Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

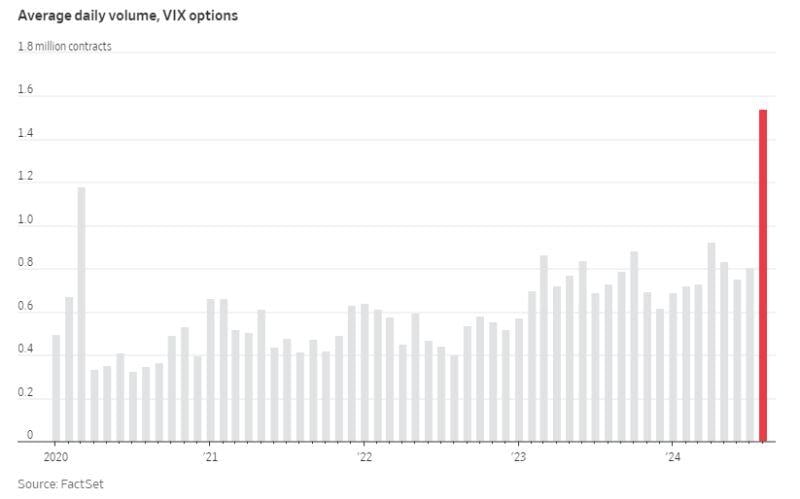

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

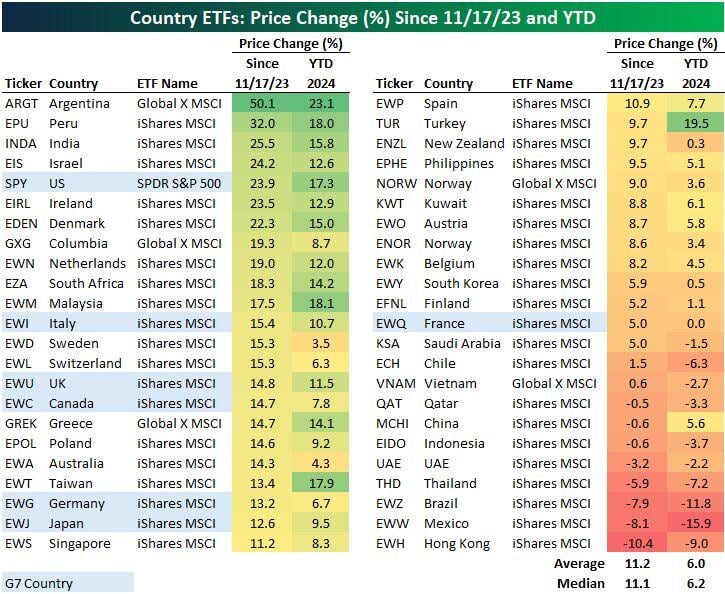

The Argentina ETF $ARGT has been the best performing out of 46 country ETFs since 11/17/23 prior to President Milei's election victory as well as year-to-date in 2024

Source: Bespoke

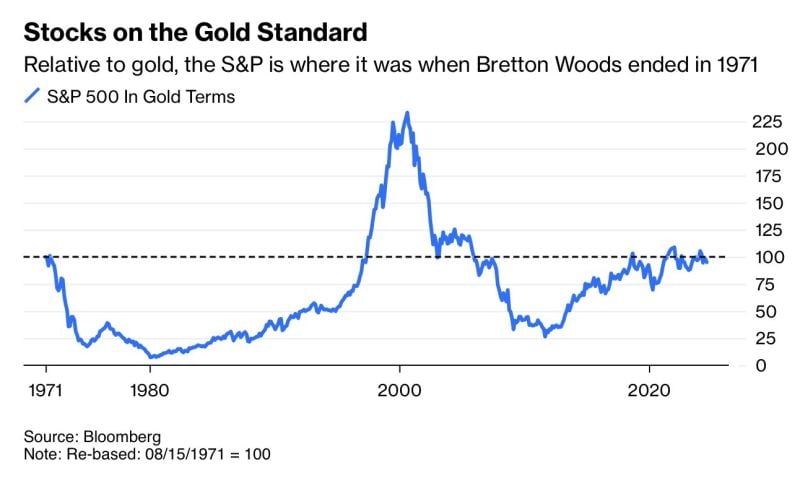

A shocking chart...

'In gold terms, the SP500 is exactly where it was in August 1971. The significance of that date is that it was the moment when President Richard Nixon severed the dollar's link to gold". Source: Bloomberg, Jesse Felder @jessefelder on X

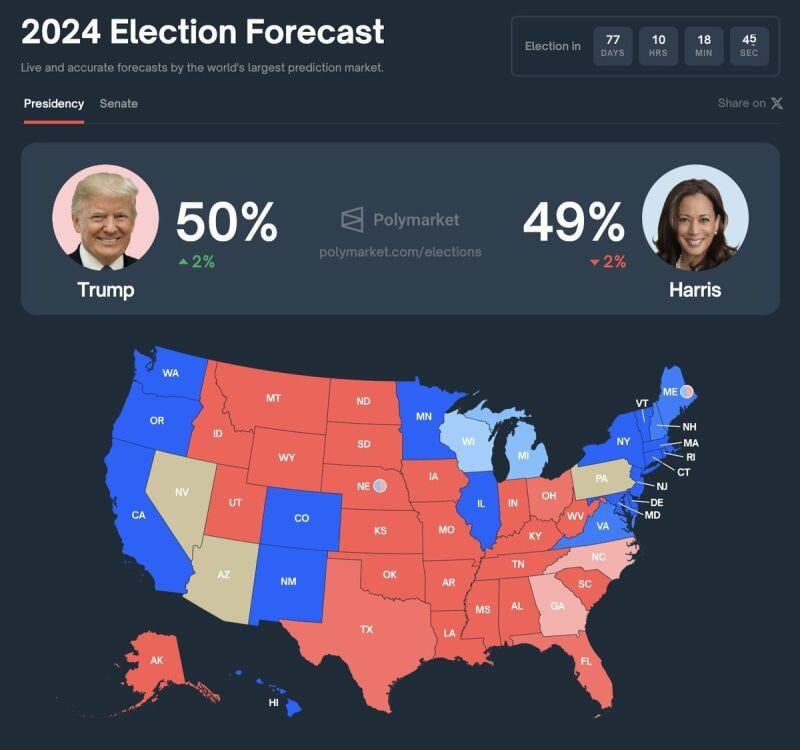

BREAKING 🚨 Still a very uncertain race...

Donald Trump is officially leading Kamala Harris in odds to win the 2024 presidential election, according to Polymarket. Kamala Harris has erased a 10 percentage point lead seen just over a week ago. Source: The Kobeissi Letter

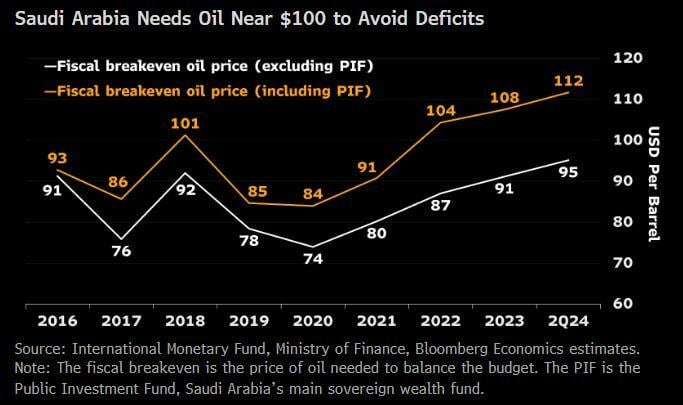

2 key takeaways from saudi budget data in the 1st half of 2024

1. Saudi needs oil at $95 to balance its budget. 2. Adding domestic investments by the sovereign wealth fund, the figure rises to $112. If Oil price stays at this level ($77), deficits are likely to persist. Source: Bloomberg, @ZiadMDaoud on X

BREAKING 🚨 US employment data...

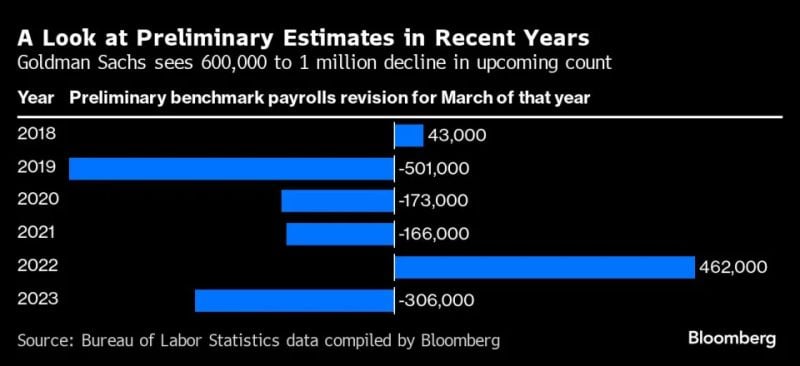

Federal Reserves faces up to 1 million US jobs "vanishing" in potentially the largest downward jobs revision in 15 years, according to Bloomberg Goldman Sachs Group Inc. and Wells Fargo & Co. economists expect the government’s preliminary benchmark revisions on Wednesday to show payrolls growth in the year through March was at least 600,000 weaker than currently estimated — about 50,000 a month. While JPMorgan Chase & Co. forecasters see a decline of about 360,000, Goldman Sachs indicates it could be as large as a million. There are a number of caveats in the preliminary figure, but a downward revision to employment of more than 501,000 would be the largest in 15 years and suggest the labor market has been cooling for longer — and perhaps more so — than originally thought. The final numbers are due early next year. Such figures also have the potential of shaping the tone of Fed Chair Jerome Powell’s speech at week’s end in Jackson Hole, Wyoming. Investors are trying to gain insight as to when and how much the central bank will start lowering interest rates as inflation and the job market cool. Source: Yahoo Finance, Bloomberg

Here's a look at the 30 best performing S&P 500 stocks over the last 20 years since Alphabet $GOOGL IPO'd

NVIDIA $NVDA is on top followed by Apple $AAPL, Netflix $NFLX and then Monster Beverage $MNST. Alphabet ranks 11th just behind Salesforce $CRM. Source: Bespoke

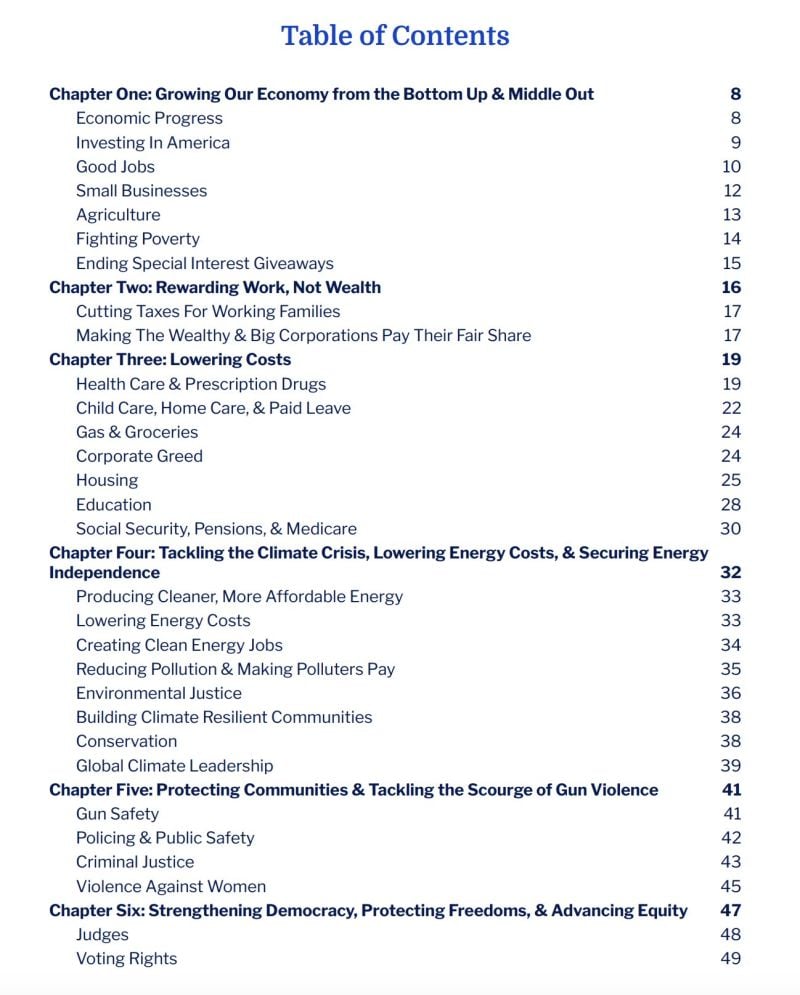

JUST IN: U.S. elections - The Democratic Party releases its platform, with no mention of Bitcoin or crypto

The Democratic Party's official 2024 platform was released yesterday (Monday) on day one of the Democratic National Convention, without any mention of Bitcoin or cryptocurrency. This decision aligns with the past four years of the Biden-Harris administration's hostility towards the industry. Despite the growing significance of Bitcoin and digital assets, neither Kamala Harris or Tim Walz, who are running for president and vice president in the upcoming election this November, has prioritized the inclusion of Bitcoin and crypto in the party's agenda. Source: Bitcoin magazine, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks