Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

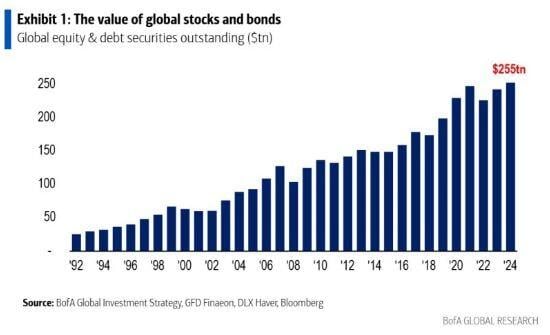

The natural trend of global markets is to go up

Source: BofA

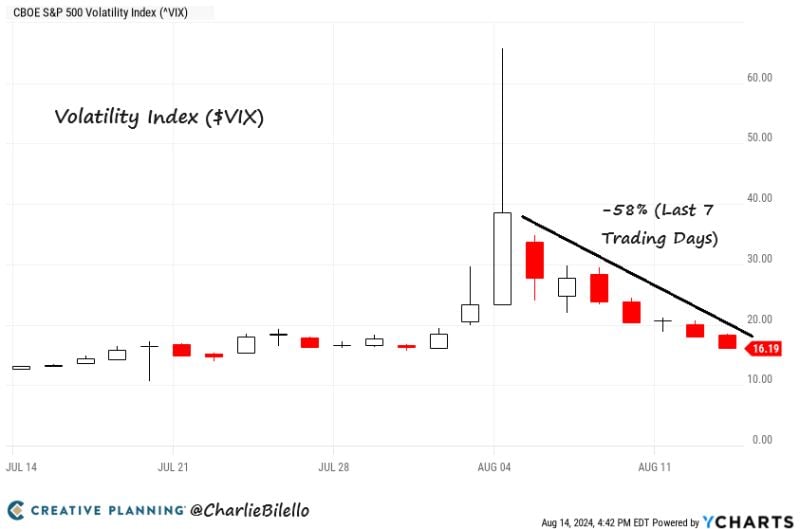

The $VIX has declined 58% (from 38.57 to 16.19) over the last 7 trading days, the biggest 7-day volatility crash in history.

Source: Charlie Bilello

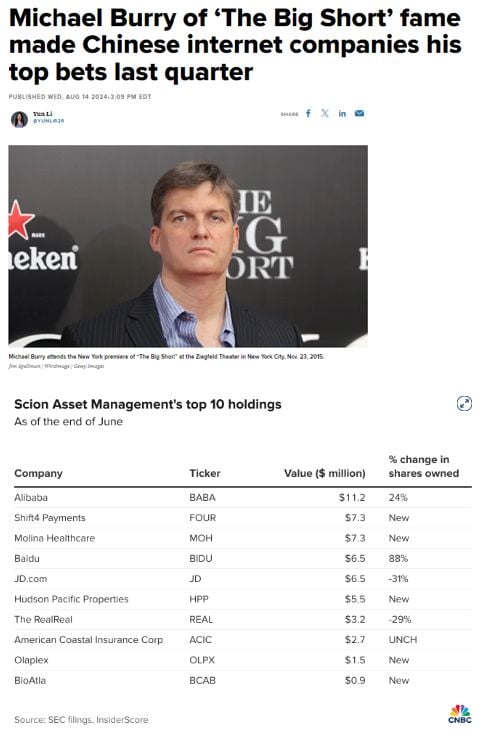

Michael Burry has made Chinese Internet Stocks his biggest holdings

His #1 holding is Alibaba which was worth $11.2 million at the end of the last quarter. Source: Barchart, CNBC

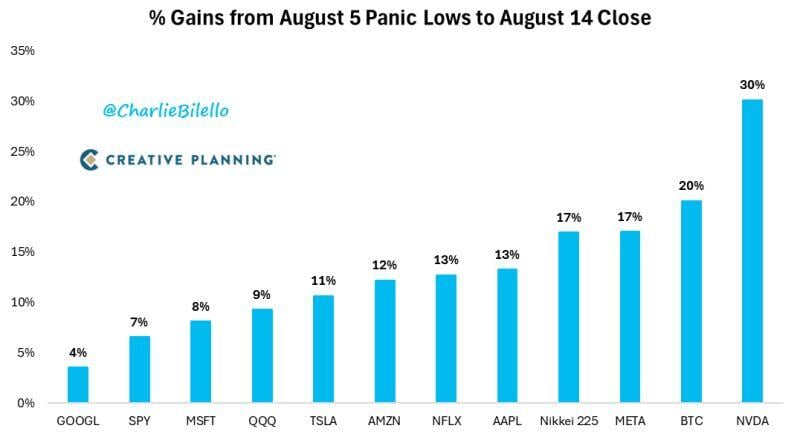

Gains from last Monday's (8/5) panic lows...

Source: Charlie Bilello

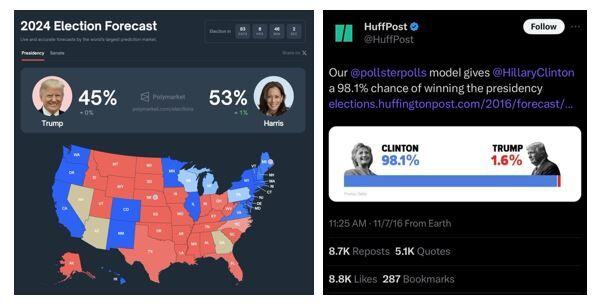

BREAKING: Prediction markets are now showing a 53% chance of Kamala Harris winning the 2024 election, according to Polymarket.

These markets are different than polls in that the probabilities are based on real money wagers. In 2016, polls put odds of Hillary Clinton beating Trump at 70%, with some as high as 98%. Trump's victory in 2016 ended up resulting in one of the largest polling and election forecaster failures in history. Will prediction markets prove to be more or less accurate? Source: The Kobeissi Letter

BREAKING >>> Hackers have reportedly stolen Social Security numbers of EVERY American from National Public Data, according to the Los Angeles Times

2.9 billion people's data was reportedly stolen Source: Stocktwits

Ulta Beauty $ULTA exploding higher in after-hours after Warren Buffett discloses a new position of 690,000 shares

Source: Barchart

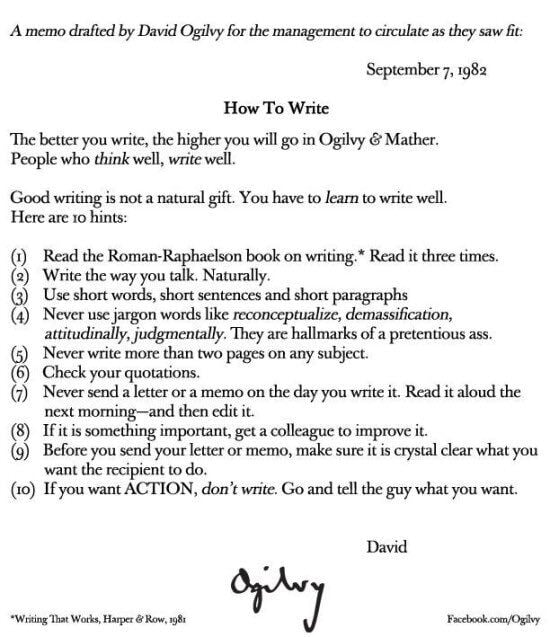

How To Write, by David Ogilvy

• Write the way you talk. Naturally. • Use short words, short sentences, and short paragraphs. • Never use jargon words. Source: marketplunger1 (@Brandon Beylo) on X

Investing with intelligence

Our latest research, commentary and market outlooks