Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

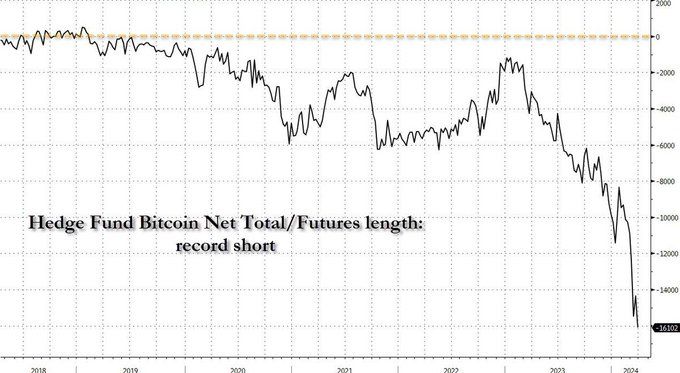

Hedge funds are shorting Bitcoin at record levels.

Is another massive short squeeze ahead of us ? Source: Bloomberg, www.zerohedge.com

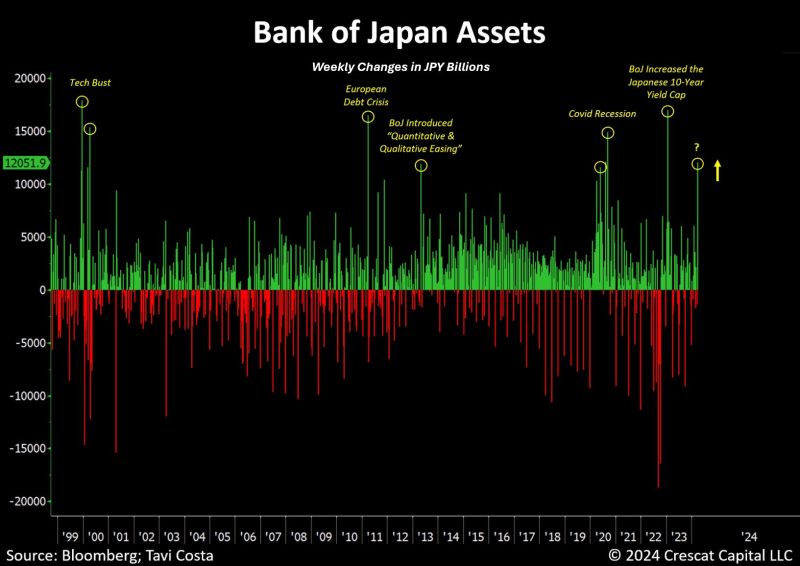

The global economy is addict to easy-money policies.

While everyone is talking about boj hiking rates, we just experienced one of the largest weekly changes in the BoJ balance sheet assets in history. In USD terms, this move accounted for nearly $80 billion in one week... Source: Tavi Costa, Bloomberg

Mind the gap:

Gold has hit fresh ATH despite a rise in US real yields. At current 2% 10y real rate, Gold at $2,300/oz is ~$270/oz expensive, Jefferies has calculated. There are fundamental reasons: Increased government spending & indications of a willingness to accept higher inflation Source: HolgerZ, Bloomberg

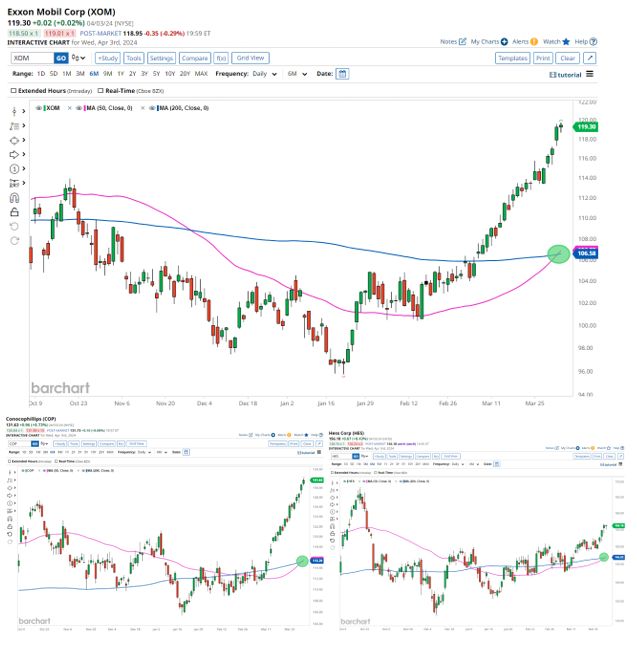

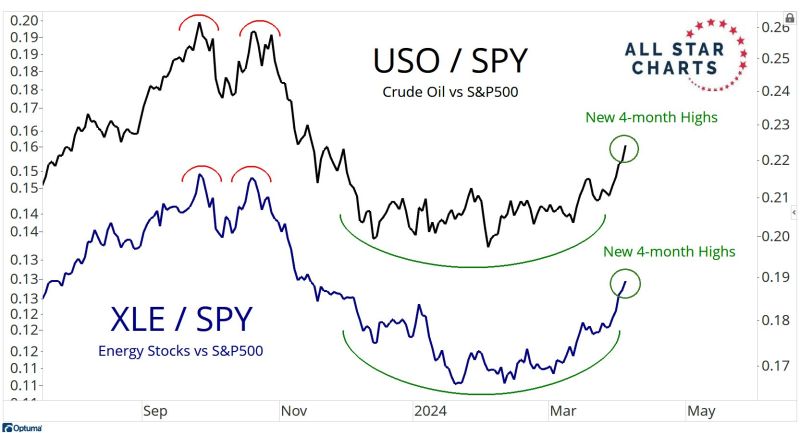

Oil-related stocks are cooking now!

Exxon $XOM, Conocophillips $COP, and Hess $HES have all formed Golden Crosses Source: Barchart

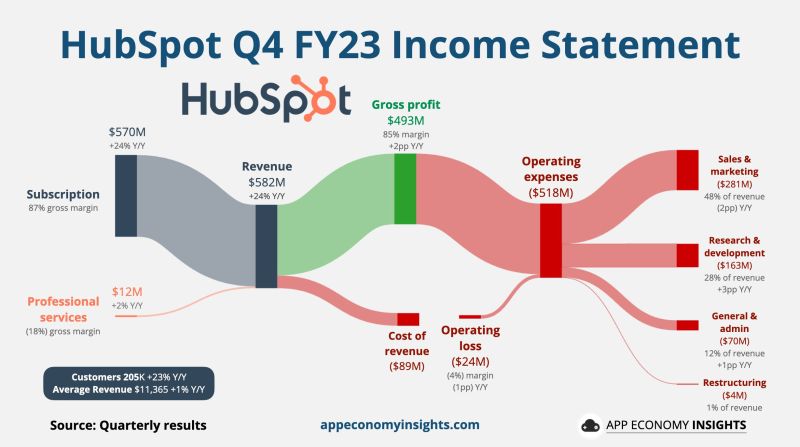

$GOOG Alphabet eyes HubSpot acquisition.

$HUBS has a $35B market cap. - Could be Google's largest deal ever. - Reuters reported talks with advisers. - Deal could boost CRM on Google Cloud. Here's a look at their latest quarter. Source: App Economy Insights

From a valuation standpoint, Alphabet is about 40% cheaper than it was the last time the stock was trading at these prices.

$GOOG 💸 Source: Trend Spider

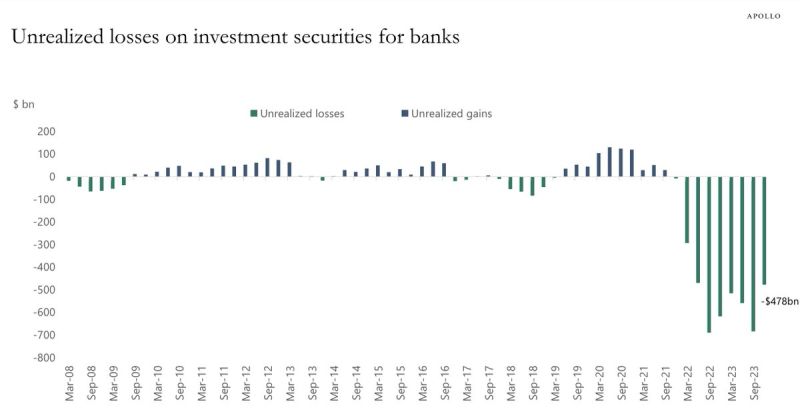

Just as everyone forgot, banks continue to carry alarming amount of unrealized losses.

In Q4 2023, unrealized losses on investment securities for banks hit $478 BILLION. This compares to over $100 billion of unrealized GAINS seen in 2020 when the Fed started cutting interest rates. Meanwhile, the Bank Term Funding Program has officially expired. This was the emergency loan program established during the regional bank crisis. Who will step in now? Source: The Kobeissi Letter

Below the relative chart of oil ETF $USO vs. S&P 500 ETF $SPY and the relative chart of oil stocks XLE vs. S&P 500 ETF $SPY.

Both just hit a 4.month relative high Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks