Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

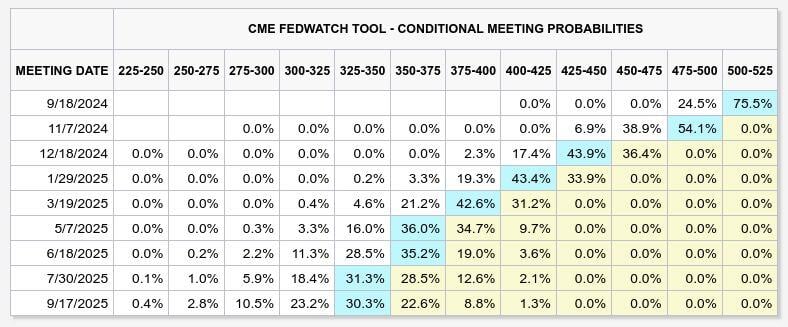

Fed Funds Futures pricing in nearly 200 bps of cuts over the next year, which seems quite aggressive and presumes a rather hard landing scenario

Based on current macro data, there's no reason for the Fed to cut this aggressively. Let's see how Powell manages it today at jacksonhole. Source: Markets & Mayhem

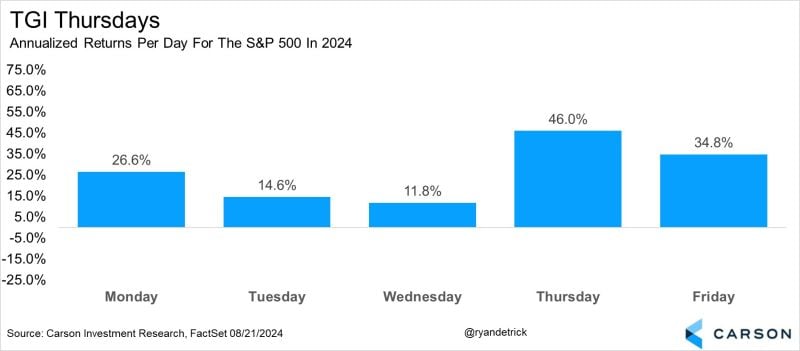

TGI Thursdays

The S&P 500 is up an annualized +46.0% on Thursday so far in 2024. This would be the best return for Thursday since '21 (+51.5%) and best for any day since Friday last year (+53.0%). Bottom line, in bull markets you tend to see strength ahead of the weekend. ✔☑✅ Source: Ryan Detrick, CMT @RyanDetrick on X, Carson research

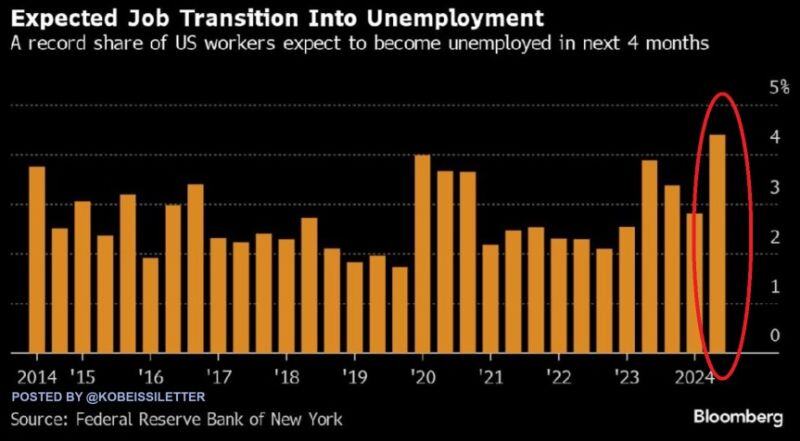

BREAKING: The share of people who believe they will become unemployed in the next 4 months jumped to 4.4%, the highest on record

This is a significant surge from the 2.8% share seen in March 2024, according to the NY Fed job situation and outlook survey. At the same time, the share of workers who reported searching for a job in the last 4 weeks increased to 28.4%, the highest since the survey began in 2014. This was also up 9 percentage points from 19.4% recorded in July 2023. Further evidence the labor market is weakening. Source: The Kobeissi Letter, Bloomberg

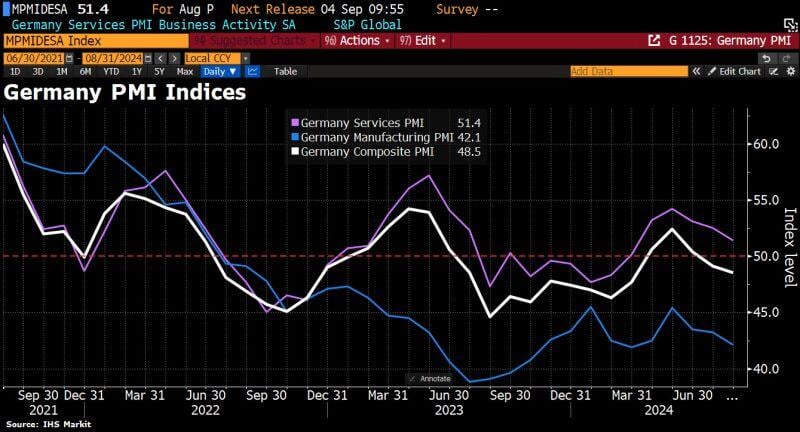

Economic malaise deepens in Germany

German private sector falls deeper into contraction, flash PMI shows. German Composite PMI Index dropped to 48.5 in August, a 5mth low, down from prior 49.1 and below the expected 49.2. Manufacturing PMI fell to 42.1 from 43.2, below the consensus estimate of 43.5. On the services side, the PMI also hit a 5mth low of 51.4, compared w/prev reading of 52.5 and analysts forecast of 52.3. The report adds to evidence that Germany's recovery has fizzled out. GDP unexpectedly contracted by 0.1% in Q2, and analysts polled by Bloomberg predict barely any expansion at all over the whole of 2024. Source: Bloomberg, HolgerZ

The US Dollar Index is at its lowest level of the year while Gold is at an all-time high, up 22% year-to-date. $USD $GLD

Source. Charlie Bilello

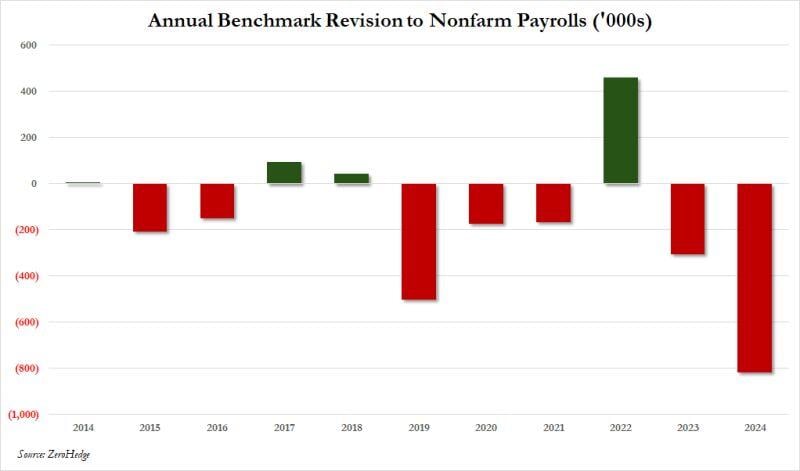

The US Labor Department revises 12-month job growth down by a massive 818,000 jobs

In other words, the US economy actually created 818,000 LESS jobs than initially reported. Furthermore, the US economy LOST 192,000 jobs in Q3 2023 and added 344,000 jobs in Q4 2023, according to the BED survey released by BLS. On the other hand, nonfarm payrolls data showed that the US labor market added 663,000 and 577,000 new jobs in Q3 and Q4 2023. This is a jaw dropping 1,088,000 difference in job count over just two quarters. This is the BIGGEST negative revision to payrolls since the global financial crisis. Crucially, it took place in an election year and was meant to pad the numbers, making the economy appear much stronger than it was. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks