Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

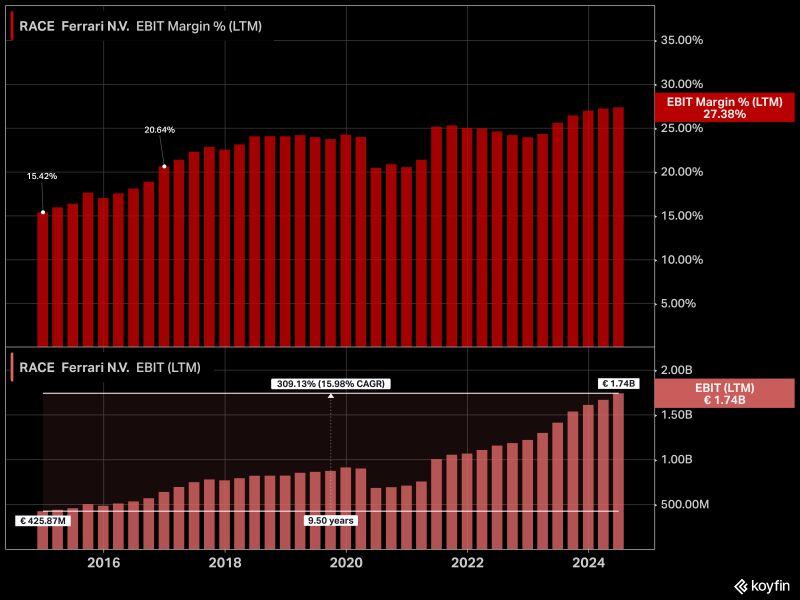

$RACE Since Ferrari IPO'd in 2015, operating margins at the luxury vehicle manufacturer have grown by almost 12%

Underlying operating income has grown at a 16% CAGR over the last decade. Source: Koyfin

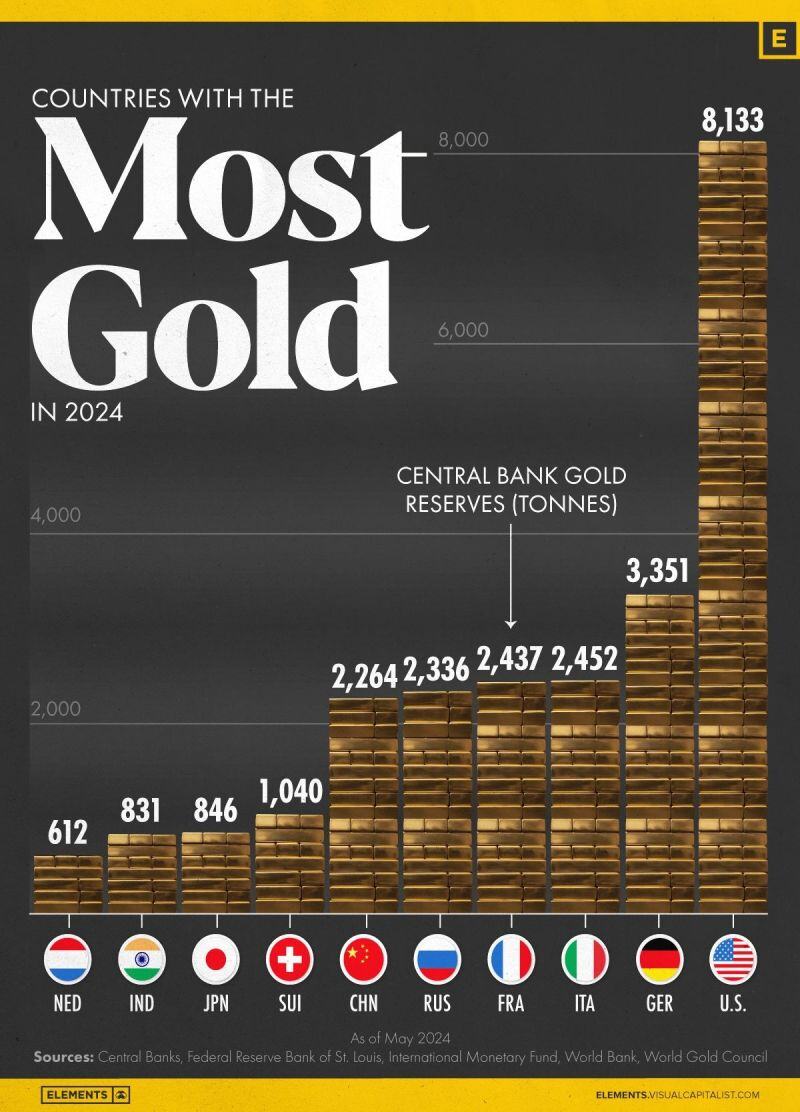

The Top 10 Countries by Gold Reserves in 2024

The country with the most gold is the United States, holding 8,133 tonnes valued at $628 billion. Half of the country’s reserves are stored at the United States Bullion Depository, commonly known as Fort Knox, a United States Army installation in Kentucky. Germany ranks second with 3,351 tonnes, followed by Italy with 2,452 tonnes. Source: Visual Capitalist

Fed rate cuts are imminent...

Here's a quick recap of the FOMC minutes... ▪ Fed Minutes said risk to inflation goal had decreased. ▪ The FOMC minutes indicate a "likely" rate cut in September as most Fed members are leaning towards a rate cut at the next meeting—if the data stays positive. ▪ July Debates: SEVERAL PARTICIPANTS SAID RECENT PROGRESS ON INFLATION AND INCREASES IN THE UNEMPLOYMENT RATE PROVIDED A PLAUSIBLE CASE FOR A 25-BASIS-POINT RATE CUT AT JULY'S MEETING OR THAT THEY COULD HAVE SUPPORTED SUCH A MOVE. ▪ ⚠️ Rising Unemployment Risks: Fed believed the labor market is in a better place but payrolls were overstated (made sense given the 818k job revision today). The majority are concerned about increasing unemployment. 📉 Economic Growth Downgraded: The outlook for growth in the second half of 2024 has been revised downward. Fed believed consumer spending did start to weaken based on delinquencies going up ▪ 📊 Inflation Confidence: Recent reports have strengthened the Fed’s belief in managing inflation. ▪ 🕰️ Timing Matters: Delaying easing could significantly weaken the economy. => The first rate cut since 2020 likely coming next month. => S&P 500, Nasdaq close higher as Fed minutes lift investors’ hopes for a September rate cut!

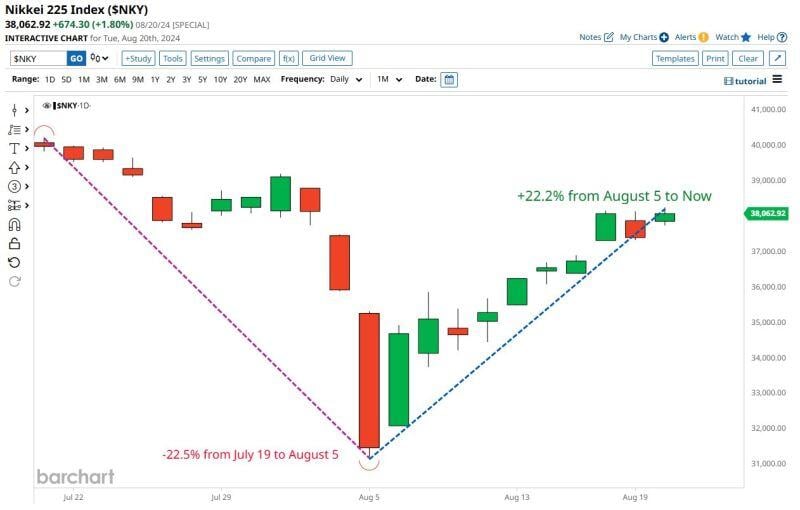

Japanese Stocks have both fallen and risen more than 20% in the last month

Source: barchart

Short Volatility etf $SVIX Assets Under Management are surging

Aug 2024: $600M Q1 2024: $140M Q1 2023: $88M Q1 2022: $22m Source: Bloomberg, Lawrence McDonald

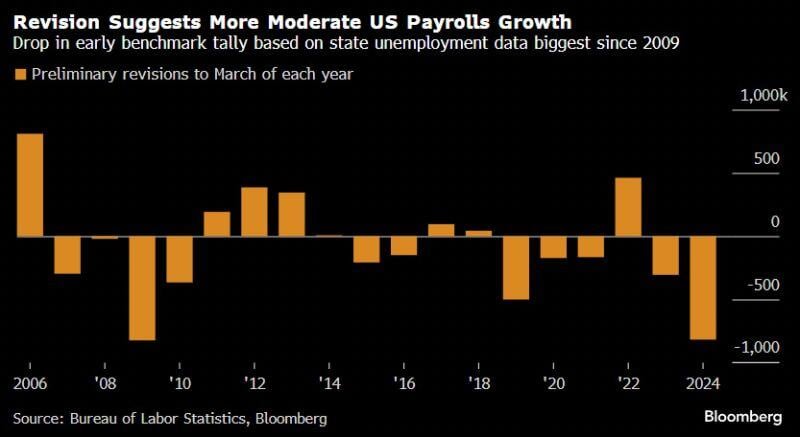

Nonfarm payroll growth revised down by 818,000 for the 12 months through March — or around 68,000 less each month – most since 2009

Before the report, the BLS’s initial payrolls figures indicated employers added 2.9mln total jobs in the period, or an avg of 242k per month. Now the monthly pace is more likely to be ~174k, still a healthy rate of hiring but a moderation from post-pandemic peak At the sector level, the biggest downward revision came in professional and business services, where job growth was 358,000 less than initially reported. => The labor market appears weaker than originally reported. This should allow the Fed to prepare markets for a cut at the September meeting. Source: Bloomberg, HolgerZ, CNBC

BlackRock’s support for shareholder proposals on environmental and social issues has hit a new low in the 2023-24 proxy season

Source: FT

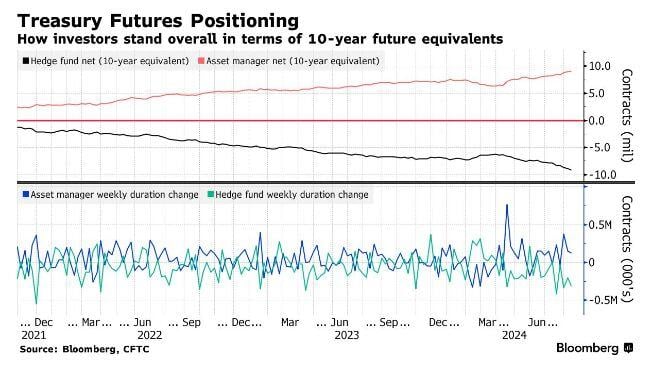

Record Short Position in 10-Year Treasuries

A short squeeze ahead? Hedge Funds have now built the largest 10-Year Treasury Future Equivalents short position in history. Note that Asset managers (long-only) have the opposite as they have built record long positions. Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks