Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

“Until you can manage your emotions, don’t expect to manage money.” -Warren Buffett

Source: Matt Allen @investmattallen on X

The scariest China chart

Source: TS Lombard, Bloomberg, Win Smart

A new fee model for airlines? WIZZ AIR LAUNCHES $550 ‘ALL YOU CAN FLY’ ANNUAL SUBSCRIPTION PASS

Travelers in Europe can now take unlimited flights for 499 euros ($550) a year, under a new travel subscription service from budget carrier Wizz Air The introductory fee will be available until Aug. 16 before the price rises to 599 euros (Source CNBC, Evan on X)

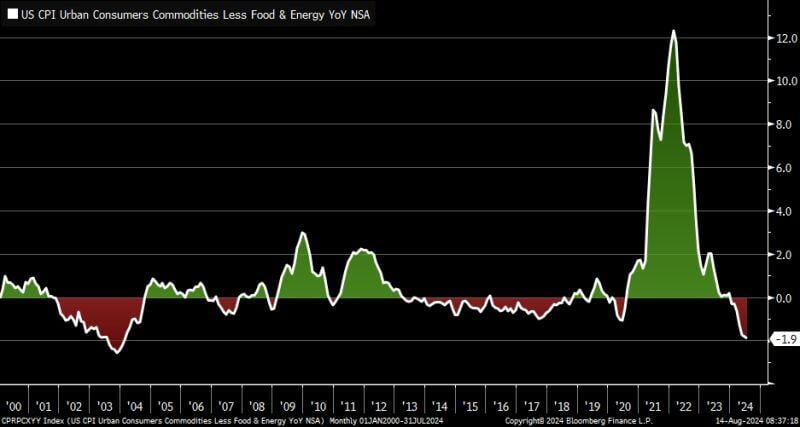

Core goods CPI plunged further into deflation territory in July ... -1.9% year/year

Source: Kevin Gordon, Bloomberg

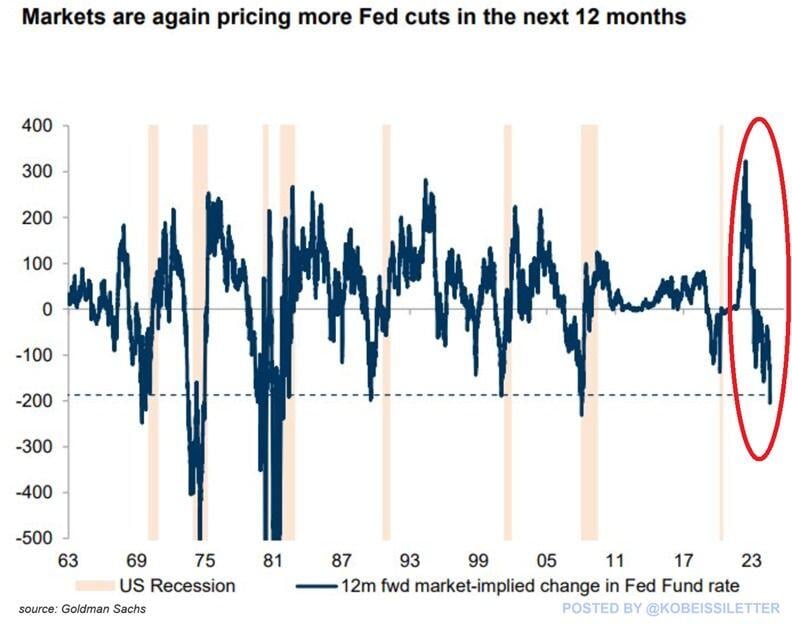

Interest rate futures are now pricing in 8 Fed rate cuts over the next 12 months, the most since the 2008 Financial Crisis.

Market expectations have sharply shifted over the last week toward more cuts in anticipation of economic weakness. Over the last 60 years, every time the market expected 200 basis points of rate cuts, a recession in the US followed within several months. Source: The Kobeissi Letter, Goldman Sachs

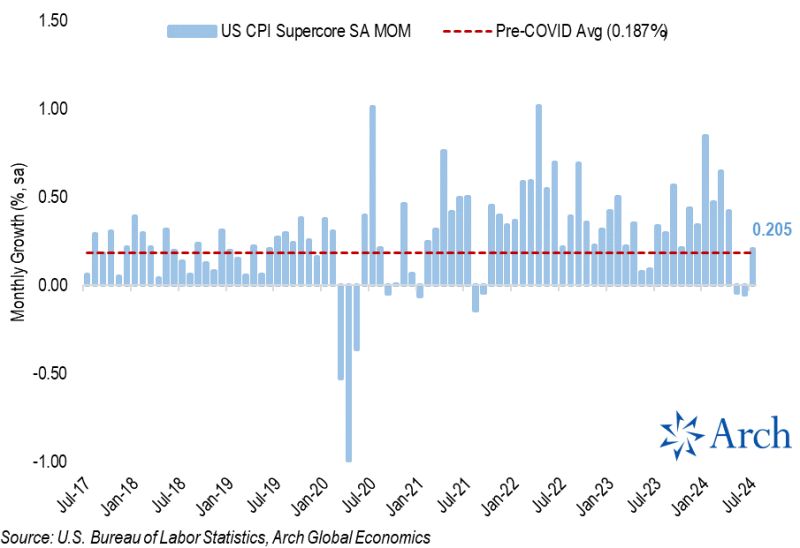

July US CPI fell to 2.9%, below expectations of 3.0%

ore CPI inflation fell to 3.2%, in-line with expectations of 3.2%. This marks the first month with CPI inflation below 3.0% since March 2021. However, Supercore inflation snapped back to just above the pre-COVID average after two months of outright declines. Shelter inflation also surged back to a 0.38% m/m gain after an unusual decline to 0.17% in June. This is not the perfect report the hashtag#Fed would be looking for. However, there is nothing overly concerning from what we've seen thus far. The first rate cut since 2020 is probably coming next month.

Cobalt is a critical mineral used in numerous commercial, industrial, and military applications.

In recent years, it has gained attention as it is also necessary for batteries used in cell phones, laptops, and electric vehicles (EVs). This graphic by Elements / Visual Capitalist illustrates estimated cobalt production by country in 2023 in metric tons. The data is from the most recent U.S. Geological Survey (USGS) Mineral Commodity Summaries, published in January 2024.

Investing with intelligence

Our latest research, commentary and market outlooks