Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Protests in China are on the rise due to the housing crisis and the slowing economy

Source : Bloomberg

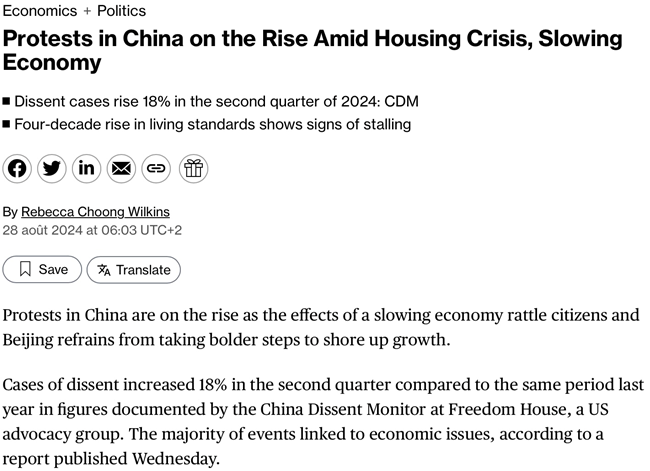

S&P 500 Index Trying to Post a New High

The S&P 500 Index (SPX) has been attempting for several days to break the resistance zone between 5640-5670. The market needs to break through this level to confirm the bullish trend. Keep an eye on it. Source: Bloomberg

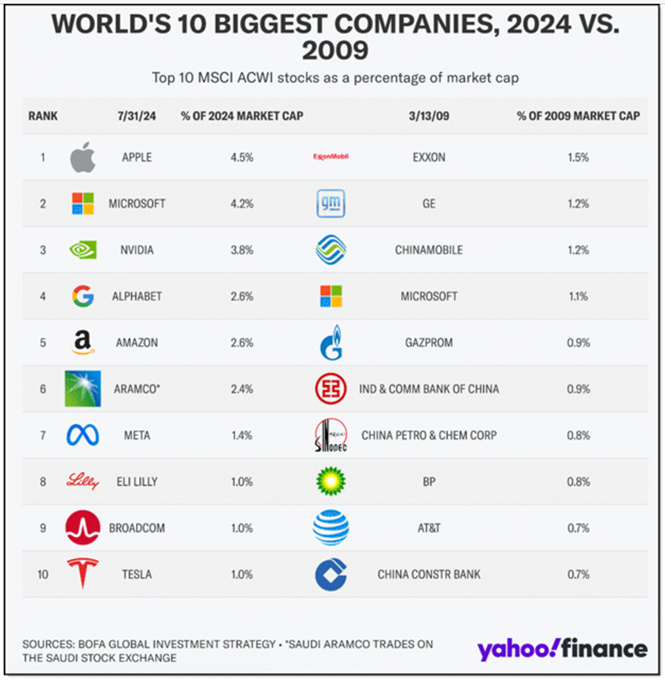

World's 10 biggest companies in 2024 vs. 2009

Source: Yahoo Finance

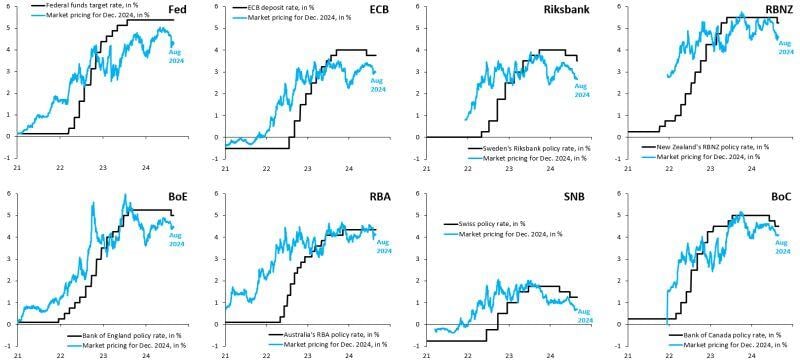

Now that the Fed has given the "all clear" for cuts, the global easing cycle that is likely to gather force

Between 50 - 100 bps in cuts are priced for most central banks across advanced economies for this year alone. Source: Robin Brooks

Investing with intelligence

Our latest research, commentary and market outlooks