Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

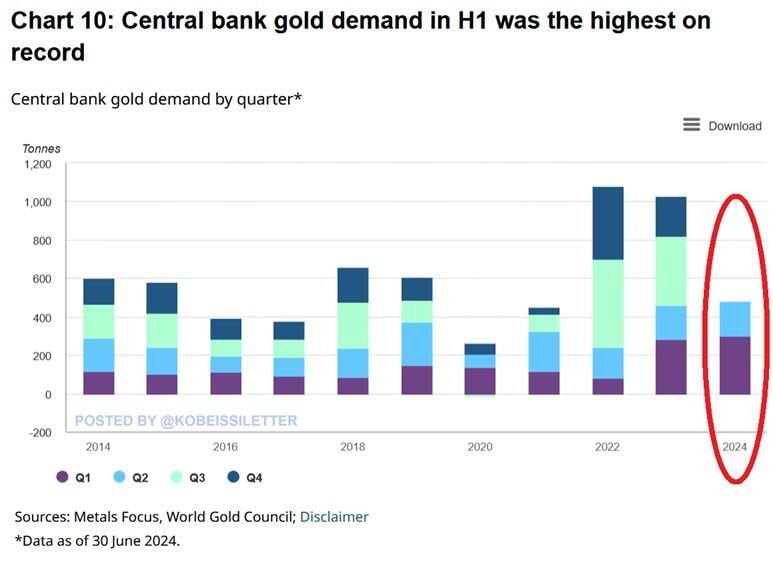

BREAKING: Global net gold purchases by central banks reached 483 tonnes in the first half of 2024, the most on record.

This is 5% higher than the previous record of 460 tonnes set in the first half of 2023. In Q2 2024, central banks bought 183 tonnes of gold, marking a 6% year-over-year increase. On the other hand, this was 39% lower than the 300 tonnes of purchases seen in Q1. The largest buyers were the National Bank of Poland, the Reserve Bank of India, and the Central Bank of Turkey. Why are central banks stocking up on gold? Source: The Kobeissi Letter

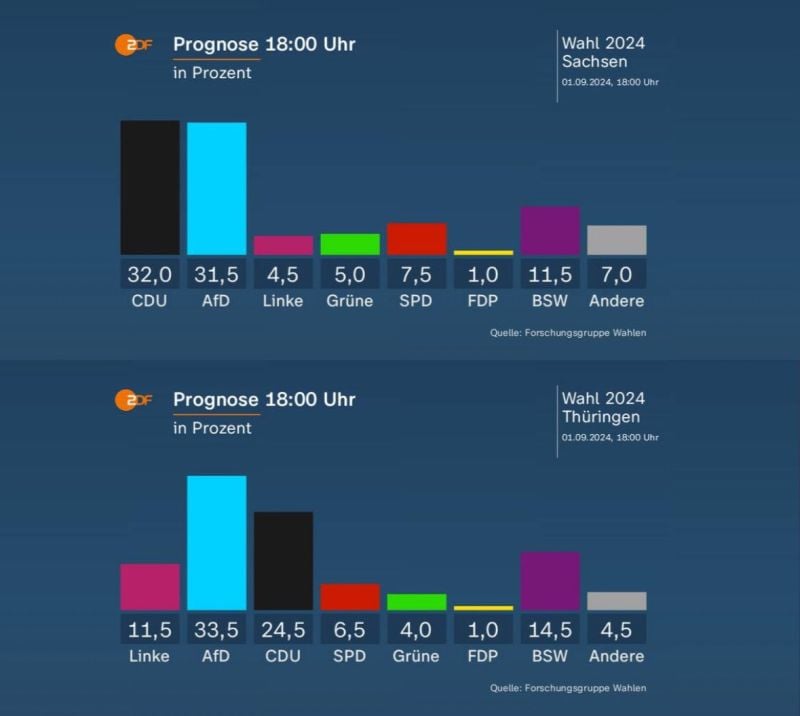

BREAKING: The right-wing AfD and the anti-woke BSW emerge as clear winners in the German state elections of Saxony and Thuringia, while the globalist government parties suffer a crushing defeat.

Source: Dr. Simon Goddek on X

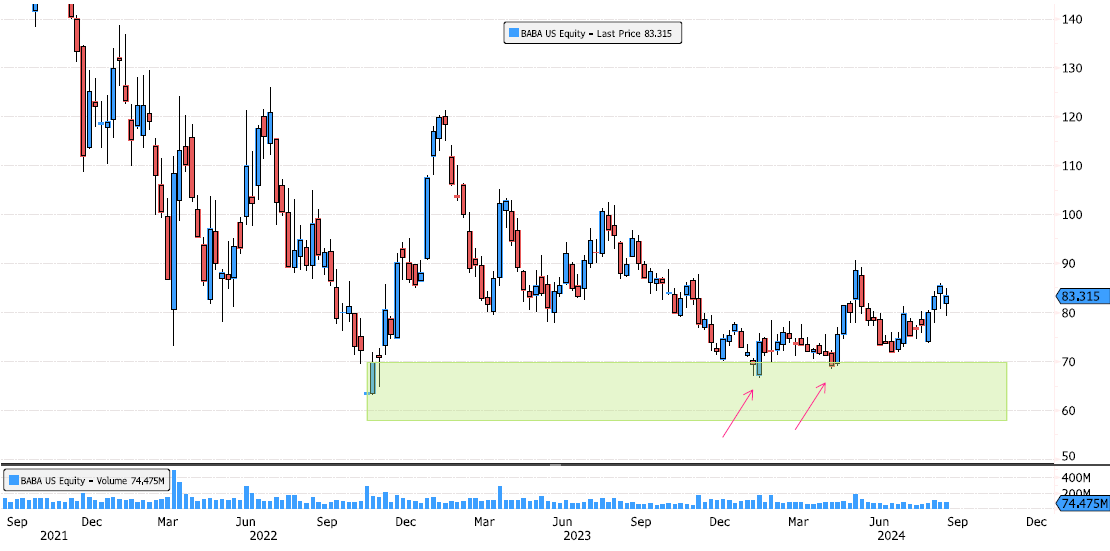

Alibaba Constructive Build-Up

Alibaba (BABA US) has consolidated more than 80% since October 2020! Although the long-term trend is still bearish, there have been some constructive rebounds since the major support zone between 58-70 was tested. Keep an eye on this key level. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks