Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

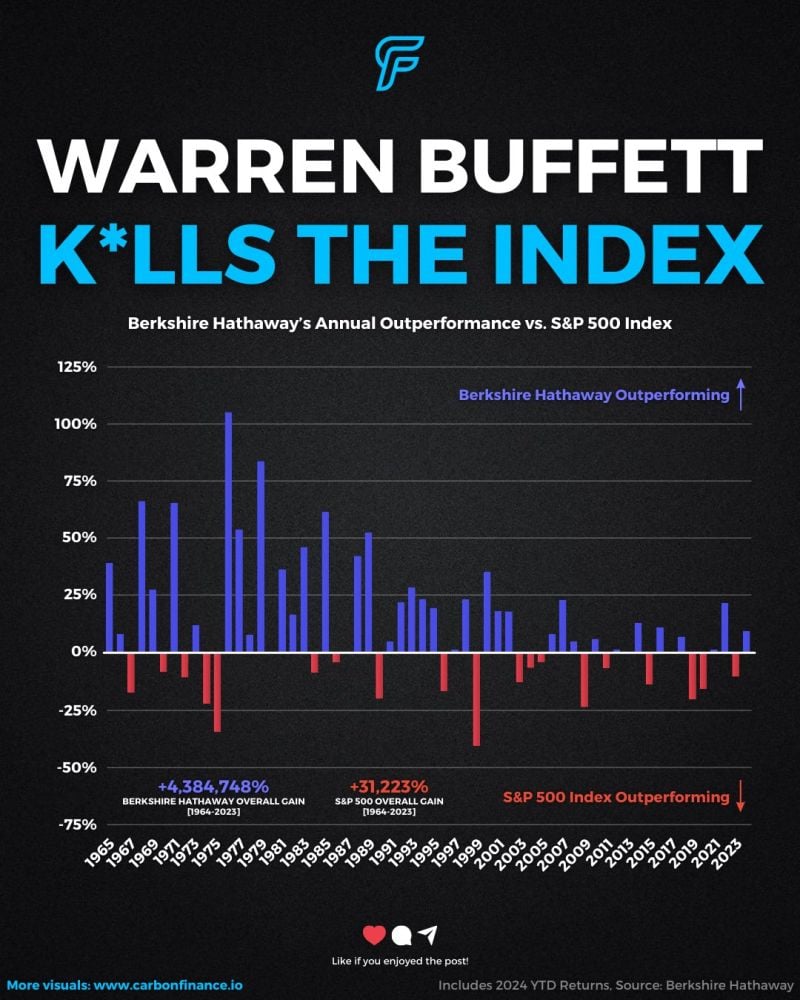

Buffett > S&P 500?

Over the last 5 years, $BRK.B returned 130% compared to the $SPY 91% return Zooming out, this is where Buffett's legacy is unparalleled... From 1964 to 2023, Berkshire Hathaway returned an astounding 4,384,748%, compared to the S&P 500’s 31,223% gain Source: Stocktwits

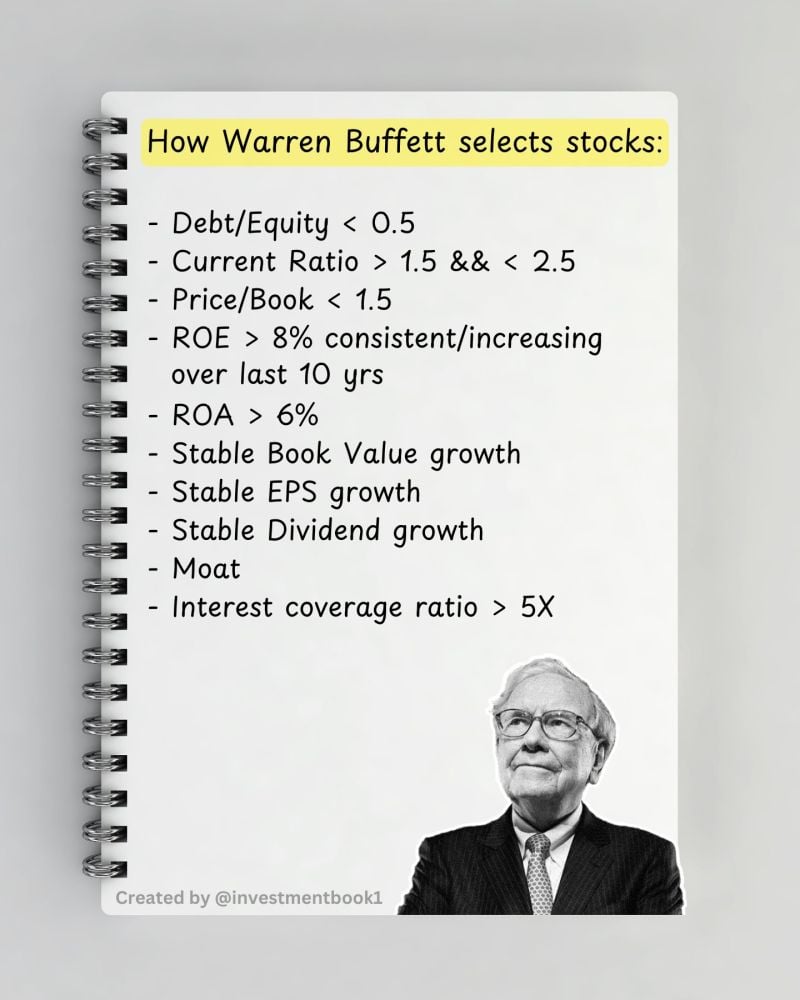

How Warren Buffet selects stocks

Source: Investment Books (Dhaval)

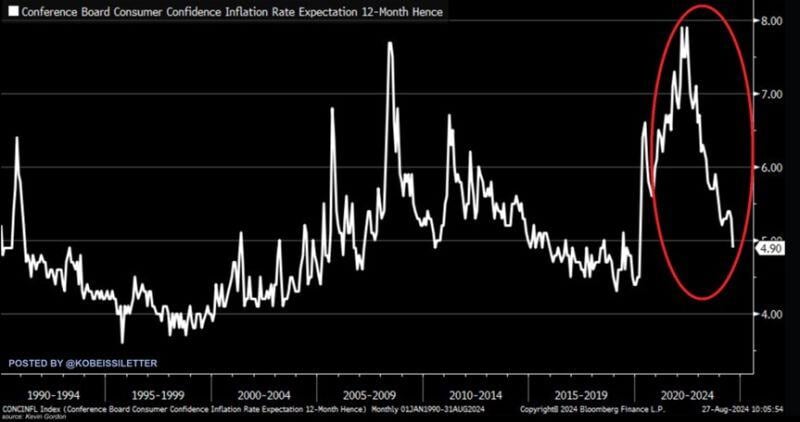

Some good news on US inflation: 1-year inflation expectations declined to 4.9% in August, the lowest since the pandemic in 2020, according to the Conference Board Consumer Confidence Survey.

Over the last 2 years, inflation expectations have fallen from ~8.0% to 4.9%, recording a similar drop as during the 2008 Financial Crisis. As a result, expectations are now at levels seen in the 2015-2019 period. Furthermore, 1-year inflation expectations in the University of Michigan consumer survey fell to 2.8%, the lowest since December 2020. Source: The Kobeissi Letter

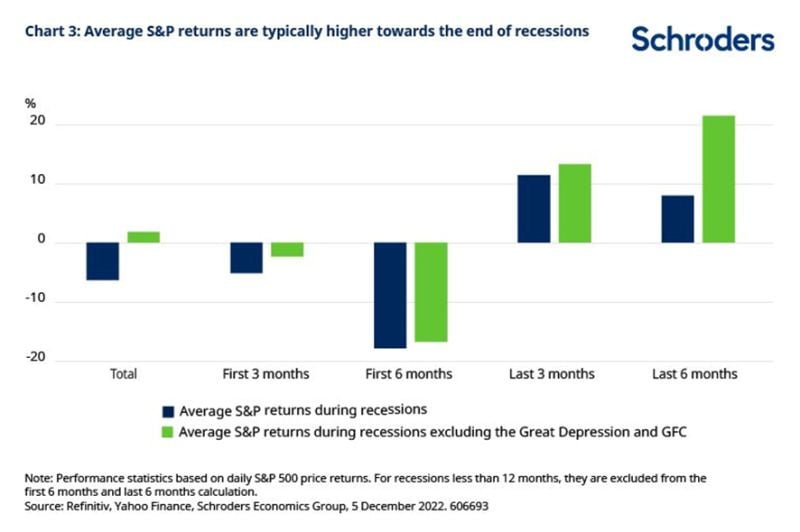

Recessions are Bad for Stocks...

-but only during the first part -stocks do well in the later stages Basically you need to lighten exposure into recession, then load up in the depths. Source: Schroders thru Callum Thomas

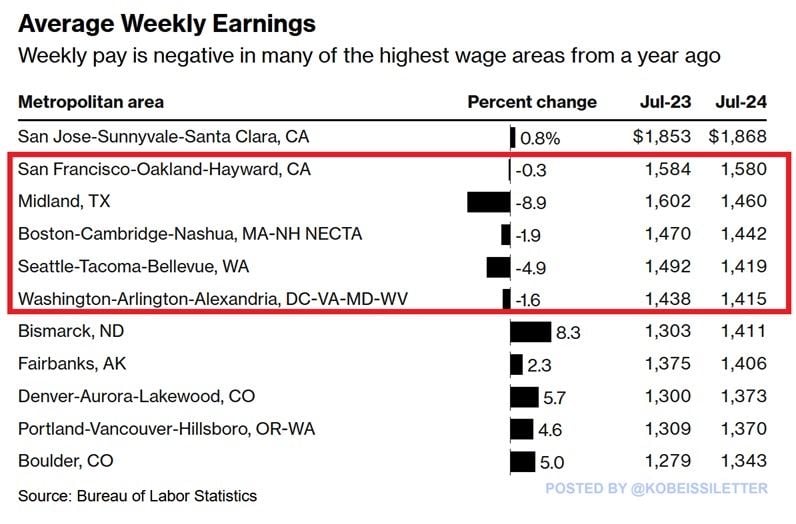

BREAKING: 90% of US cities saw a rise in year over year unemployment rates in July, according to the BLS.

Jobless rates jumped in 350 of the 389 metropolitan areas last month. Additionally, in 8 large metro areas with a population of 1 million or more, FEWER people held a job in July 2024 than in July 2019. At the same time, average weekly wages DROPPED in 43% of the 389 metropolitan areas. In 5 of the 8 highest-paying areas with average weekly wages above$1,400, salaries declined year-over-year. The US labor market is weakening. Source: The Kobeissi Letter

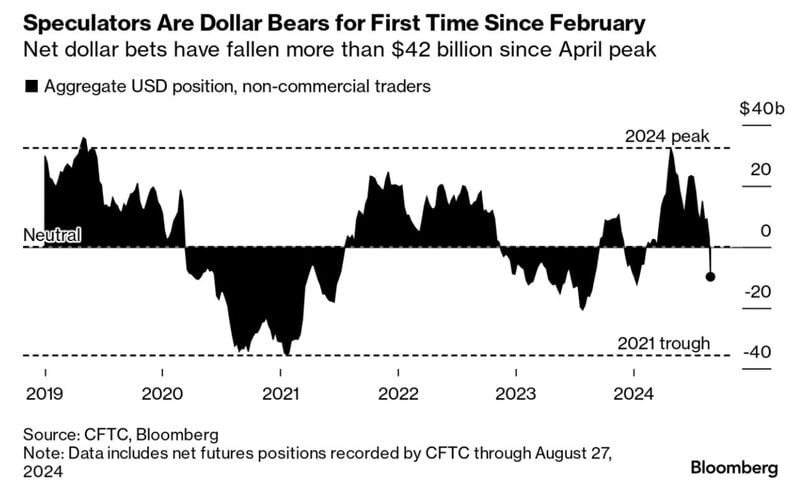

Speculators have turned Bearish on the U.S. Dollar for the first time since February 🚨

Source: Barchart, Bloomberg

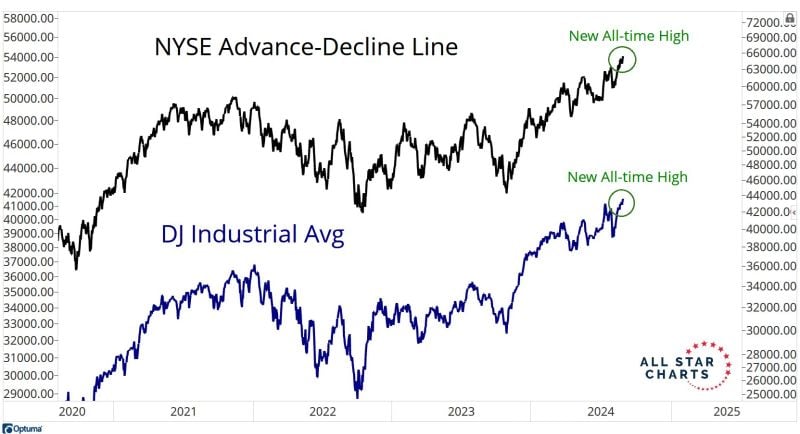

The world's most important stock exchange and the world's most important stock index.

Source: J-C Parets

Investing with intelligence

Our latest research, commentary and market outlooks