Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING 🚨: Europe

European stocks are underperforming the S&P 500 by the largest amount in history. Source: Barchart

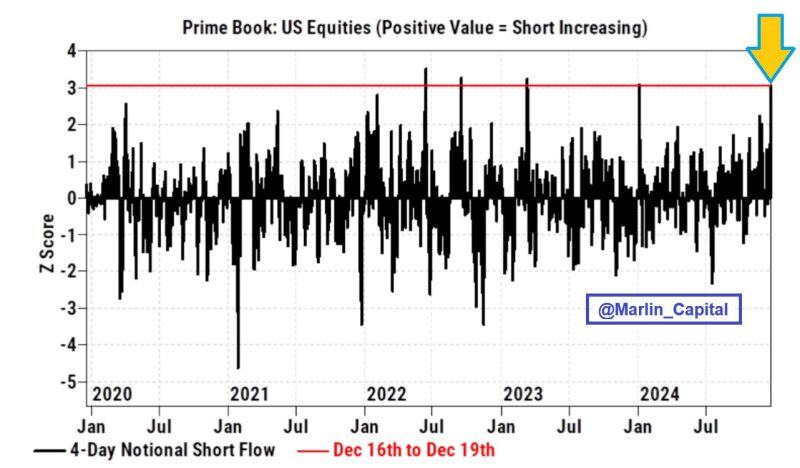

Hedge funds sold US equities at the fastest pace in 8+ months last week, driven heavily by short selling.

This was the fastest pace of HF short selling in ~12 months. Source: David Marlin $SPY $QQQ $IWM

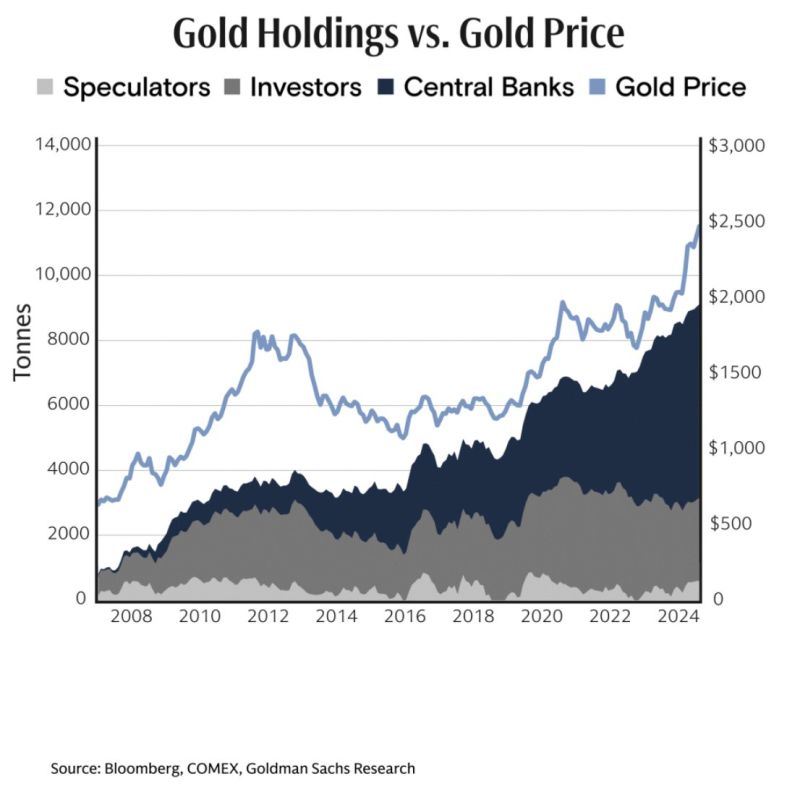

"Gold's rally could extend through 2025 on the back of falling rates and persistent central bank demand."

Source: Goldman Sachs, Win Smart, CFA @WinfieldSmart

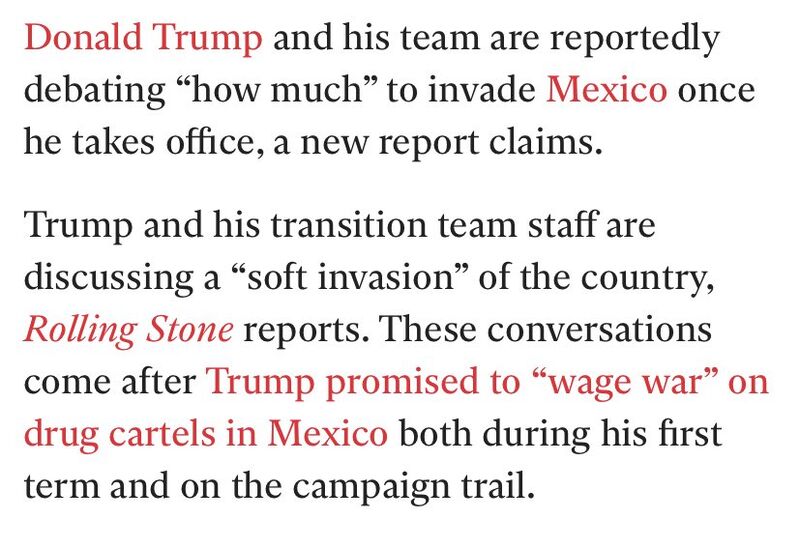

BREAKING: Donald Trump and his team are reportedly debating “how much” to invade Mexico once he takes office, per the Independent.

Trump and his transition team staff are discussing a “soft invasion” of the country, Rolling Stone reported. Source: Win Smart, CFA,@WinfieldSmart

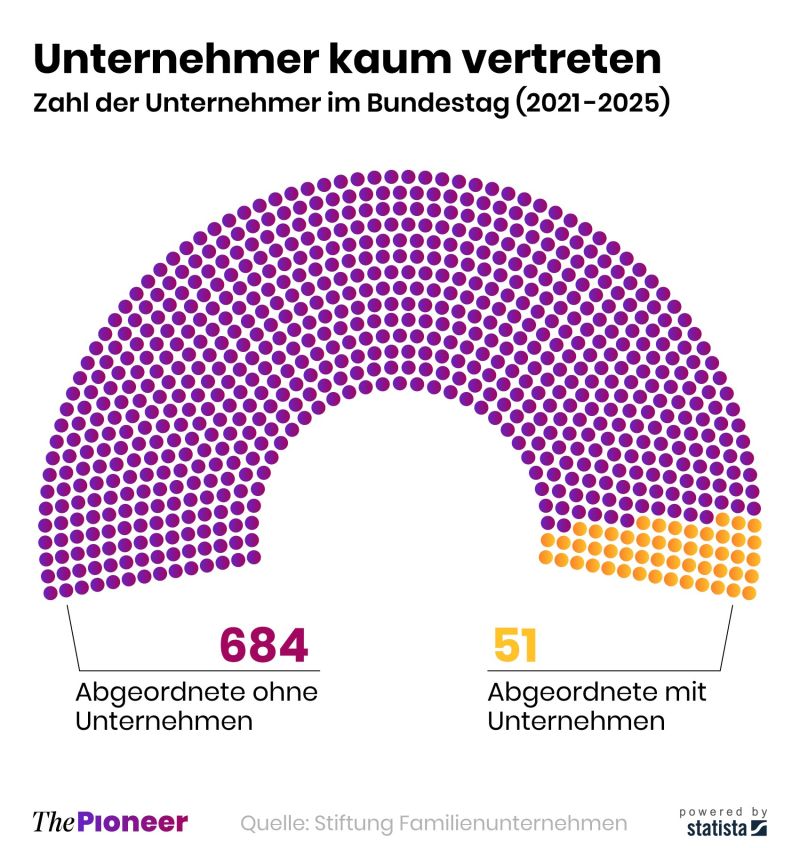

In Germany, too few business leaders are involved in politics, which has made the bureaucracy stronger.

In the current legislative period, only 51 of the 735 Bundestag members are entrepreneurs —the lowest number in years (the yellow seats below). Between 2017 and 2021, there were still 76. Top executives or major entrepreneurs have rarely held ministerial positions in the history of the Federal Republic. A notable exception was Werner Müller, the late former head of Ruhrkohle AG, who served as Economics Minister under Chancellor Gerhard Schröder from 1998 to 2002. Source: Statista, HolgerZ

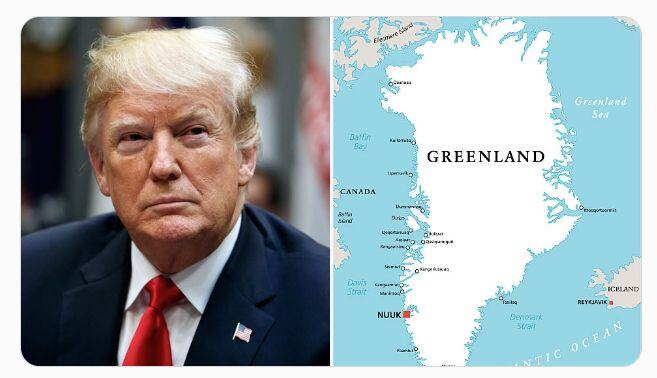

Trump officially calls for the purchase of Greenland, stating:

“For purposes of national security and freedom throughout the world, the US feels that the ownership of Greenland is a necessity.” Source: AF Post

Novo Nordisk Long-Term Bullish Trend Broken

Novo Nordisk (NVO) has seen its long-term bullish trend broken, with the stock losing 49% since its highs. It’s now trying to find support. On Friday, the stock rebounded from the major support zone between 504-535. The stock will likely be volatile in the coming days, so keep an eye on this support zone to see if it has found a low. Source: Bloomberg

JUST IN - US MACRO DATA RELEASED ⚡

👉 GDP (Q3), 3.1% Vs. 2.8% Est. (prev. 2.8%) 👉Jobless Claims, 220K Vs. 230K Est. (prev. 242K) 👉PCE Prices (Q3), 1.5% Vs. 1.5% Est. (prev. 2.5%) 👉Core PCE (Q3), 2.2% Vs. 2.1% Est. (prev. 2.8%)

Investing with intelligence

Our latest research, commentary and market outlooks