Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Google is considering charging for new “premium” features powered by generative artificial intelligence, in what would be the biggest ever shake-up of its search business.

The proposed revamp to its cash cow search engine would mark the first time the company has put any of its core product behind a paywall, and shows it is still grappling with a technology that threatens its advertising business, almost a year and a half after the debut of ChatGPT. Google is looking at options including adding certain hashtag#AI-powered search features to its premium subscription services, which already offer access to its new Gemini AI assistant in Gmail and Docs, according to three people with knowledge of its plans. Engineers are developing the technology needed to deploy the service but executives have not yet made a final decision on whether or when to launch it, one of the people said. Google’s traditional search engine would remain free of charge, while ads would continue to appear alongside search results even for subscribers. But charging would represent the first time that Google — which for many years offered free consumer services funded entirely by advertising — has made people pay for enhancements to its core search product. Source: FT

In the us, soft data (less reliable) has surprised to the upside a lot more than the hard data (more reliable) since the start of the year.

Source: Bob Elliott, The Daily Shot

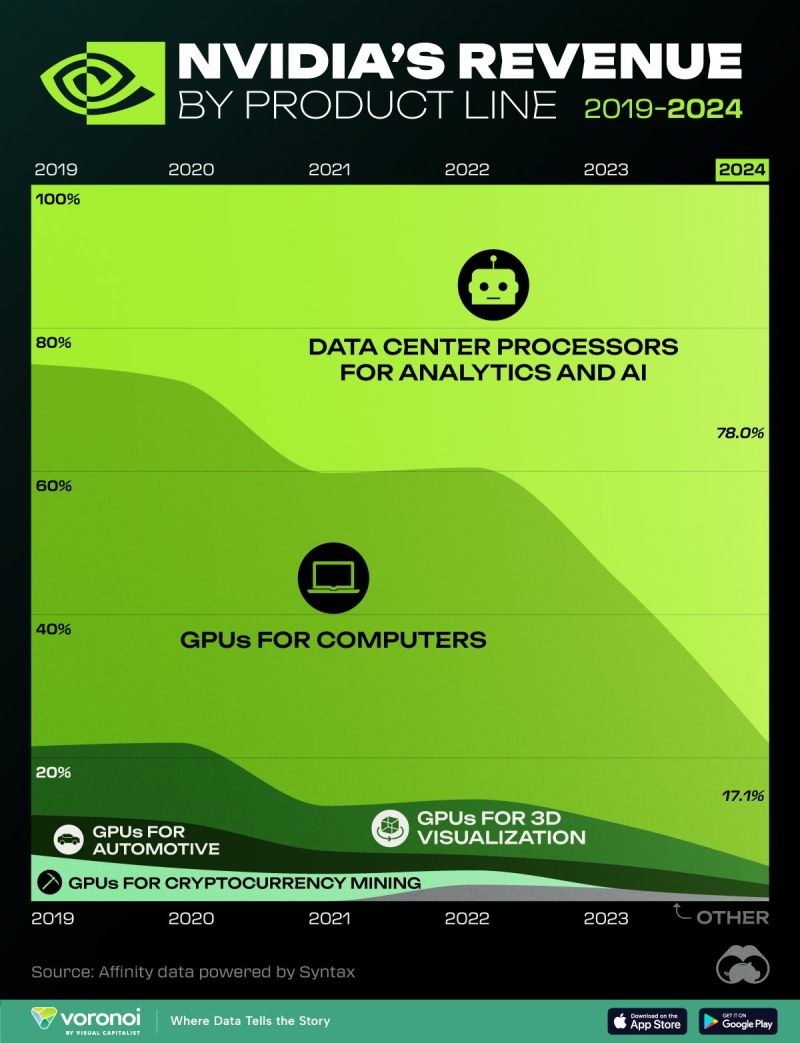

Nvidia's $NVDA Revenue by product segment over the last 5 years

Source: Visual Capitalist

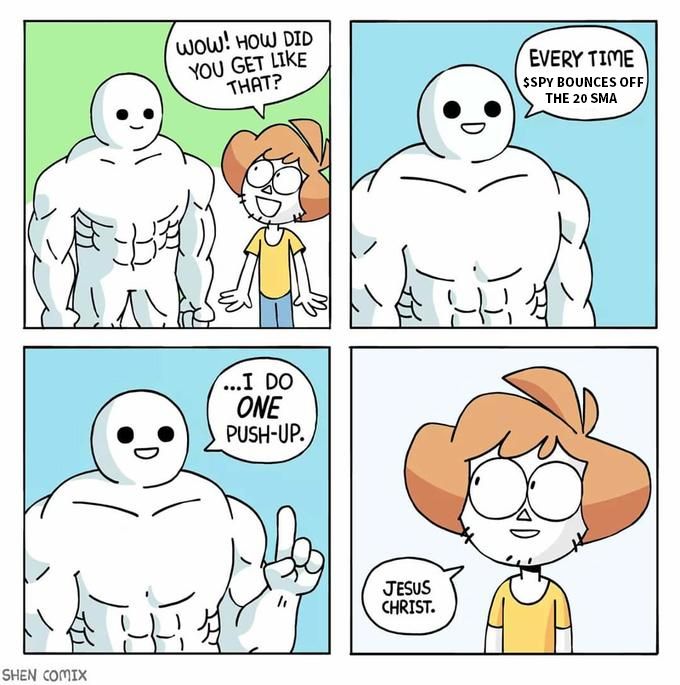

The S&P 500 has not had a weekly drop of 2% or more since the week of October 23rd, 2023.

There have only been a total of TWO weekly drops in the entire 2024 so far. Since October 2023, the S&P 500 has added almost $11 TRILLION in market cap. That's more than 4 TIMES the value of the Canadian stock market added in 5 months. $11 trillion in market cap is also the same value of China's entire stock market. Source: The Kobeissi Letter

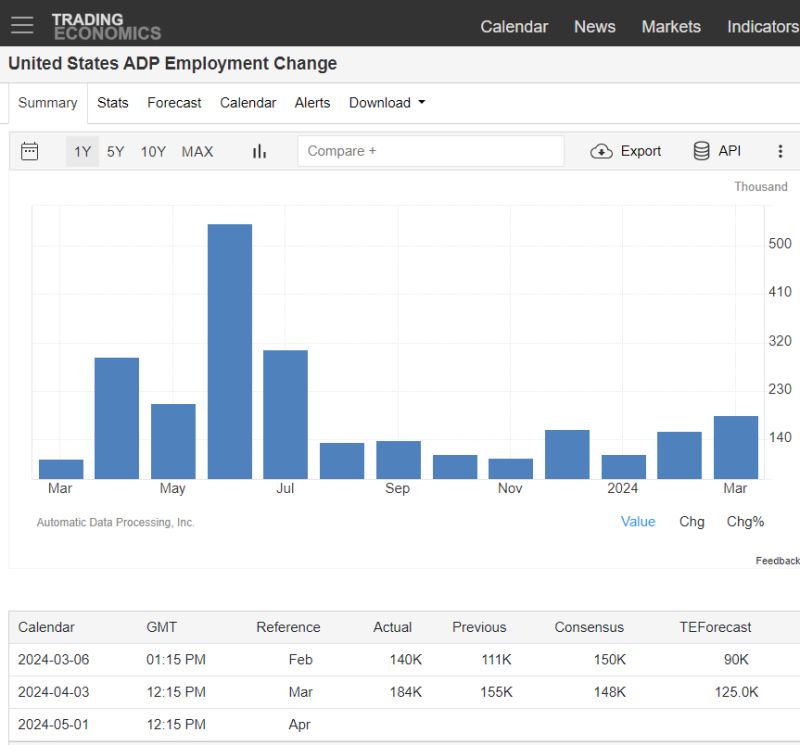

SUMMARY OF US MARCH ADP JOBS REPORT:

1. The U.S. economy added a higher-than-expected 184,000 jobs in March, as per ADP, easily beating forecasts for +148,000. 2. The number of monthly job gains was the highest in eight months (July 2023) 3. February number was also revised upwards. 4. Wage growth accelerated for those who changed jobs, rising +10% from a year earlier. Key Takeaway: The pickup in jobs growth supports the case that the labor market remains strong, and the economy continues to hold up better than expected. The ADP report does not point to imminent Fed rate cuts as markets continue to push back the timing of the first move. Source: Jesse Cohen, Trading Economics

The Bitcoin halving is now only about 16 days away 👀

https://bitbo.io/halving/ Source: Bitcoin Magazine

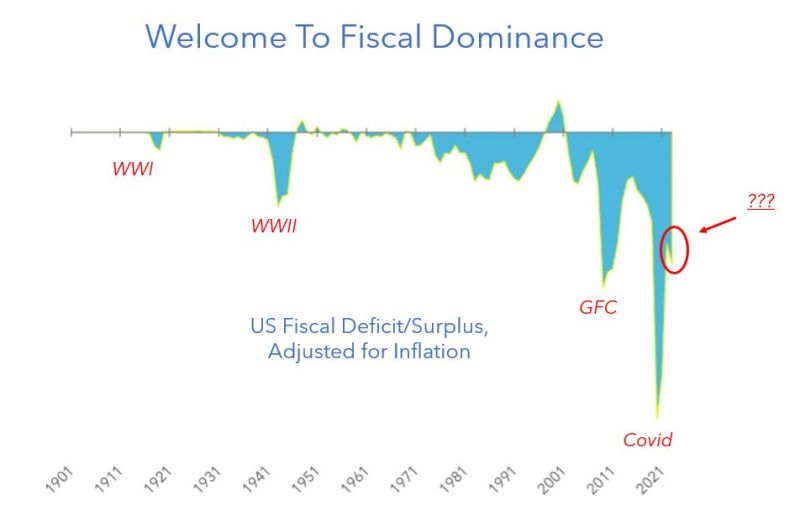

The era of fiscal dominance

source: MacroAlf. Inflation-adjusted US fiscal deficits popping up at: - World War I - World War II - Great Financial Crisis - Covid - 2023 Find the outlier...

Investing with intelligence

Our latest research, commentary and market outlooks