Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

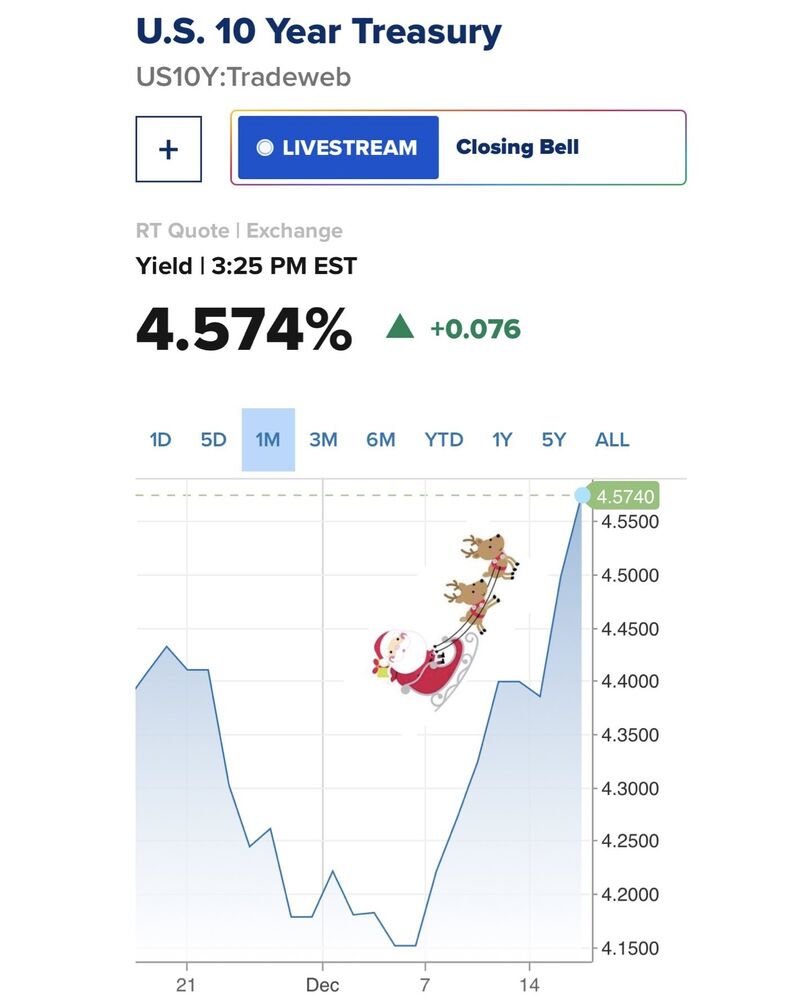

Is this the Santa Rally?

US Mortgage Rates Surged Back Over 7% Today Source: Amy Nixon on X

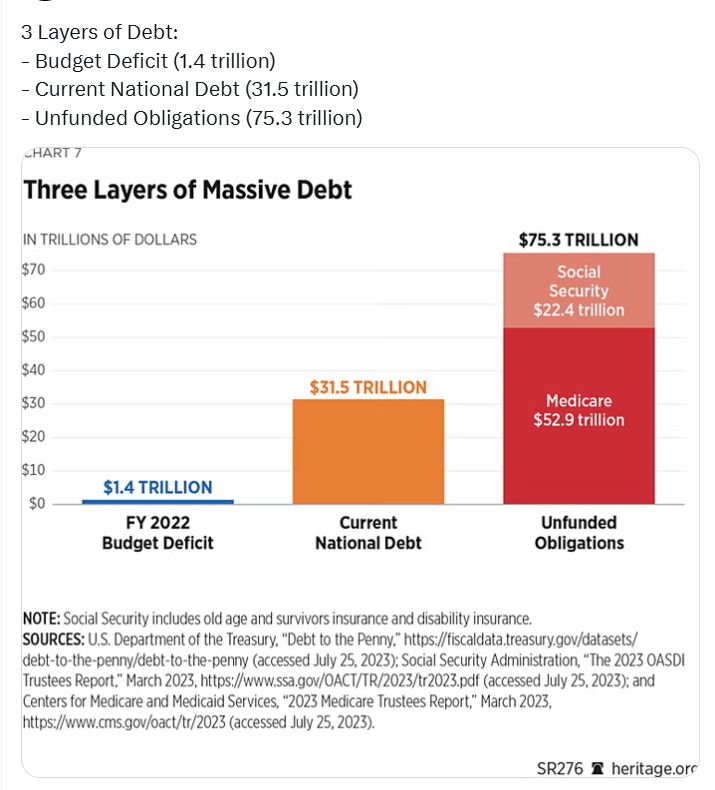

America's massive leverage summarized in one chart

Source: The Rabbit Hole

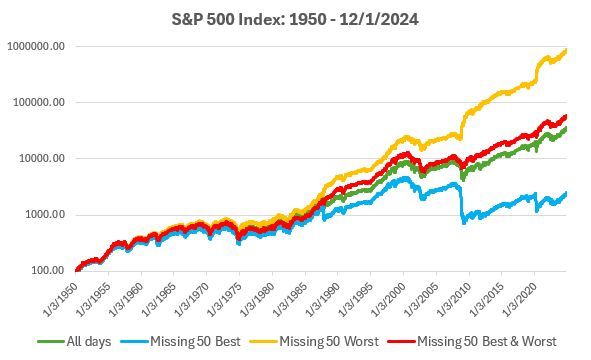

Remember: timing the market versus time in the market.

Source: Willie Delwiche, CMT, CFA @Tyler_Lovingood

On December 10th, Lisa Su was named CEO of the year.

Today, $AMD made a new low for 2024🔻 Source; Stocktwits

- >>&summary=In a jaw-dropping 3-minute video, BlackRock just challenged Bitcoin's most sacred promise. The world's largest asset manager suggests the unthinkable: "There's no guarantee that Bitcoin will maintain its 21 million coin limit." They’re right—there’s no guarantee. If everyone decides to change the supply cap, then it will be changed. But that’s highly unlikely. See some comments below on X&source=https://blog.syzgroup.com/syz-the-moment/todays-bombshell-' target="_blank">

Today's bombshell >>>

In a jaw-dropping 3-minute video, BlackRock just challenged Bitcoin's most sacred promise. The world's largest asset manager suggests the unthinkable: "There's no guarantee that Bitcoin will maintain its 21 million coin limit." They’re right—there’s no guarantee. If everyone decides to change the supply cap, then it will be changed. But that’s highly unlikely. See some comments below on X

Trump threatens tariffs if the EU doesn't buy more US oil and gas

The President-elect said he told the EU they must "make up their tremendous deficit" with large scale purchases of American fuel The US is the world's top LNG exporter, and the biggest Oil producer. Source: Stephen Stapczynsk

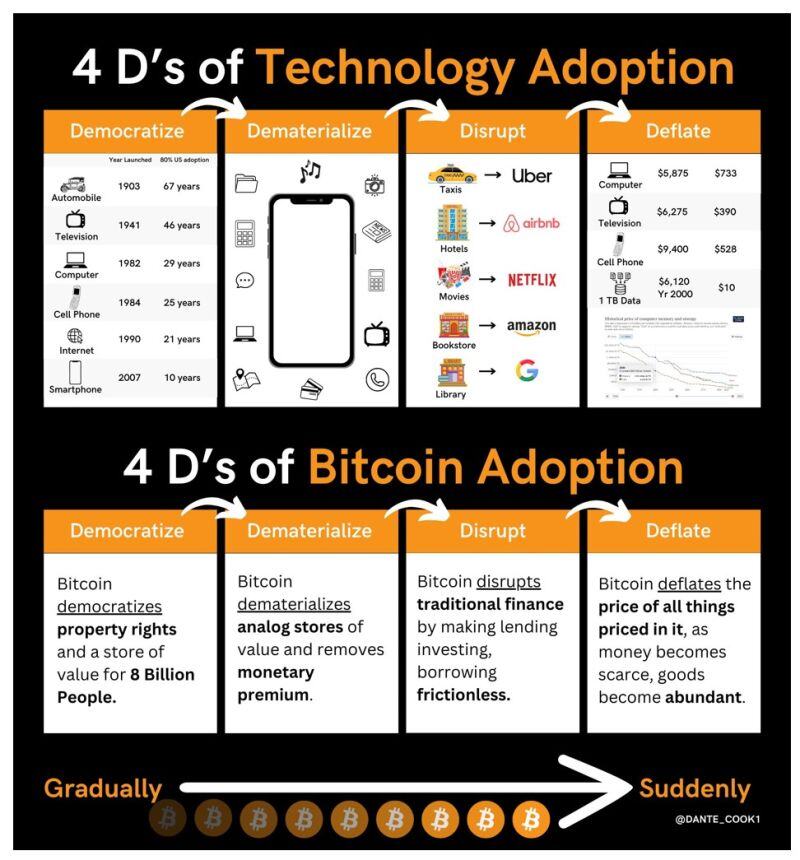

The 4D's of Bitcoin Adoption are happening:

- Democratization Bitcoin democratized property rights. - Dematerialization Capital is moving from analog capital->digital capital. - Disruption Finance is shifting -> Bitcoin. - Deflation All goods are being repriced by this. Source: Dante Cook

Investing with intelligence

Our latest research, commentary and market outlooks