Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

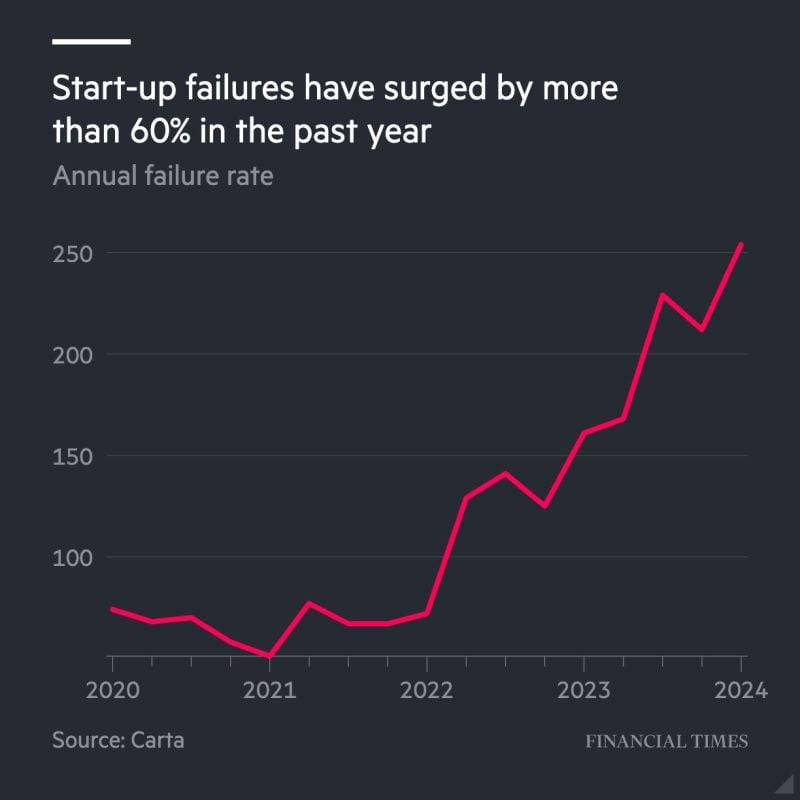

FT article: "The rate at which US start-ups are going bust is more than seven times higher than in 2019, threatening millions of jobs and risking spillover to the wider economy"

Source: FT

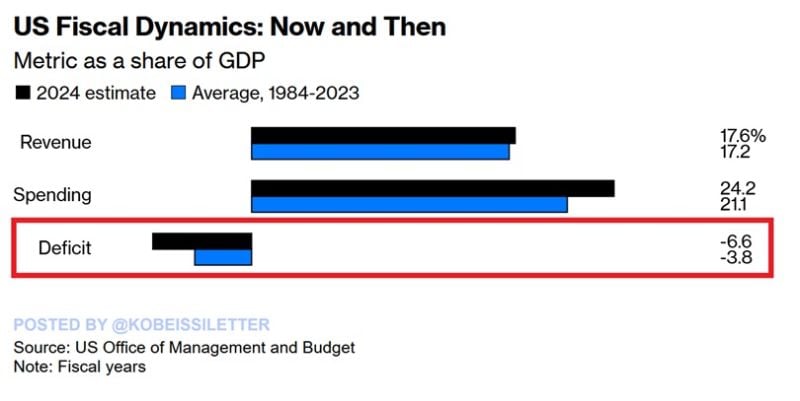

US government spending is expected to hit 24.2% of GDP in 2024, significantly above the previous 39-year average of 21.1%, according to the CBO.

At the same time, revenues are projected to reach 17.6% of GDP, just 0.4 percentage points above the 1984-2023 average. As a result, the US deficit is estimated to hit 6.6% of GDP, almost DOUBLE the 39-year average. In nominal terms, the deficit is set to hit $1.9 trillion in 2024, the highest level since 2021 when the deficit was $2.8 trillion in response to the pandemic. US government spending relative to GDP is expected to rise rapidly while revenue stagnates. Multi-trillion Dollar deficits are the new normal. Source: The Kobeissi Letter

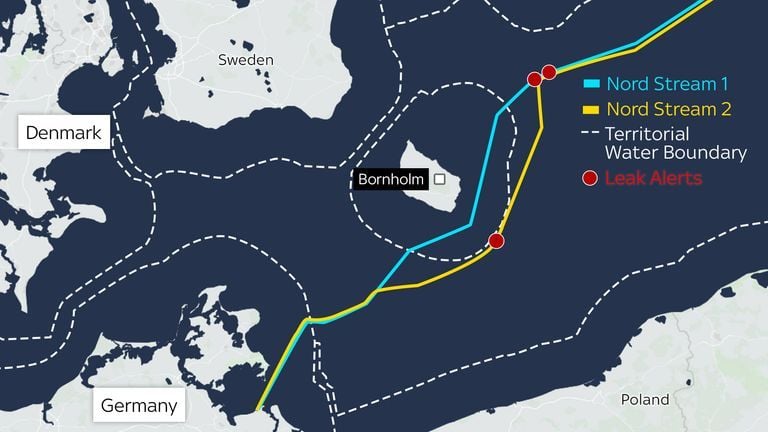

GERMAN MP: UKRAINE MUST PAY FOR DAMAGE TO NORD STREAM PIPELINES

Some major changes on Germany-Ukraine relationships took place over the recent days... Last week, Germany said it has frozen its military aid to Ukraine, claiming that a domestic budgetary crisis means it can no longer afford to supply Kyiv with new weapons. Olaf Scholz, the German chancellor, told his defence minister this month that there would be no money available for further military aid, according to a new report in the Frankfurter Allgemeine newspaper. Today, Alice Weidel has called for Ukraine to compensate Germany for the damage caused to its economy as a result of the attack: “The economic damage to our country caused by the demolition of Nord Stream presumably ordered by Zelensky - and not Putin as we were led to believe - should be "billed" to Ukraine.” Berlin-Kyiv relations were strained after the German Prosecutor General's Office issued an arrest warrant for a Ukrainian suspected of involvement in the pipeline sabotage. Source: Mario Nawfal on X

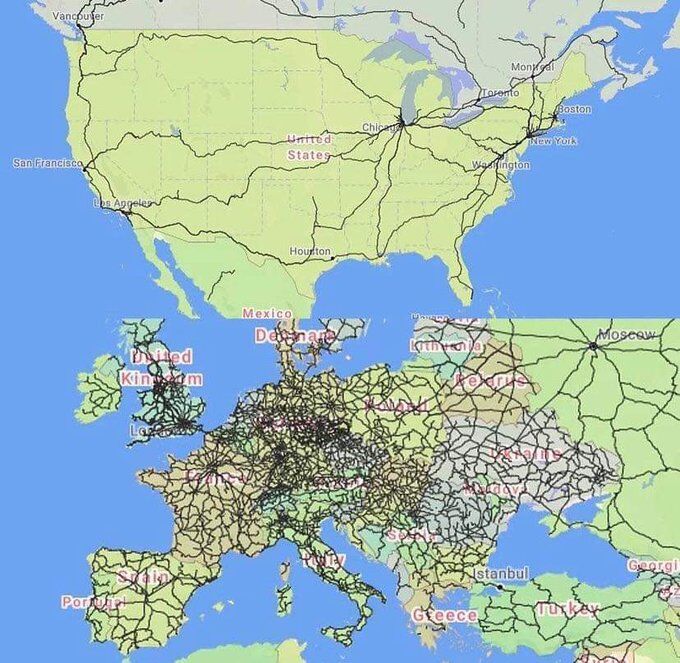

Passenger train lines in the USA vs Europe

Source: Massimo @Rainmaker1973

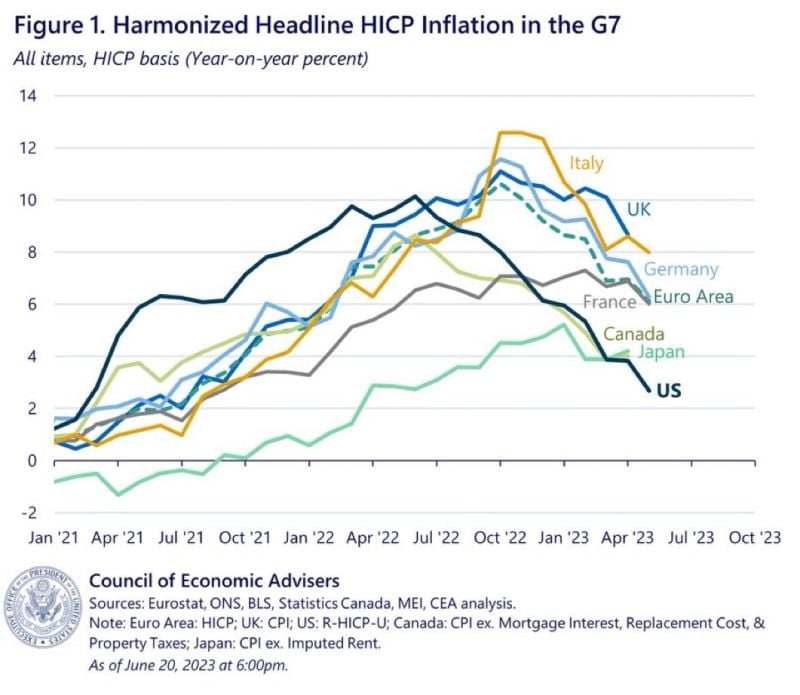

What’s the best explanation for why inflation has fallen so much more in the United States than any other G7 country?

Source: Erik Brynjolfsson @erikbryn on X

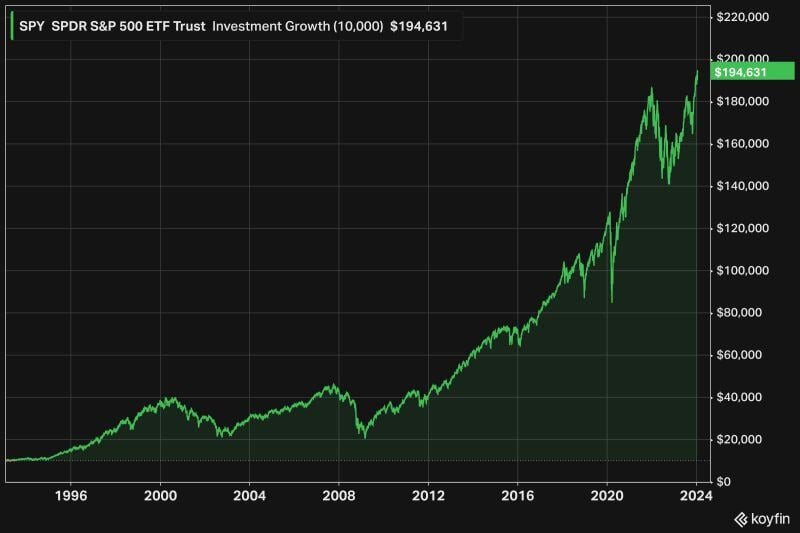

A person who invested $10k in the S&P 500 $SPY in 1993 would have faced:

• Asian Crisis, 1997 • Dotcom bubble, 2000 • GFC, 2007 • EU debt crisis, 2010 • Global pandemic, 2020 • Numerous recessions Yet, their initial investment would be worth $195k today (10% CAGR). Source: @KoyfinCharts

Hedge funds have finally turned net bullish on the Japanese Yen

Source: Bloomberg, David Ingles

Investing with intelligence

Our latest research, commentary and market outlooks