Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

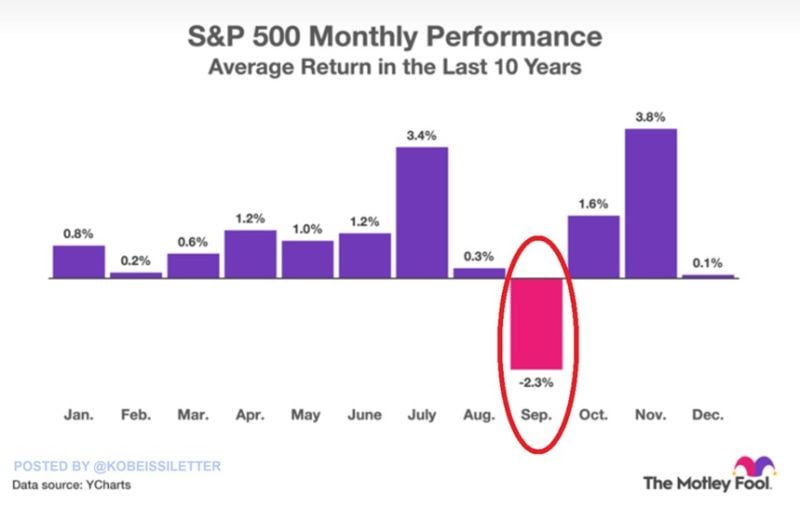

September is historically the worst month of the year for stocks:

The S&P 500 has fallen -2.3% on average in September over the last 10 years, marking the only month with negative returns. Since World War II, the average September return has been negative, at -0.8%. Moreover, the Volatility Index, $VIX, has seen an average spike of ~10% in September over the last 33 years. Subsequently, in October and November, the S&P 500 has seen a +1.6% and +3.8% rally on average. Markets are entering their most volatile period of the year. Source: The Motley Fool, The Kobeissi Letter

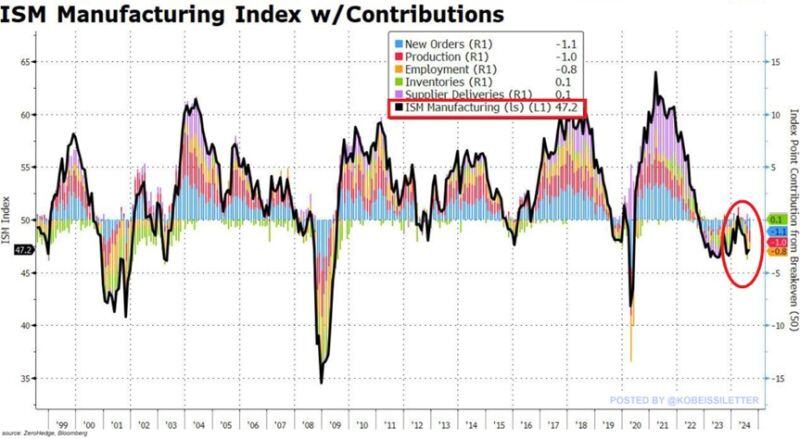

US manufacturing has officially contracted for the 5th consecutive month, to 47.2 points.

The ISM manufacturing PMI index missed expectations of 47.5 points for last month. New orders fell to 44.6 points from 47.4 in July, experiencing contraction for the 3rd straight month. Manufacturing activity has now shrunk in 21 of the last 22 months, extending the second-longest downturn in history. The worst part? The prices paid index jumped to 54.0 points from 52.9 in July, expanding for the 8th month in a row. Rising prices with falling output is rarely a good combo for stocks >>> to be monitored Source: www.zerohedge. The Kobeissi Letter

BREAKING: Magnificent 7 stocks have now erased $550 BILLION of market cap today.

Nvidia, $NVDA, is on track for its largest daily drop since April 2024. As discussed during our H2 outlook, volatility is coming back with a vengeance ahead ahead of US elections. Source: The Kobeissi Letter, Bloomberg

Is it sustainable?

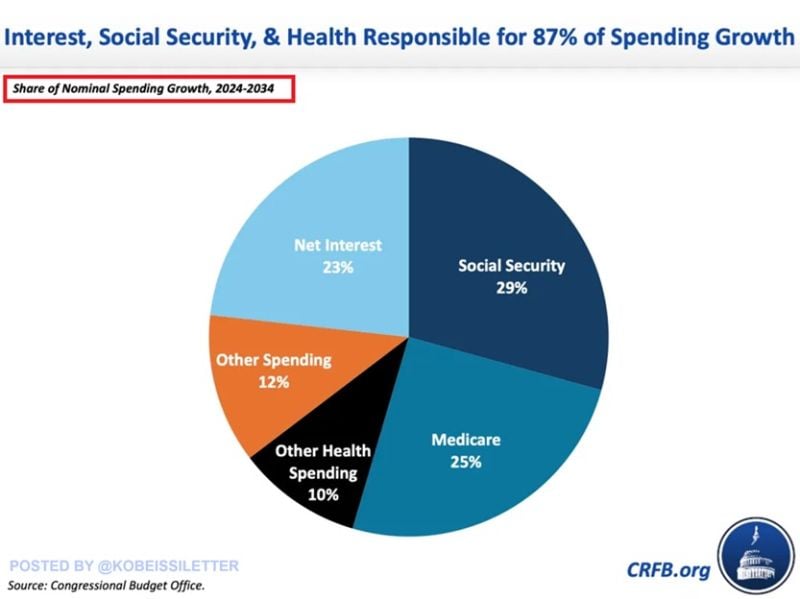

Interest Expense, Social Security, and Health are set to account for 87% of the US government spending growth over the next 10 years. Government spending is estimated to grow from $6.8 trillion in Fiscal Year 2024 to $10.3 trillion in 2034, according to the CBO. $3.0 trillion of the $3.5 trillion increase come from Social Security, federal health care programs, and interest costs on the public debt. Interest costs are projected to be the fastest growing part of the budget, DOUBLING from $892 billion in 2024 to $1.7 trillion by 2034. The net interest share of spending growth could hit as high as 23%. Source: The Kobeissi Letter, CBO

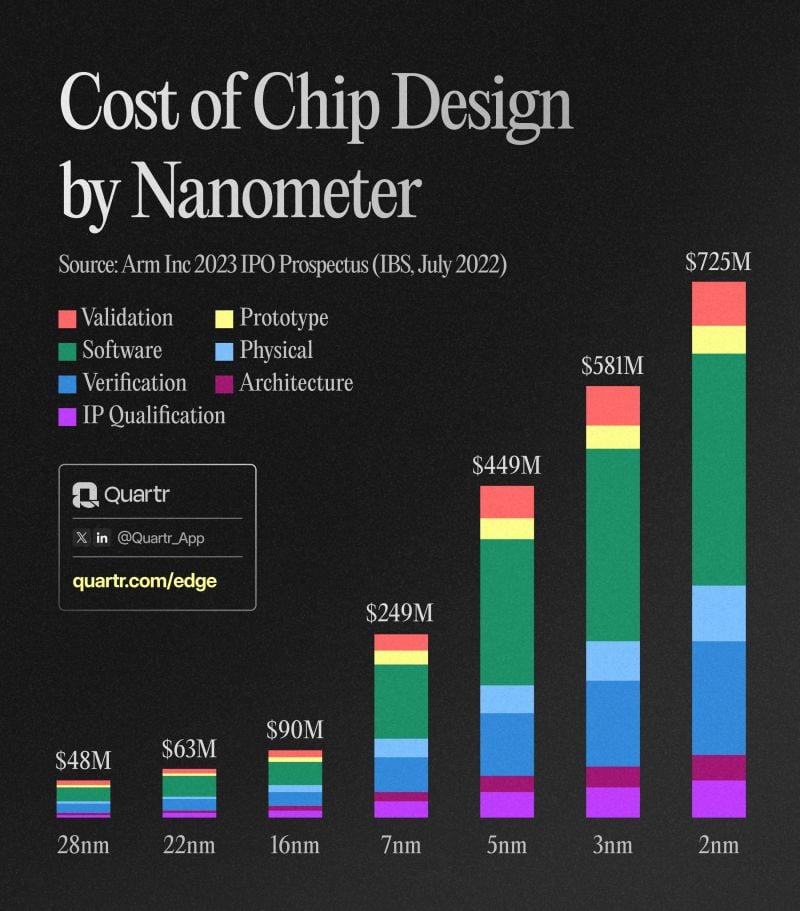

The cost of chip designs has risen at an incredibly rapid pace.

From the 28nm design in 2011 to 3nm in 2022, the cost of designing a chip increased by 12x – benefiting design tool and IP giants such as $SNPS, $CDNS, and $ARM. Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks