Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Norway’s massive sovereign wealth fund on Wednesday posted first-half profit of 1.48 trillion kroner ($138 billion)

It has been primarily driven by robust returns on its investments in technology stocks. The so-called Government Pension Fund Global — the world’s largest sovereign wealth fund — said it had a value of 17.75 trillion kroner at the end of June. The fund’s overall return for the six-month period was 8.6%, which was 0.04 percentage points lower than the return on its benchmark index. “The result was mainly driven by the technology stocks, due to increased demand for new solutions in artificial intelligence,” CEO Tangen said in a statement. Source: CNBC

BREAKING: For those who were off the last 2 weeks, nothing happened: the $VIX is back to where it was on August 1...

Source: Stocktwits, Bloomberg

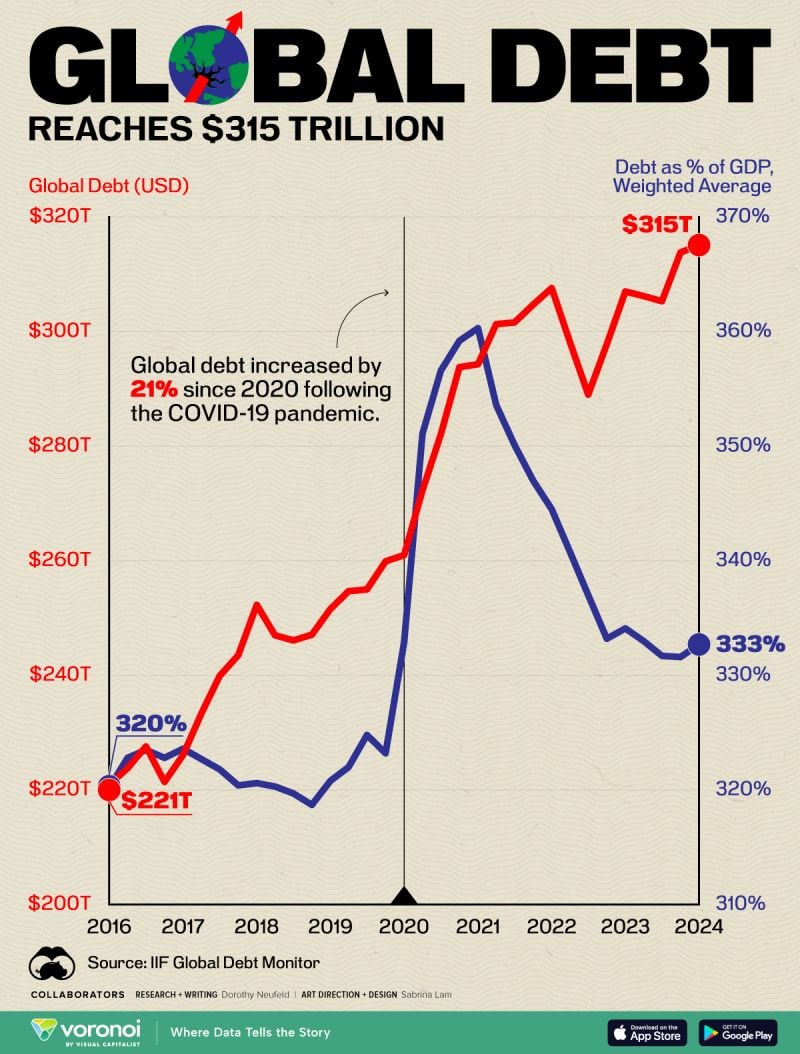

Global debt has officially reached $315 trillion

Source: IIF Global Debt

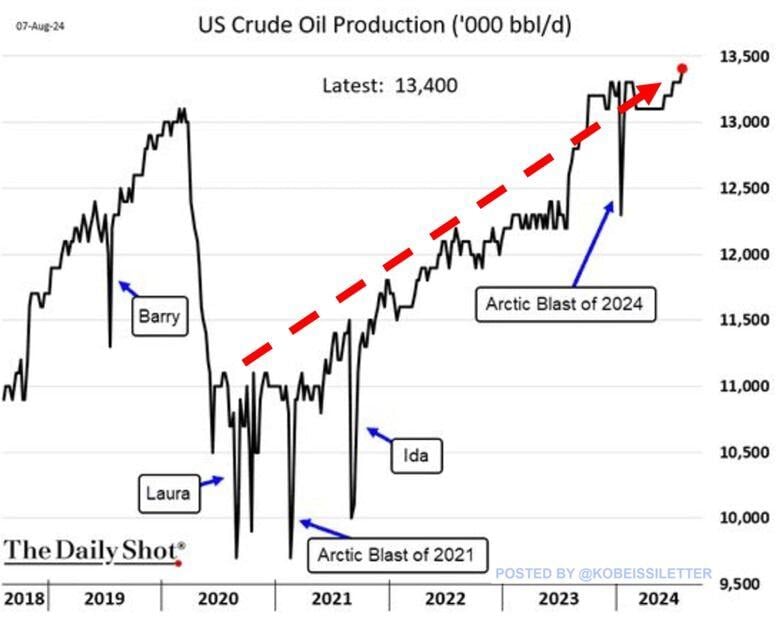

BREAKING: US crude oil production has officially hit a record 13.4 million barrels per day.

Daily oil production has increased by 22% over the last 4 years. Since 2008, production has skyrocketed 350% from ~3.8 million barrels per day. The US is now the world’s largest oil producer exceeding Russia's output by ~35% and Saudi Arabia by ~38%. The US is dominating global oil production. Source: The Kobeissi Letter, The Daily Shot

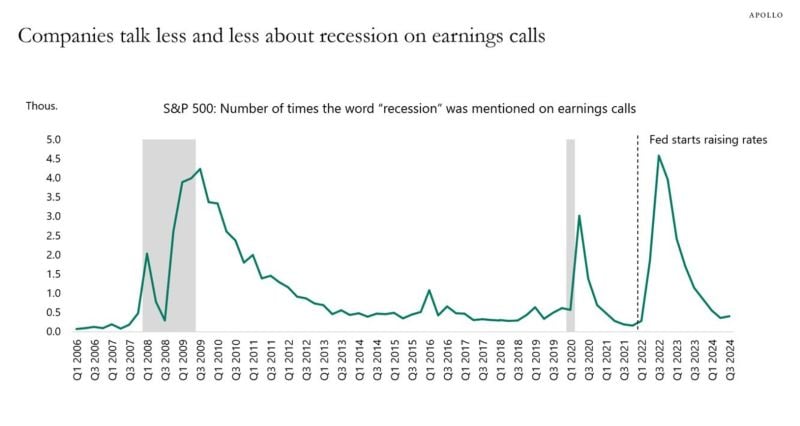

Torsten from Apollo: the reality is that firms on earnings calls talk less and less about recession

Source: Mike Z.

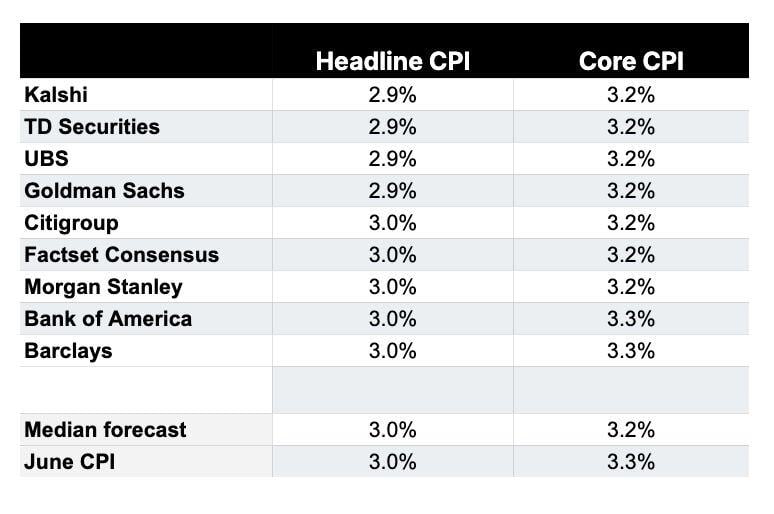

US July CPI inflation expectations:

1. Kalshi: 2.9% 2. TD Securities: 2.9% 3. UBS: 2.9% 4. Goldman Sachs: 2.9% 5. Citigroup: 3.0% 6. Morgan Stanley: 3.0% 7. Bank of America: 3.0% 8. Barclays: 3.0% The median July CPI expectation shows headline inflation at 3.0% and Core CPI inflation at 3.2%. If today CPI inflation comes in at 2.9% or lower, it will mark the first month with inflation under 3.0% since March 2021. Today's CPI report could solidify a hashtag#fed September rate cut. Source: The Kobeissi Letter

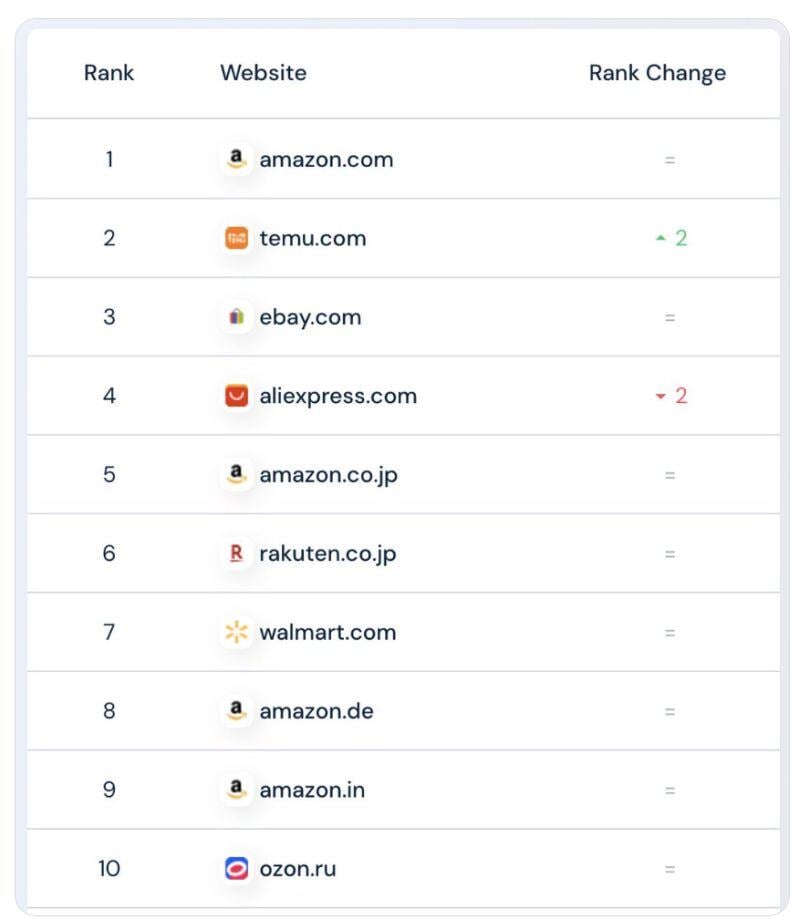

Temu overtook eBay to become the 2nd most-visited e-commerce website in the world

Source: SimilarWeb, Juozas Kaziukėnas on X

$SBUX Starbucks replaces CEO Laxman Narasimhan with $CMG Chipotle CEO Brian Niccol

$CMG Chipotle's stock is up 773% since Brian Niccol became CEO in March 2018 Just 9 S&P 500 stocks have performed better than $CMG since March 2018 $SBUX must have paid him the star bucks... Source: Stocktwits

Investing with intelligence

Our latest research, commentary and market outlooks