Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Athletes from four California universities won 89 Olympic medals. (The United States won 126 total).

Athletes from Stanford University alone won more medals than all but seven countries in the world. Source: Erik Brynjolfsson

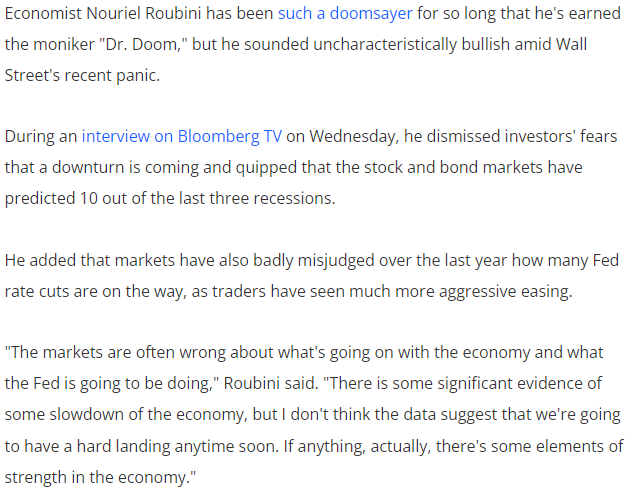

"Dr Doom" Nouriel Rouvinsi is upbeat about the economy

Source: Fortune

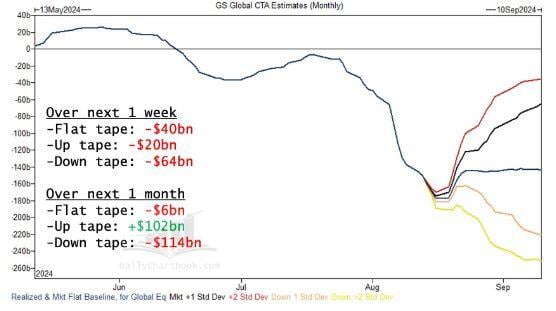

CTAs are projected to sell global stocks in every single scenario over the next week, up to a total of $64 billion if the market trades lower, warns Goldman Sachs!

Source: GS, Barchart

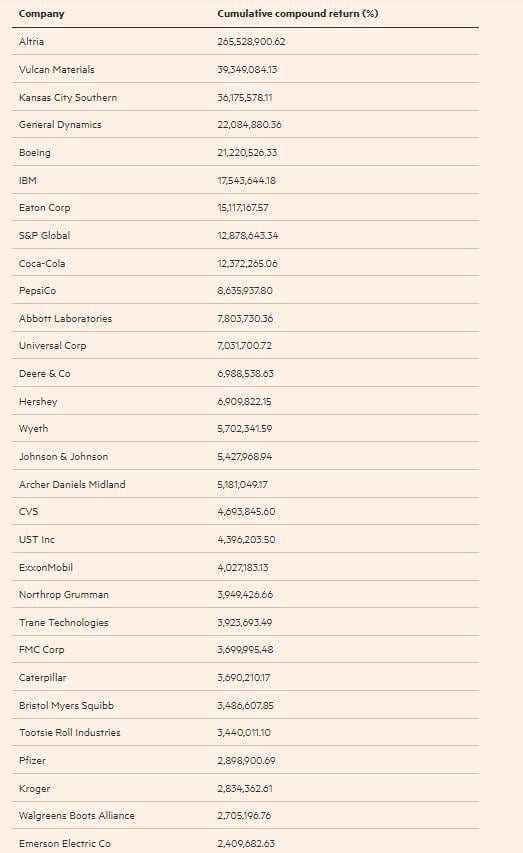

If you invested $1 in Altria, you would have $2.6 million today, making it the best-performing stock in history, according to research from Arizona State

Altria has generated a cumulative compound return of 265,528,900.62% since data began being recorded. Here are the others. Source: Barchart

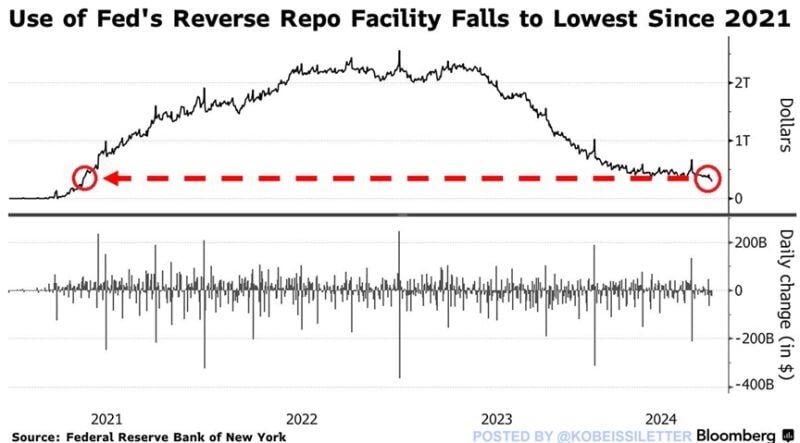

BREAKING: The Fed’s Reverse Repo (RRP) facility has dropped below $300 billion for the first time since 2021

The RRP is one of the financial system's excess liquidity metrics and is widely watched by investors. Large banks, government-sponsored enterprises, and money-market funds put their extra cash into the facility to earn interest on it. RRP usage has plummeted by $2.3 TRILLION since December 2022. Over the last several months, however, the decline has stabilized and the facility usage has been oscillating around $300-$400 billion. Source: www.zerohedge.com, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks