Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

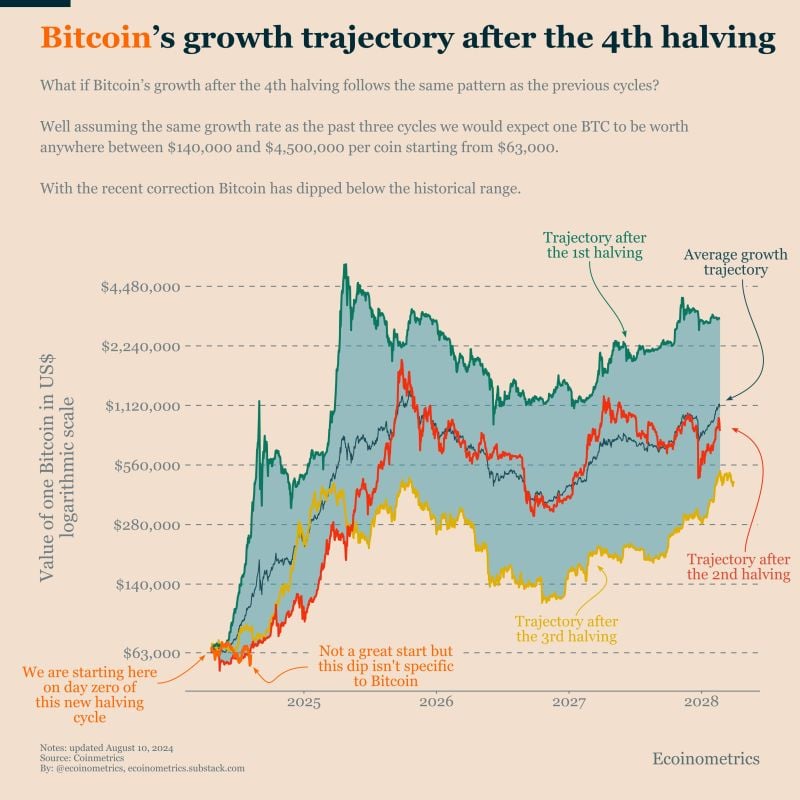

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

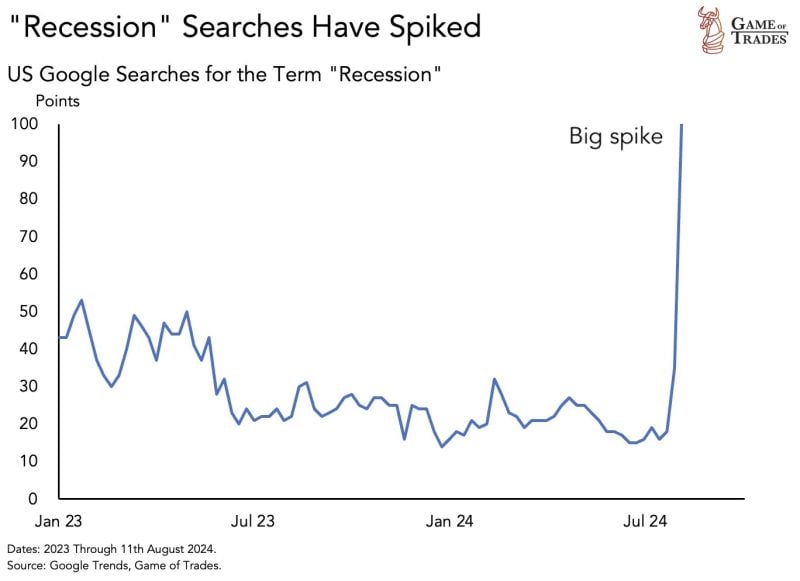

Recession is the talk of the town again

In just 1 week, recession searches have hit record levels. Source: Game of Trades

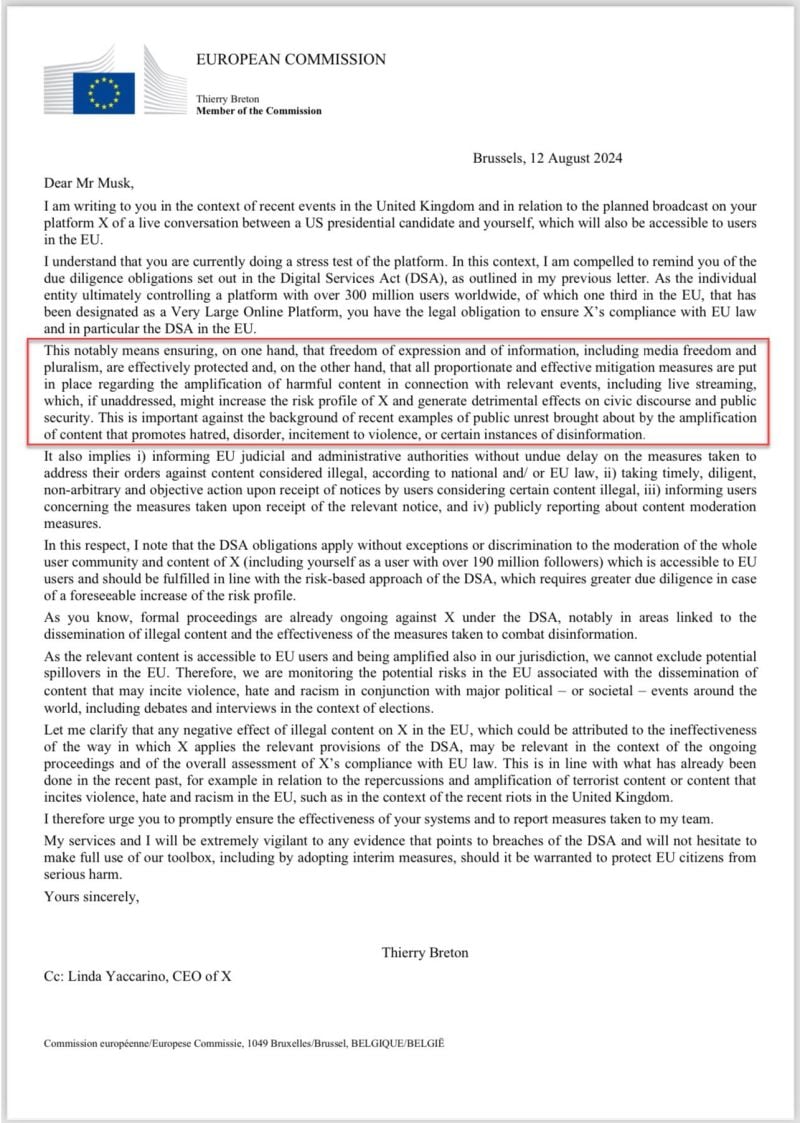

BREAKING: Elon Musk will interview Donald Trump at 8pm ET tonight on X.

Ahead of the interview, the European Commission issued a letter to Elon Musk demanding that he CENSOR Donald Trump in their upcoming interview. They are even threatening him with "legal obligations" if he fails to stop the "disinformation"... They talk about "ensuring freedom of expression" and of "information being protected"... Source: www.zerohedge.com

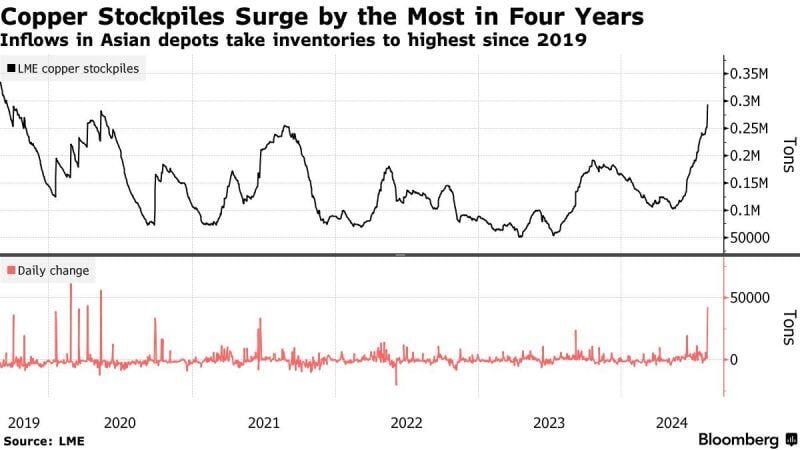

Copper Inventories have jumped to the highest level in more than 4 years signaling weak demand in Asia!

Source: Bloomberg, Barchart

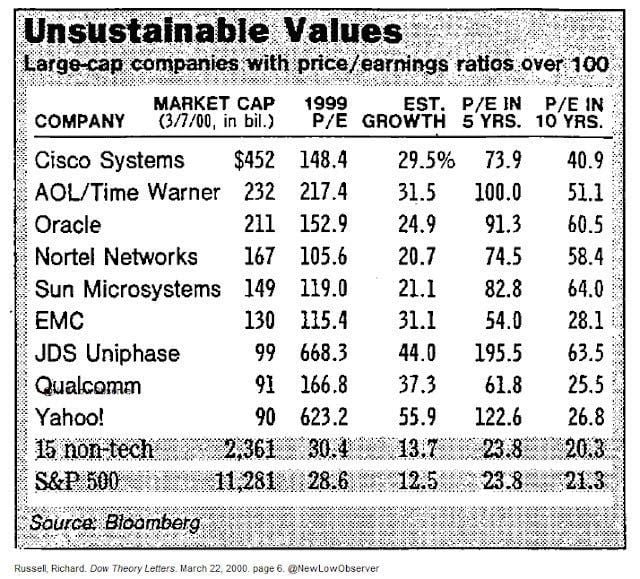

March 22, 2000

Difficult to compare the internet bubble with the current ai mania. Source: Andrew Kuhn

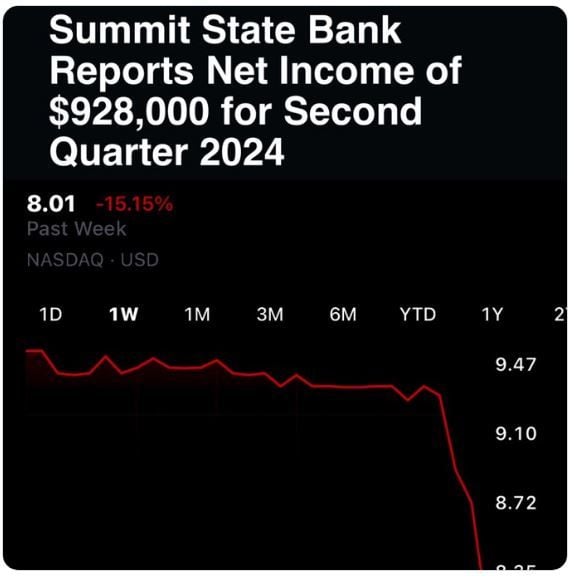

Is the US regional bank crisis worsening?

Summit State Bank's Q2 Earnings Plummet. Q2 2024 Net Income: $928,000 Drops -67% from Q2 2023 Net Income $2,985,000. Earnings Decline: 69%. Stock Drop: -15%. $SSBI. Source: The Coastal Journal

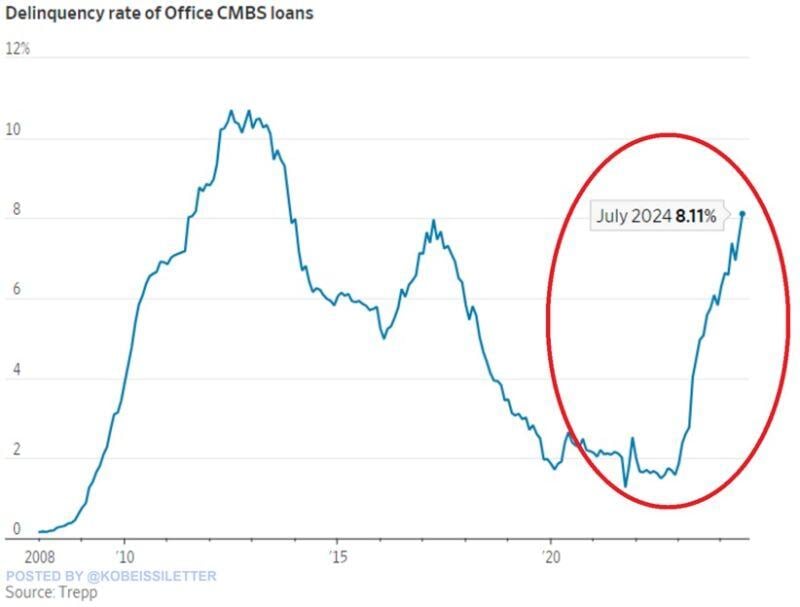

The delinquency rate on commercial mortgage-backed securities (CMBS) for offices spiked to 8.1% in July, the highest in 11 years.

The delinquency rate of office CMBS loans has QUADRUPLED in 1.5 years. Delinquencies are currently rising at a faster pace than during the 2008 Financial Crisis. A top AAA-rated CMBS experienced a $40 million loss in May for the first time since the 2008 Financial Crisis. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks