Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

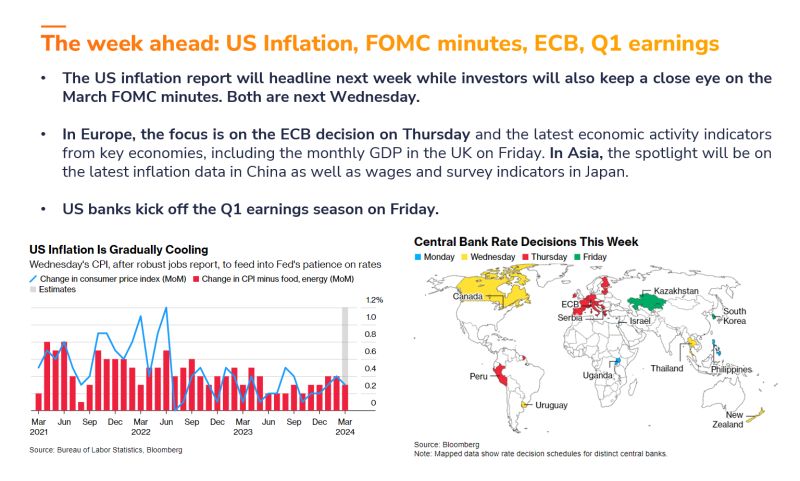

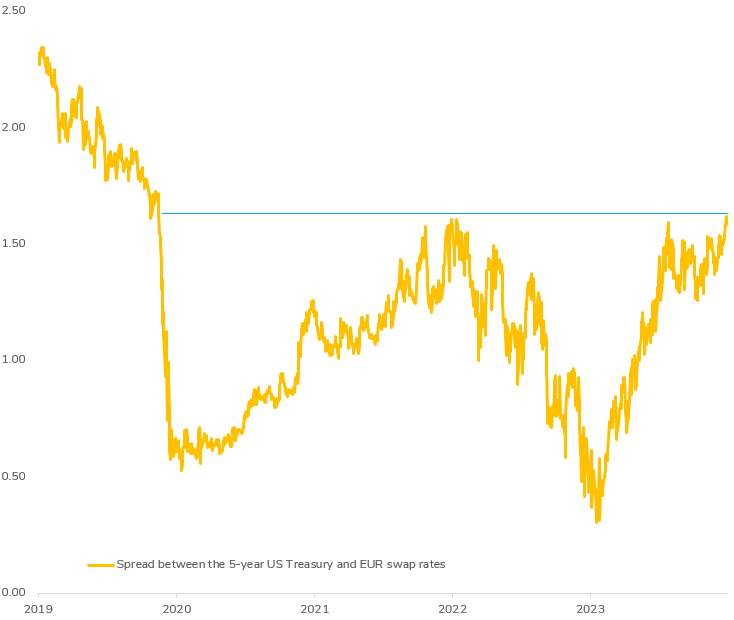

A Pivotal Moment Between the ECB and the Fed?

This week unfolds as a critical juncture for the interest rate disparity between the US and Europe. As the spread between the 5-year US Treasury and EUR swap yields hits its highest level since the pandemic, the upcoming release of US CPI data and the ECB meeting carry the potential to reshape this landscape once again. All eyes are on ECB President Lagarde as she navigates the challenge of maintaining ECB independence from the Fed, especially amidst differing inflation dynamics across the Atlantic. The implications for currency exchange rates, interest rates, and monetary policy are captivating areas to watch closely in the coming days.

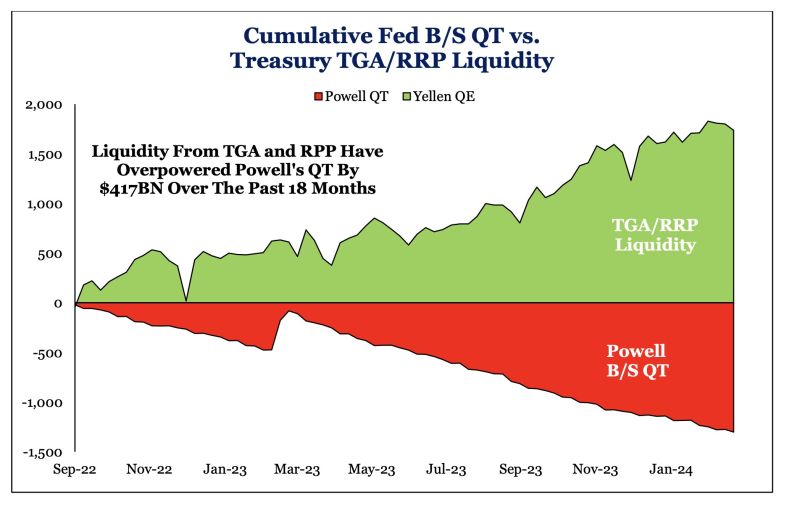

It's the liquidity, stupid! Yellen's stealth QE overpowering Powell's QT.

This probably helps risk assets performing well despite high interest rates and qt (Chart via SRP thru HolgerZ)

Price cuts in Florida just surged up to the highest level

In http://Realtor.com's data set: 30.1% of all house listings had a price reduction in March 2024. Indicating substantial "selling pressure". Source: Nick Gerli, Re.venture

The Q1 reporting us earnings season kicks off next week with the banks reporting on Friday.

Below is a sneak preview of what's to come during the first three weeks. Note: companies marked with * are currently unconfirmed. Watch for: $MSFT, $TSLA, $AMZN, $GOOGL, $META, $TSM, $JPM, $XOM, $MA, $V, $NFLX, $CAT, $ASML and more Source: Wall Street Horizon

Some hawkish comments by fed officials seemed to be behind yesterday sell-off in stocks.

Among the comments: *BARR: BANKS' OFFICE COMMERCIAL REAL-ESTATE ISSUES TO TAKE TIME *KUGLER: `SOME LOWERING' OF RATES THIS YEAR LIKELY APPROPRIATE *FED'S HARKER SAYS INFLATION IS STILL TOO HIGH *BARKIN: FED HAS TIME TO GAIN MORE CLARITY BEFORE LOWERING RATES *GOOLSBEE: WORTH STAYING ATTUNED TO DETERIORATION IN JOBS MARKET *MESTER: NEED MORE PROGRESS ON HOUSING, CORE SERVICES INFLATION But the key market driver (to the downside) was Kashkari - President and CEO of the Federal Reserve Bank of Minneapolis - who hinted at the potential of NO RATE-CUTS. *KASHKARI: QUESTION OF WHY CUT RATES IF ECONOMY REMAINS STRONG “In March I had jotted down two rate cuts this year if inflation continues to fall back towards our 2% target,” Kashkari said in a virtual event with LinkedIn on Thursday. “If we continue to see inflation moving sideways, then that would make me question whether we needed to do those rate cuts at all.” His comments seemed to trigger a wave of selling in stocks.

Life Lessons from Charlie Munger.

It's so simple. You spend less than you earn. Invest shrewdly. Avoid toxic people and toxic activities. ~ Charlie Munger. Source: Investment Books (Dhaval)

Investing with intelligence

Our latest research, commentary and market outlooks