Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Eric Schmidt, ex-CEO at Google $GOOGL, said his former company is losing the AI race and remote work is to blame - WSJ

“Google decided that work-life balance and going home early and working from home was more important than winning” Source: Evan

After escaping a black Monday (and the 2nd largest surge in the vix ever) over a week ago, the S&P 500 $SPX is only 2.2% away from all-time highs

Source: Barchart

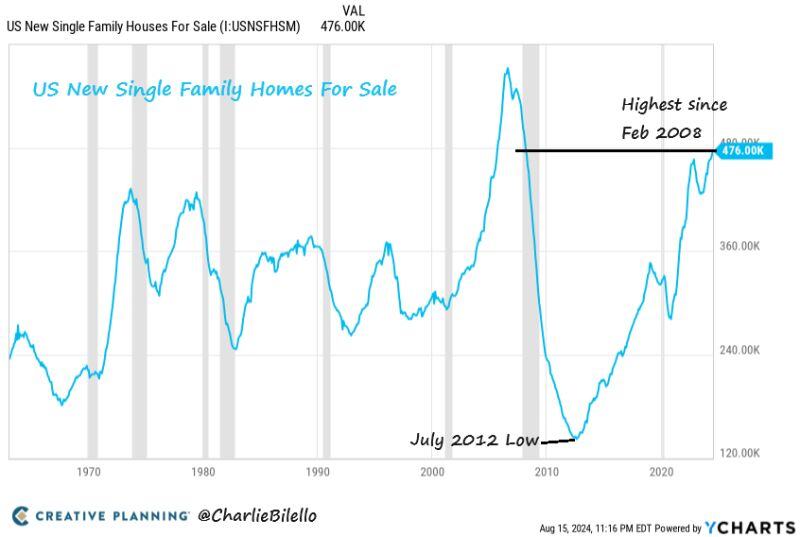

There are now 476,000 new homes for sale in the US, the highest inventory since February 2008.

Source: Charlie Bilello

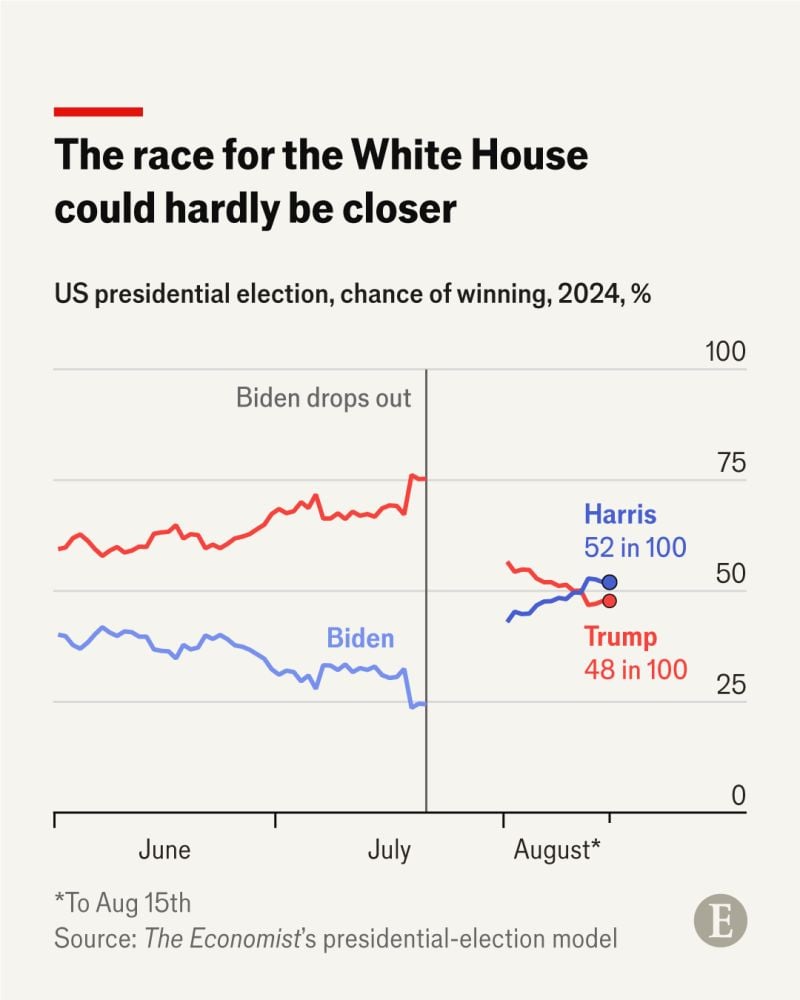

The Economist revised forecast shows the presidential election between Kamala Harris and Donald Trump is, in effect, a toss-up.

Source: The Economist

Is long AI short yen the same trade?

Gray line is 30-year T-bond yield relative to tech 12 month forward earnings yield ratio Dotted green line is EUR/JPY Source: www.zerohedge.com

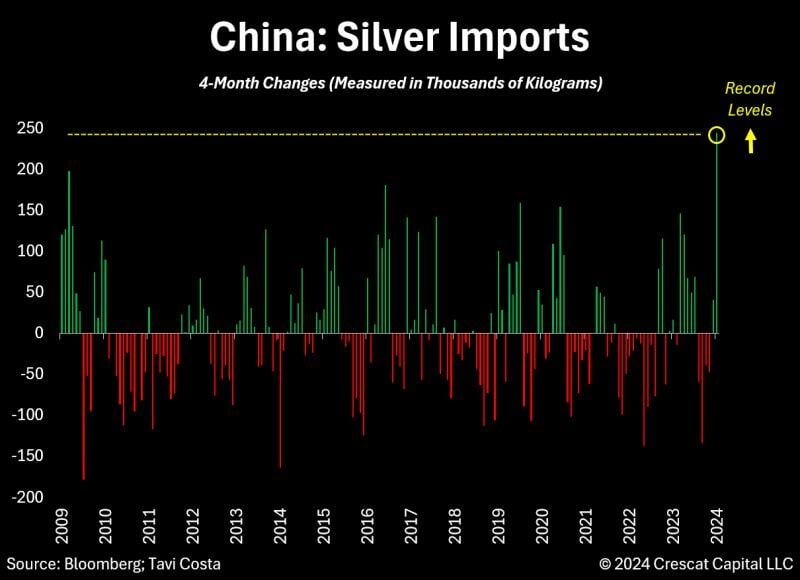

China reported record levels of silver imports.

Source; Tavi Costa, Crescat Capital, Bloomberg

JUST IN 🚨: Odds of a 50 bps interest rate in September has plummeted to less than 25%

Source: Barchart

BREAKING 🚨 The S&P 500 has added nearly $4 TRILLION in market cap since the August 5th bottom

That's $4 trillion in 9 trading days or $444 billion PER TRADING DAY since August 5th. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks