Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

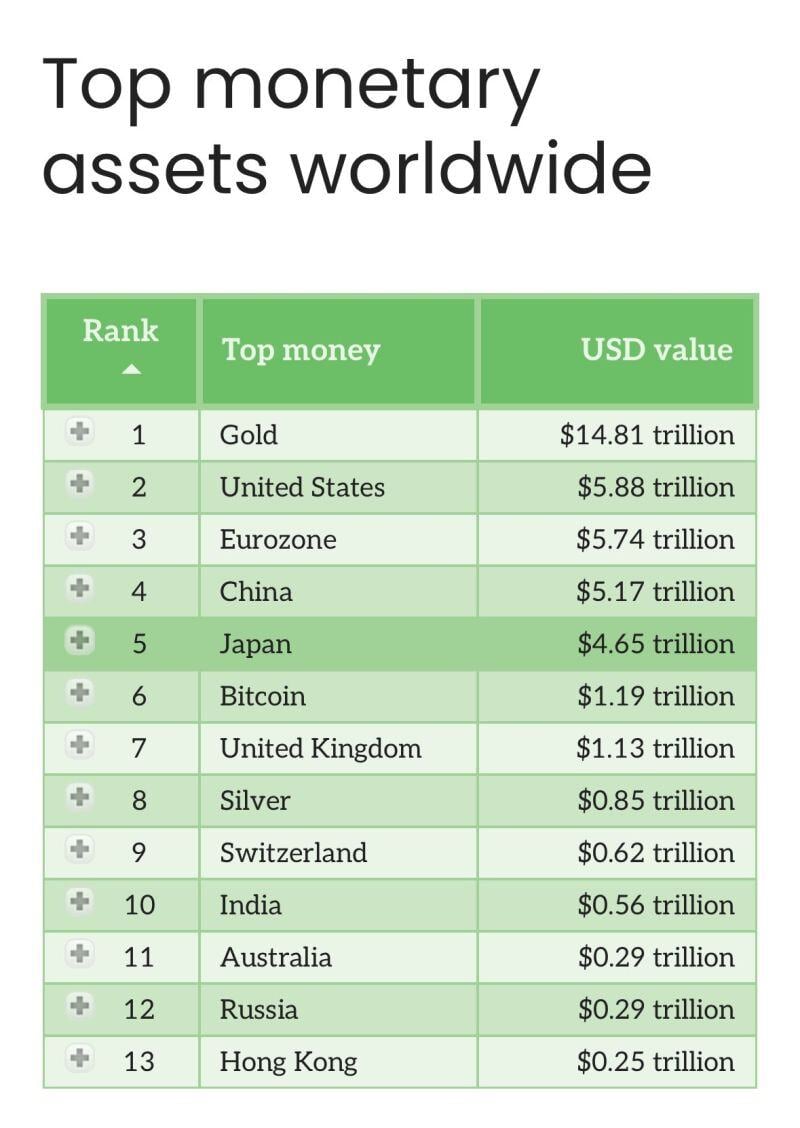

Top monetary assets worldwide

Source: Porkopolis Economics

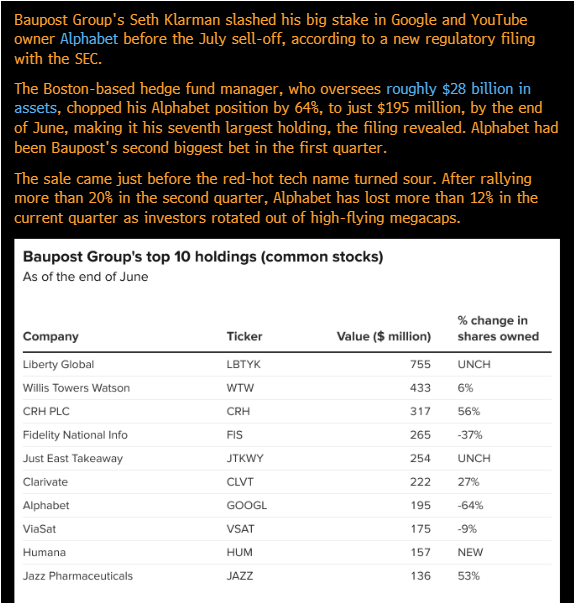

Value investor Seth Klarman cuts his stake in Alphabet and buys Humana

Source: Bloomberg

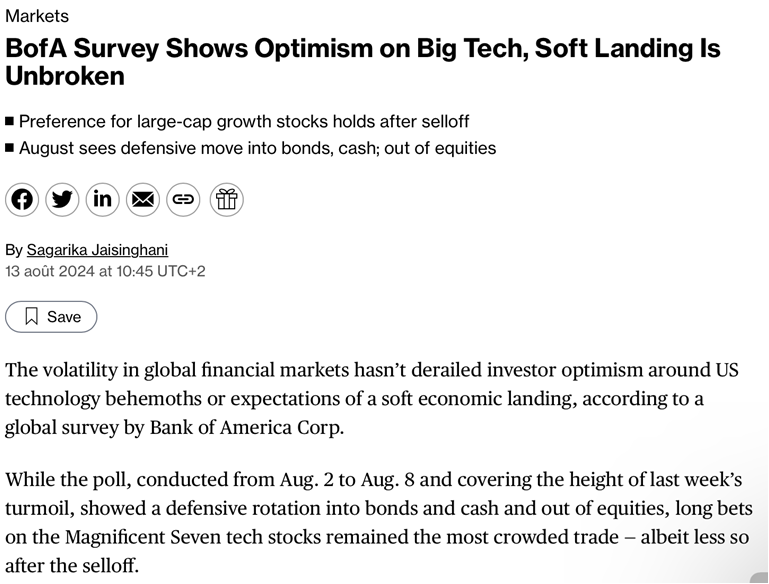

Bank of America survey shows continued optimism on Big Techs

Source: Bloomberg

The European Commission has denied that its internal market commissioner had approval from Ursula von der Leyen to send the letter

one EU official saying, 'Thierry has his own mind and way of working and thinking'. Source: FT

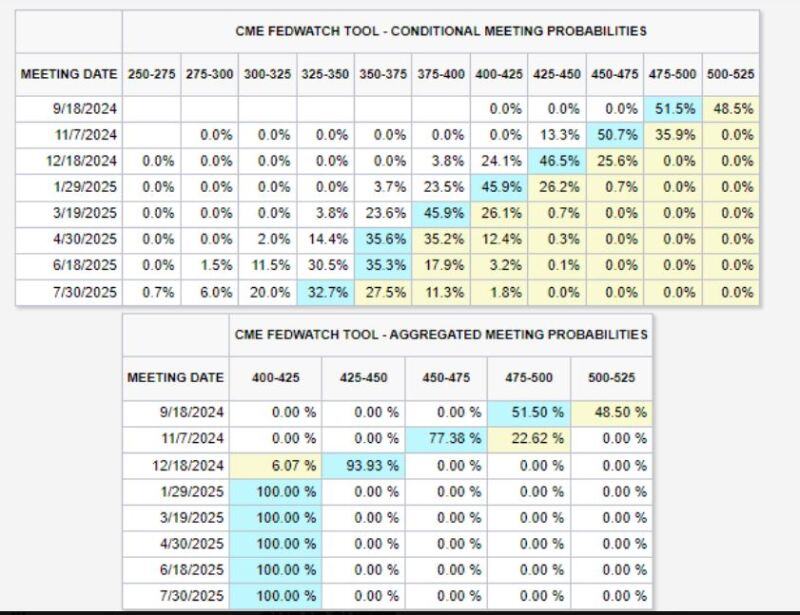

105bps of fed rate cuts are now priced into 2024.

Source: Mike Z.

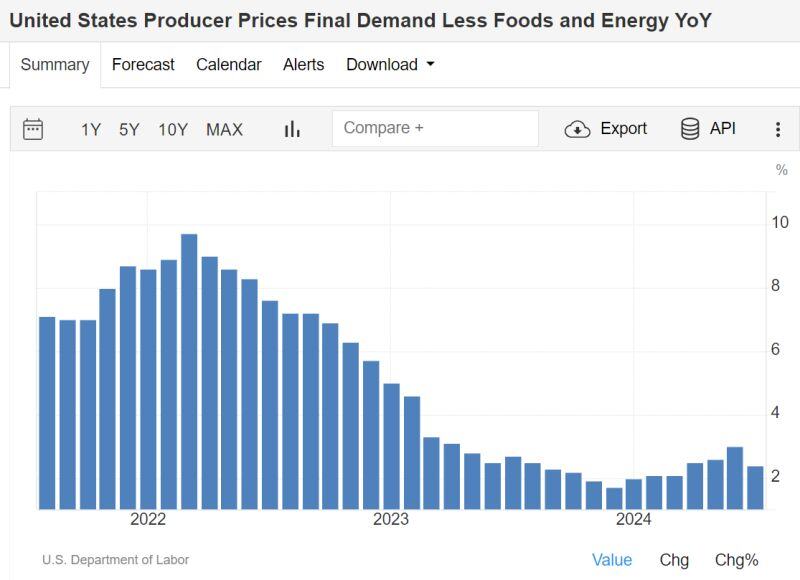

BREAKING: US July PP inflation falls to 2.2%, below expectations of 2.3%

Core PPI inflation falls to 2.4%, below expectations of 2.7%. This is the first drop in Core PPI YoY since December last year... In another constructive sign, PPI inflation is now at its lowest level since March 2024. A September hashtag#fed rate cut seems to be on its way. PPI numbers in a nutshell: - PPI 0.1% MoM, Exp. 0.2% - PPI Core 0.0% MoM, Exp. 0.2% - PPI 2.2% YoY, Exp. 2.3% - PPI Core 2.4% YoY, Exp. 2.6% Source: The Kobeissi Letter, US Department of Labor, Mike Z.

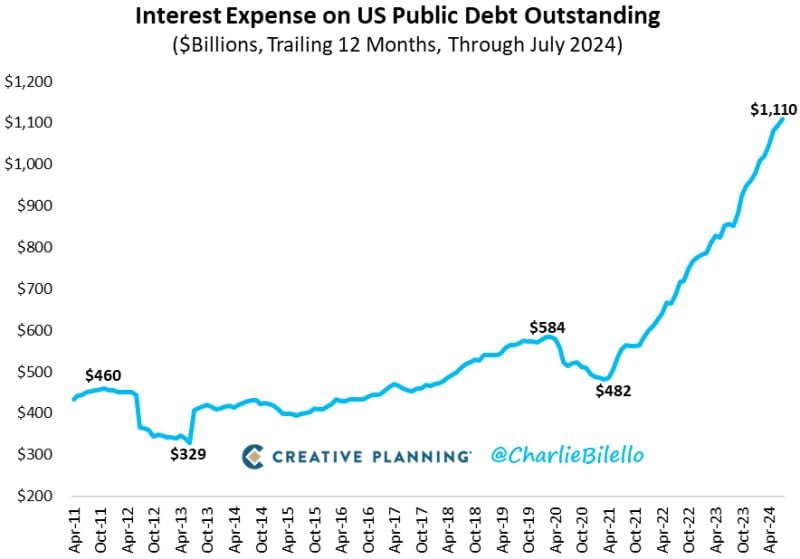

The Interest Expense on US Public Debt rose to a record $1.11 trillion over the last 12 months, more than doubling over the past two years

At the current pace it will soon be the largest line item in the Federal budget, surpassing Social Security. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks