Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

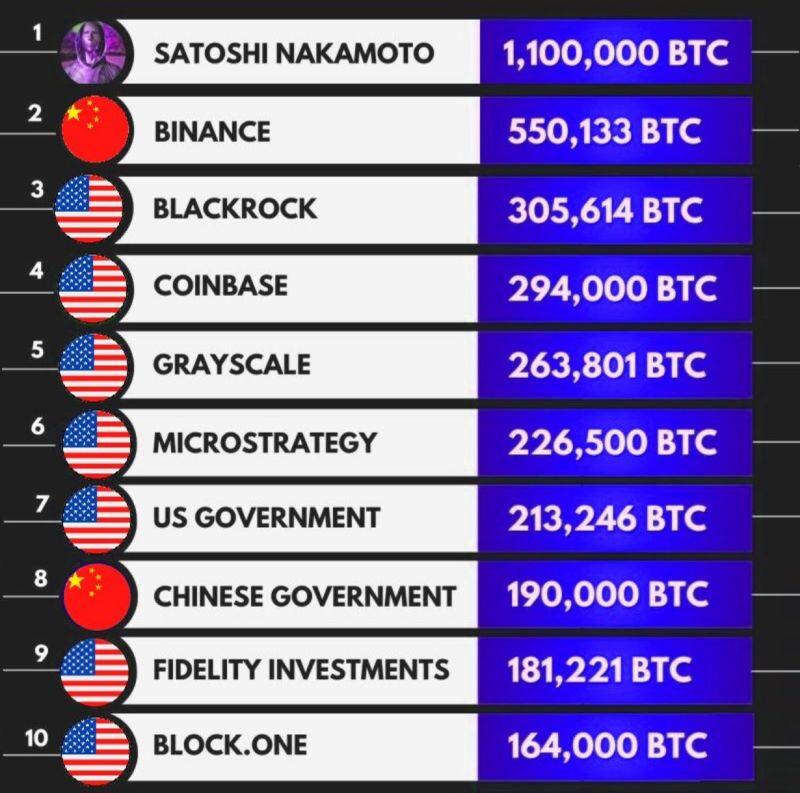

- bitcoin

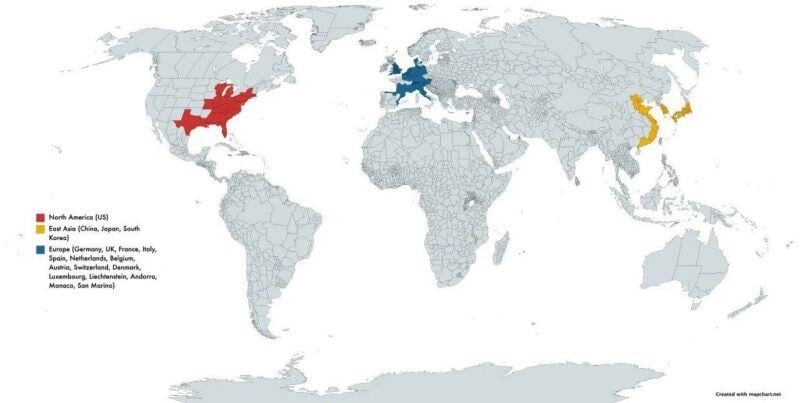

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

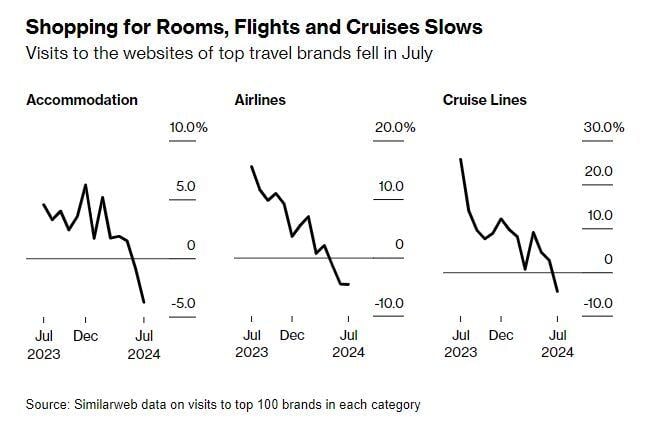

Flights, Hotels and Parks Are All Flashing Travel Warning Signs - Bloomberg

Facing an uncertain outlook, consumers are getting choosier when booking vacations and holding out for discounts. ‘We’re shifting back to normal.’

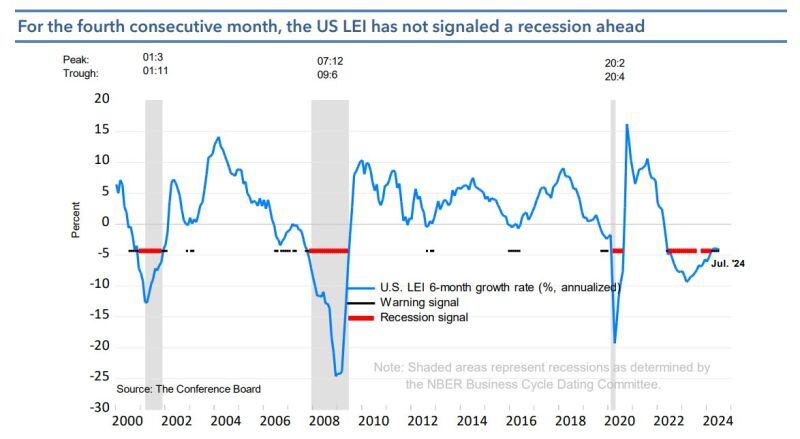

For the fourth consecutive month, the US LEI (leading indicators) has not signaled a recession ahead

Source: Mike Z.

BREAKING 🚨 Jerome Powell will indicate that the Fed is open to a 50 bps rate cut during his speech at the Jackson Hole, according to analysts from Evercore

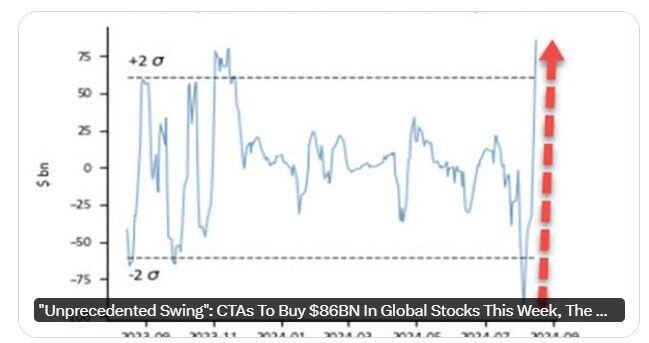

BULLS, GET EVEN MORE EXCITED... Source: Stocktwits, www.investing.com

Investing with intelligence

Our latest research, commentary and market outlooks