Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

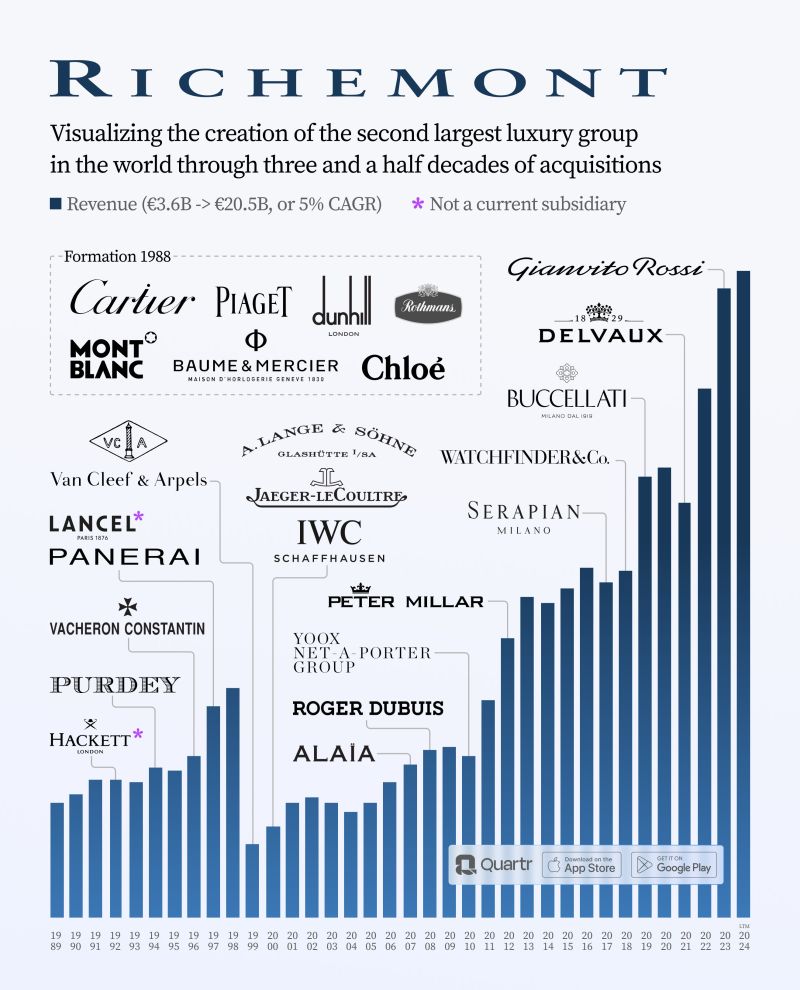

A great chart by Quartr about swiss luxury giant Richemont

In 1987, Bernard Arnault created $LVMH. In 1988, Johann Rupert created richemont $CFR.SW – an acquisition-driven luxury group much like LVMH, and to date, one of Arnault's largest competitors. Richemont is now the second largest luxury conglomerate and the third largest luxury company (with $RMS being the second) in the world. The group's many prestigious maisons include Cartier, Van Cleef & Arpels, Montblanc, Piaget, and Vacheron Constantin, to name a few. Since inception, Richemont has compounded its top line at 5% per year. Looking instead at the last 15 years, the group has grown its revenue and FCF at a 6% and 9% CAGR respectively. Quartr just created this infographic, mapping out every acquisition since Richemont's inception.

The Power of Vision or Why Exceptional Founders Embrace the Future, Define Their Destiny, and Forge the Path to Remarkable Success...

Source: R yan Junee

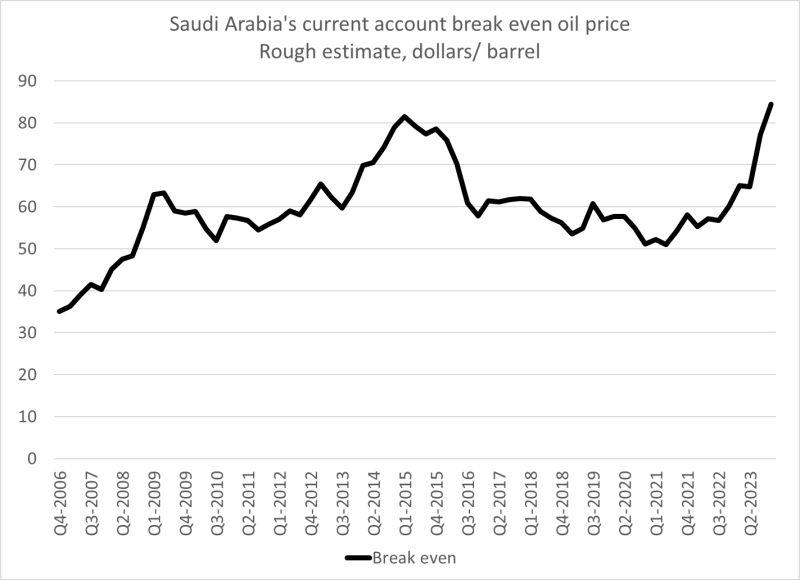

Looks like saudi arabia's balance of payments breakeven oil price (oil price that avoids a current account deficit) is now close to $85 a barrel...

This could explain why there is some scale back from NEOM + the need for oil prices to stay higher for longer... Source: Brad Setser

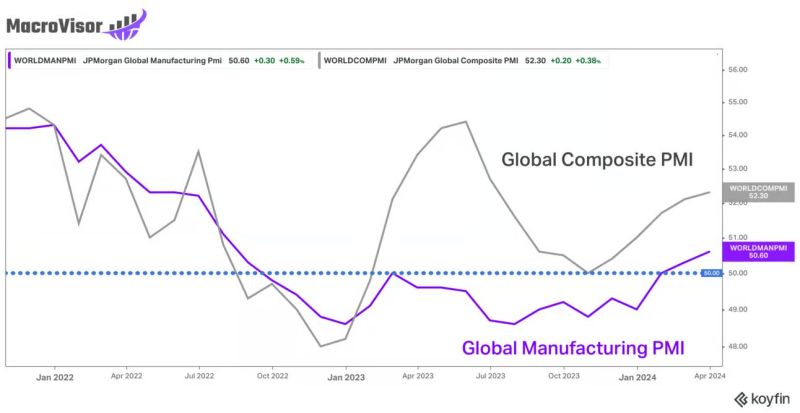

Global PMIs recovering nicely.

Source: Markets & Mayhem reposted Ayesha Tariq

Investing with intelligence

Our latest research, commentary and market outlooks