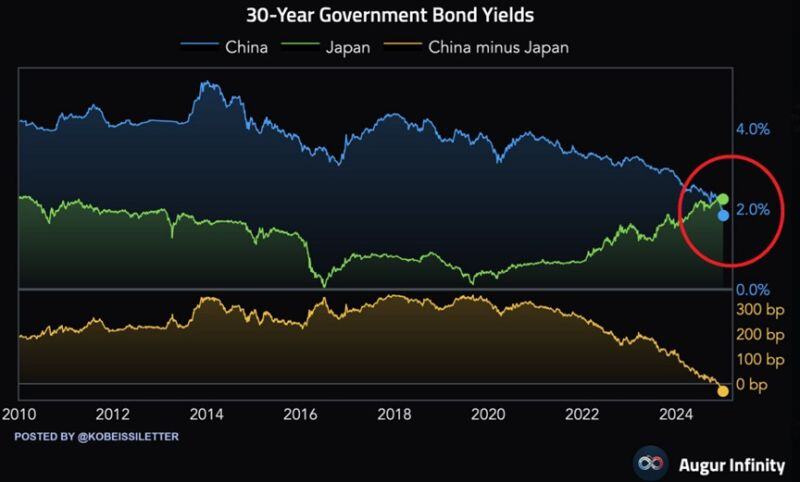

This is truly historic: China’s 30-year government bond yield has dropped below Japan’s 30-year yield for the first time ever.

Over the last 4 years, China’s bond yield has declined by a whopping 215 basis points. This comes as China’s economy has slowed and experienced 6 straight quarters of deflation, the longest streak since 1999. At the same time, Japan’s bond yield has risen 160 basis points as inflation has picked up in the country. In the past, Japan had seen 3 decades of economic stagnation and had suffered 25 years of deflation starting in the 1990s. Is China entering its own "japanification" economic phase? Source: The Kobeissi Letter, Augur Infinity

Investing with intelligence

Our latest research, commentary and market outlooks