Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

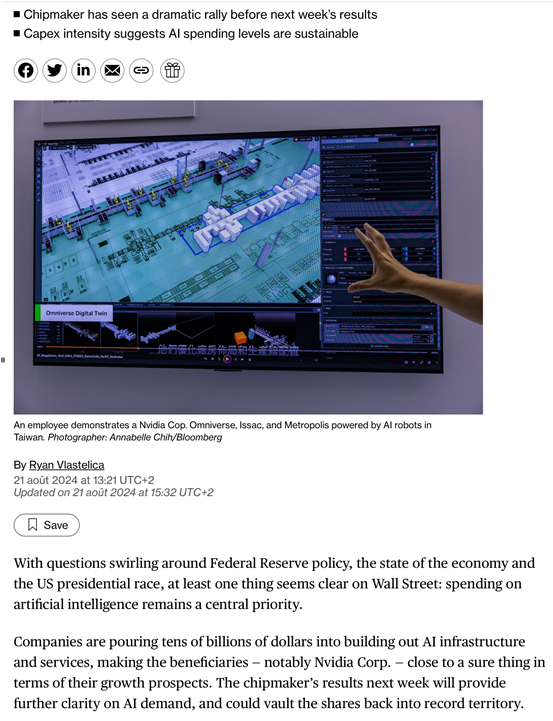

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Stock buyback tax would quadruple under Democrats' plan

Source: MarketWatch

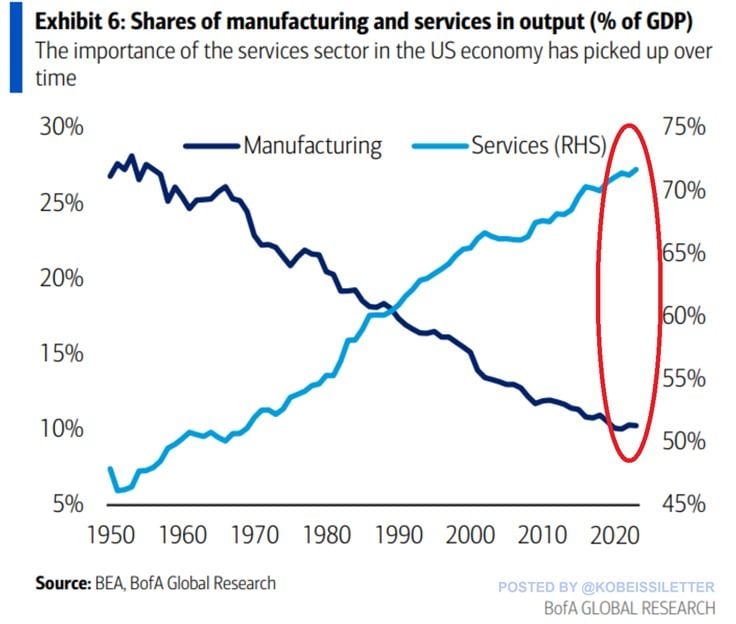

The U.S. economy is now almost entirely driven by the services sector

The services industry now accounts for ~72% of US GDP, up from ~60% in 1990. By comparison, in the 1950s, services reflected just 47% of the US economy. On the other hand, the manufacturing sector's share in US GDP has declined from ~27% in the 1950s to ~10% currently. Meanwhile, the ISM Manufacturing PMI index has shrunk in 20 of the last 21 months, marking 22 months without two consecutive readings of an expansion, the longest streak since the 1990s. Services are keeping the US economy alive. Source: The Kobeissi Letter, BofA

Top 10 biggest companies in 2024 vs. 2009: What a difference 15 years can make...

Source: Stocktwits, Yahoo Finance

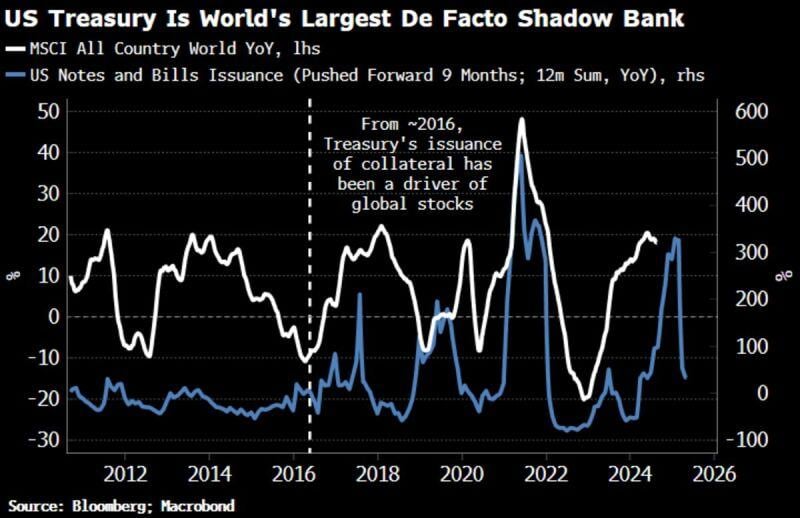

The US Treasury has become a key driver of stocks and other asset markets through its pro-cyclical issuance of debt and the increasing depth and liquidity of repo markets

Writes net treasury issuance leads global equity prices by about 6-9mths due to repo markets. The rise in the volume of collateralized lending, i.e. repo, facilitated by the increase in the supply of USTs is increasingly influential for the behavior of asset prices. Source: HolgerZ, Bloomberg

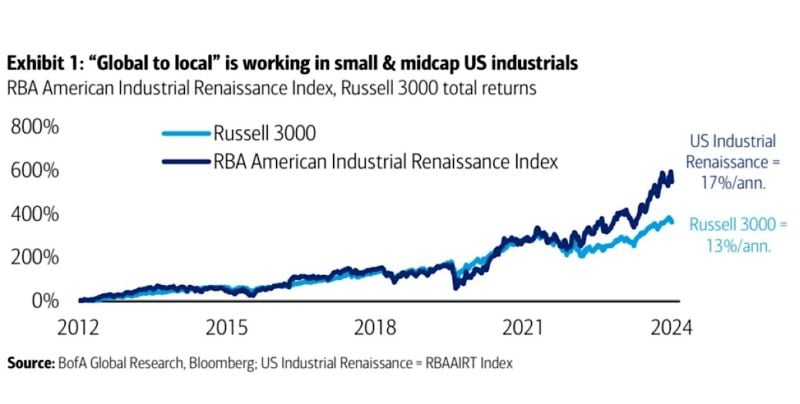

While Europe is deindustrializing, US industrial renaissance is in full swing

17% annual return anyone? Source: Michel A.Arouet, BofA

Investing with intelligence

Our latest research, commentary and market outlooks