Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

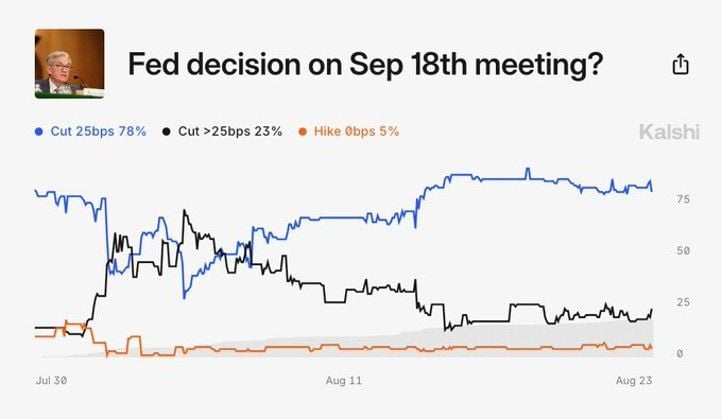

BREAKING: Odds of a 50 basis point interest rate cut at the September Fed meeting rise to 23%

There's now a 95%+ chance that interest rates are cut in September with a 78% chance of a 25 bps rate cut, according to @Kalshi Source: The Kobeissi Letter

JUST IN: US RFK Jr. withdrew from the presidential race, and the Trump campaign announced a special guest in today’s rally

Source: Bitcoin magazine

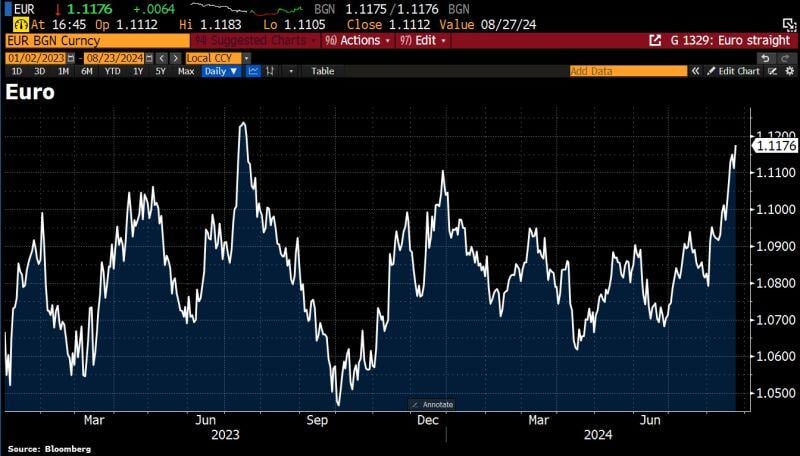

Euro jumps to highest since July 2023 following dovish Powell remarks

The most important statement in his speech: “We do not seek or welcome further cooling in labor market conditions.” Source: Bloomberg, HolgerZ

BREAKING - Jackson Hole - it seems the Fed Pivot is here

Here's a summary of Fed chair Powell's remarks (8/23/24): 1. "The time has come for Fed policy to adjust" 2. Fed "will do everything" to support a strong labor market 3. Fed does not welcome further weakening of the labor market 4. Confidence has grown that inflation is heading to 2% 5. Balance of risks to Fed mandates has changed 6. Inflation has declined significantly toward the goal As mentioned by Nick Timiraos, the Powell pivot is complete: “The cooling in labor market conditions is unmistakable.” “It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon.” “We do not seek or welcome further cooling in labor market conditions.” “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” “We will do everything we can to support a strong labor market as we make further progress toward price stability.” equities, bonds, cryptos, gold, etc. are all rallying post-statement. Bottom-line: Fed Chair Powell validates rate cuts soon, but didn't make any promises on size and extent. We believe that moving away from a restrictive monetary policy, to a more neutral stance, makes sense. We continue to believe the first fed funds rate cut will be -25bp in September.

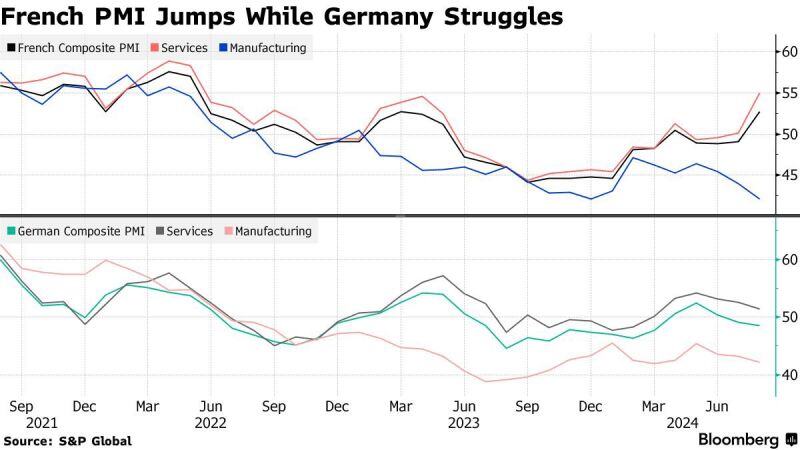

French Economy Gets Olympic Boost as Germany’s Malaise Deepens French composite PMI rises to 52.7; Germany’s down to 48.5.

‘August is likely an outlier due to the Olympic Games’ French services expanded at the fastest pace in more than two years, driving Europe’s second-biggest economy as visitors from around the world flocked to Paris for the Olympic Games. S&P Global’s Purchasing Managers’ Index for the sector surged to 55 in August from 50.1 in July, far above the 50 threshold that divides growth from contraction and the median estimate of 50.3 in a Bloomberg survey. Source: Bloomberg

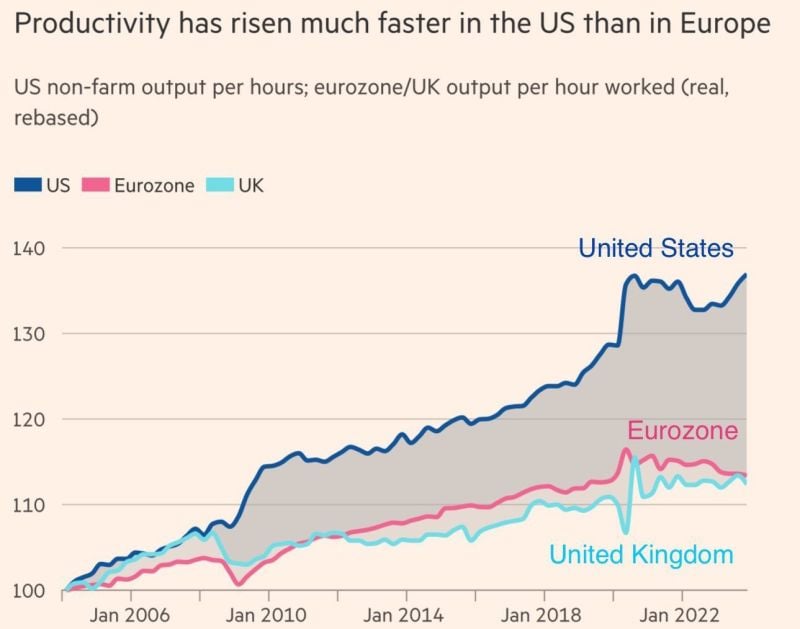

This is the reality the old continent needs to face: There is only one way to prosperity, hard work and higher productivity

UK and the eurozone have been lagging the US big time. Time for a wake-up call? Source: FT. Michel A.Arouet

The Bank of Japan (boj) is still on a path toward higher interest rates provided inflation and economic data continue in line with its forecasts

“If we are able to confirm a rising certainty that the economy and prices will stay in line with forecasts, there’s no change to our stance that we’ll continue to adjust the degree of easing,” Ueda said in response to questions in parliament Friday. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks