Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Q1 reporting us earnings season kicks off next week with the banks reporting on Friday.

Below is a sneak preview of what's to come during the first three weeks. Note: companies marked with * are currently unconfirmed. Watch for: $MSFT, $TSLA, $AMZN, $GOOGL, $META, $TSM, $JPM, $XOM, $MA, $V, $NFLX, $CAT, $ASML and more Source: Wall Street Horizon

Some hawkish comments by fed officials seemed to be behind yesterday sell-off in stocks.

Among the comments: *BARR: BANKS' OFFICE COMMERCIAL REAL-ESTATE ISSUES TO TAKE TIME *KUGLER: `SOME LOWERING' OF RATES THIS YEAR LIKELY APPROPRIATE *FED'S HARKER SAYS INFLATION IS STILL TOO HIGH *BARKIN: FED HAS TIME TO GAIN MORE CLARITY BEFORE LOWERING RATES *GOOLSBEE: WORTH STAYING ATTUNED TO DETERIORATION IN JOBS MARKET *MESTER: NEED MORE PROGRESS ON HOUSING, CORE SERVICES INFLATION But the key market driver (to the downside) was Kashkari - President and CEO of the Federal Reserve Bank of Minneapolis - who hinted at the potential of NO RATE-CUTS. *KASHKARI: QUESTION OF WHY CUT RATES IF ECONOMY REMAINS STRONG “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target,” Kashkari said in a virtual event with LinkedIn on Thursday. “If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.” His comments seemed to trigger a wave of selling in stocks.

Life Lessons from Charlie Munger.

It's so simple. You spend less than you earn. Invest shrewdly. Avoid toxic people and toxic activities. ~ Charlie Munger. Source: Investment Books (Dhaval)

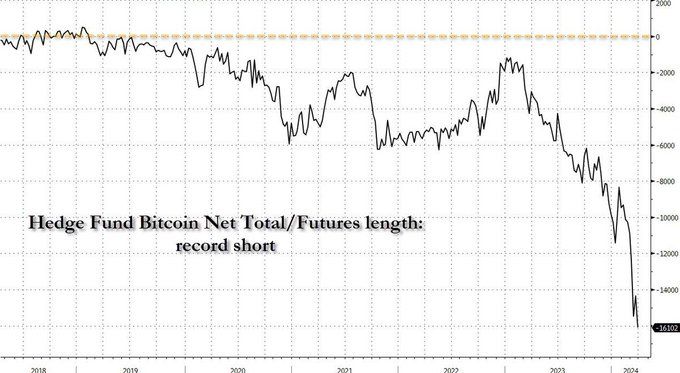

Hedge funds are shorting Bitcoin at record levels.

Is another massive short squeeze ahead of us ? Source: Bloomberg, www.zerohedge.com

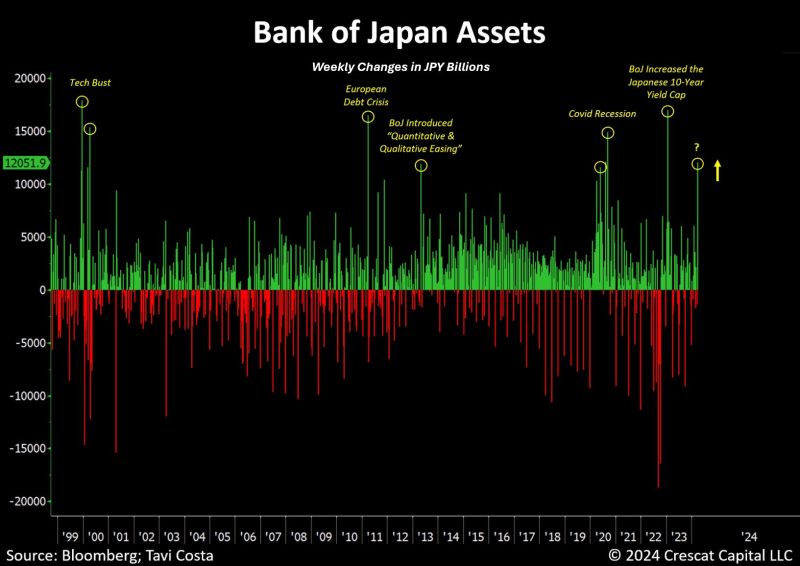

The global economy is addict to easy-money policies.

While everyone is talking about boj hiking rates, we just experienced one of the largest weekly changes in the BoJ balance sheet assets in history. In USD terms, this move accounted for nearly $80 billion in one week... Source: Tavi Costa, Bloomberg

Mind the gap:

Gold has hit fresh ATH despite a rise in US real yields. At current 2% 10y real rate, Gold at $2,300/oz is ~$270/oz expensive, Jefferies has calculated. There are fundamental reasons: Increased government spending & indications of a willingness to accept higher inflation Source: HolgerZ, Bloomberg

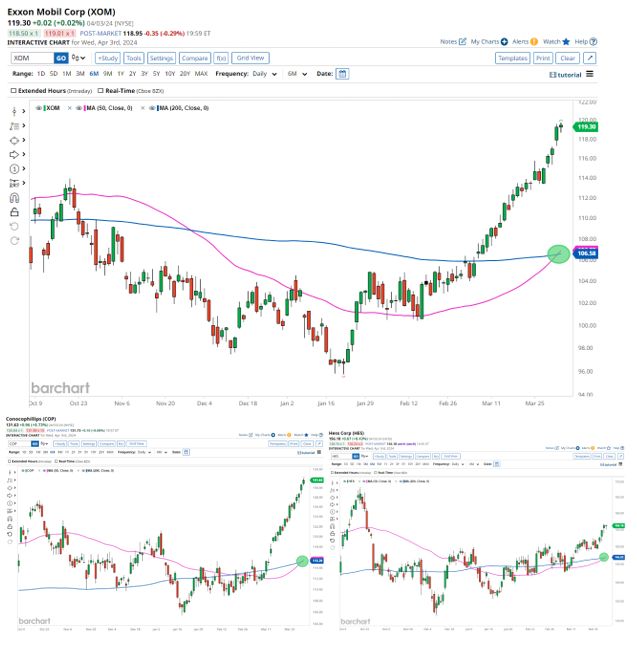

Oil-related stocks are cooking now!

Exxon $XOM, Conocophillips $COP, and Hess $HES have all formed Golden Crosses Source: Barchart

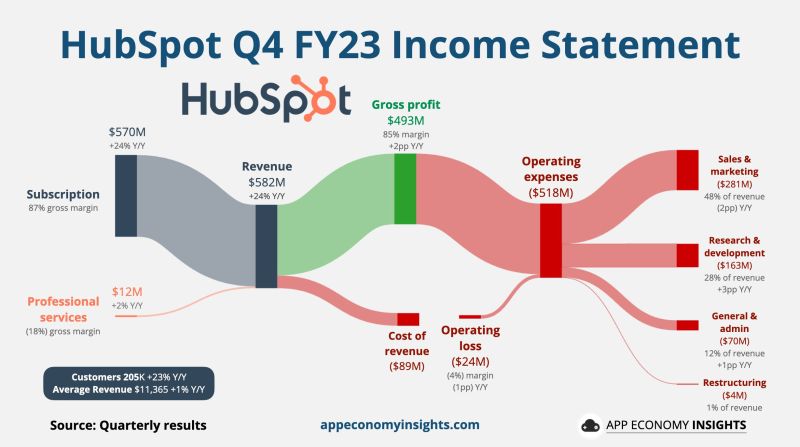

$GOOG Alphabet eyes HubSpot acquisition.

$HUBS has a $35B market cap. - Could be Google's largest deal ever. - Reuters reported talks with advisers. - Deal could boost CRM on Google Cloud. Here's a look at their latest quarter. Source: App Economy Insights

Investing with intelligence

Our latest research, commentary and market outlooks