Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Short Volatility etf $SVIX Assets Under Management are surging

Aug 2024: $600M Q1 2024: $140M Q1 2023: $88M Q1 2022: $22m Source: Bloomberg, Lawrence McDonald

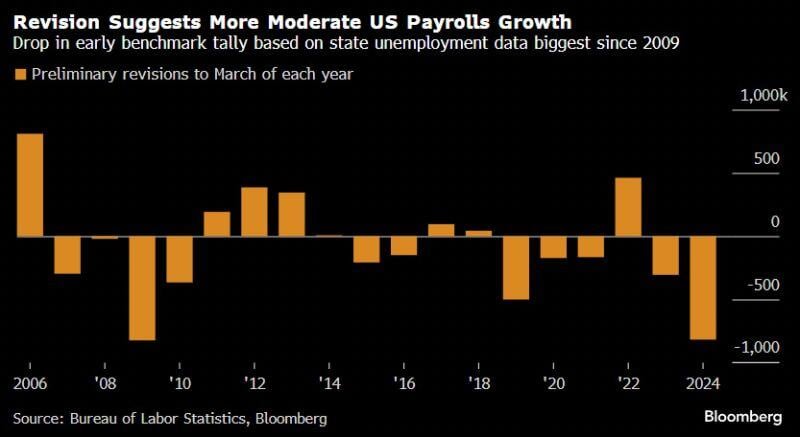

Nonfarm payroll growth revised down by 818,000 for the 12 months through March — or around 68,000 less each month – most since 2009

Before the report, the BLS’s initial payrolls figures indicated employers added 2.9mln total jobs in the period, or an avg of 242k per month. Now the monthly pace is more likely to be ~174k, still a healthy rate of hiring but a moderation from post-pandemic peak At the sector level, the biggest downward revision came in professional and business services, where job growth was 358,000 less than initially reported. => The labor market appears weaker than originally reported. This should allow the Fed to prepare markets for a cut at the September meeting. Source: Bloomberg, HolgerZ, CNBC

BlackRock’s support for shareholder proposals on environmental and social issues has hit a new low in the 2023-24 proxy season

Source: FT

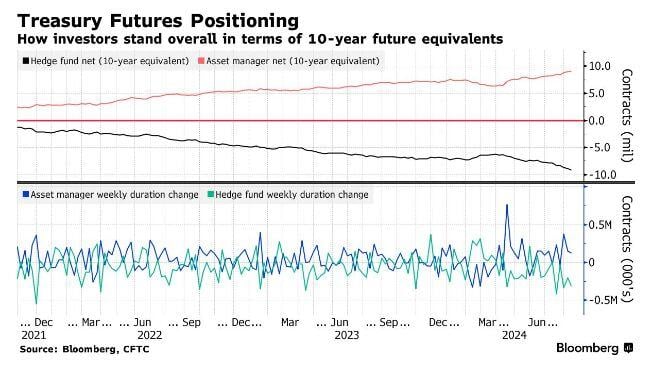

Record Short Position in 10-Year Treasuries

A short squeeze ahead? Hedge Funds have now built the largest 10-Year Treasury Future Equivalents short position in history. Note that Asset managers (long-only) have the opposite as they have built record long positions. Source: Barchart

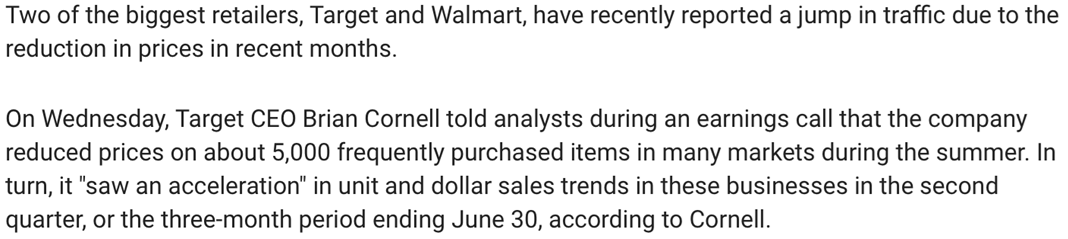

Major retail stores are cutting prices to lure custormers as inflation soars.

Source: Foxbusiness.com

China names healthcare, education, tech as likely venues for more foreign investment

Source: South China Morning Post

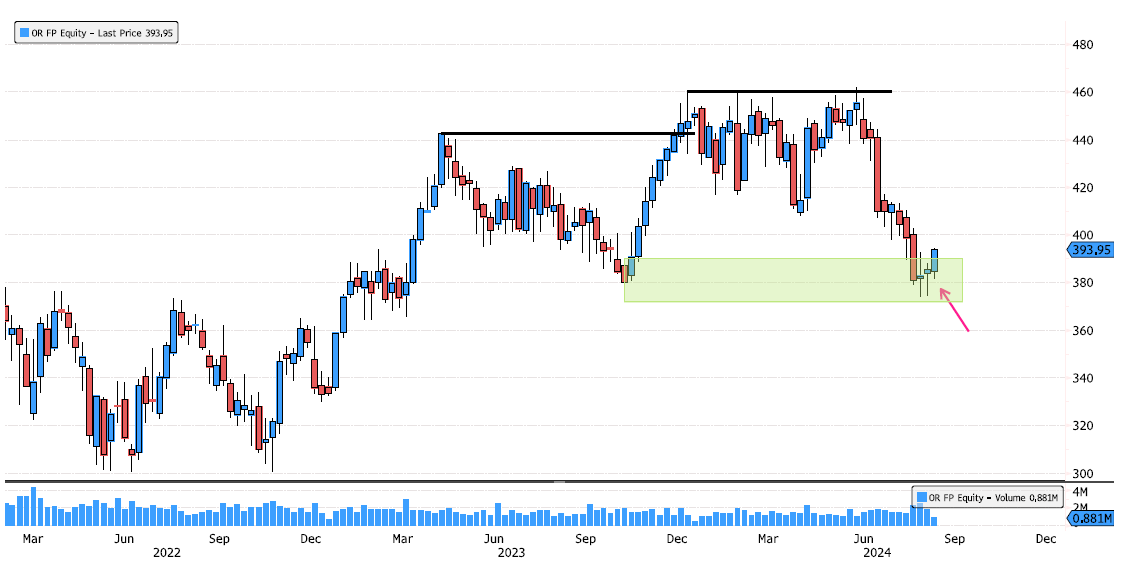

L'Oreal Starting to Rebound on Major Support

L'Oreal has tested the major support zone of 372-390 over the last three weeks and has started to break out to the upside from that zone! The trend remains bullish. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks