Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

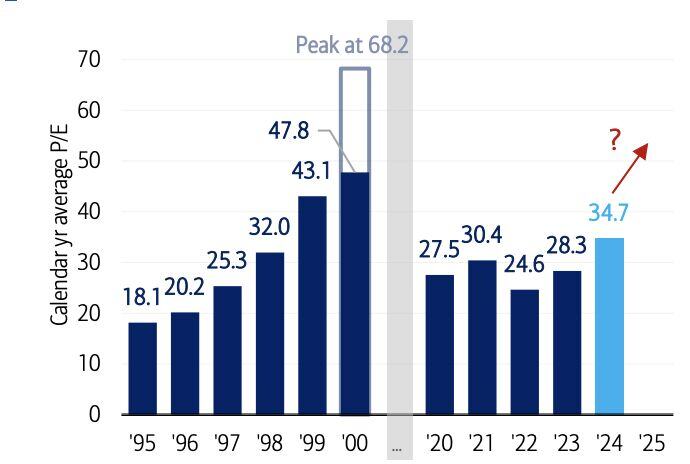

DOTCOM BUBBLE vs. TODAY

Tech P/E Ratio are still half of the peak P/E Ratio from the Dotcom era and still well below the 1999 average P/E Ratio. Source: Seth Golden

France has a new government - Back to the future?

French President Emmanuel Macron’s office announced a new government Monday, after the previous Cabinet collapsed in a historic vote prompted by fighting over the country’s budget. Coming up with a 2025 budget will be the most urgent order of business. The new government enters office after months of political deadlock and crisis and pressure from financial markets to reduce France’s colossal debt. The government, put together by newly named Prime Minister Francois Bayrou, includes members of the outgoing conservative-dominated team and new figures from centrist or left-leaning backgrounds. Among them: two former Prime minister - Manuel Walls and Elizabeth Borne. Both failed. Back to the future?

In case you missed it... China is beating the S&P 500 YTD

$FXI $SPY Source: Mike Zaccardi, CFA, CMT, MBA

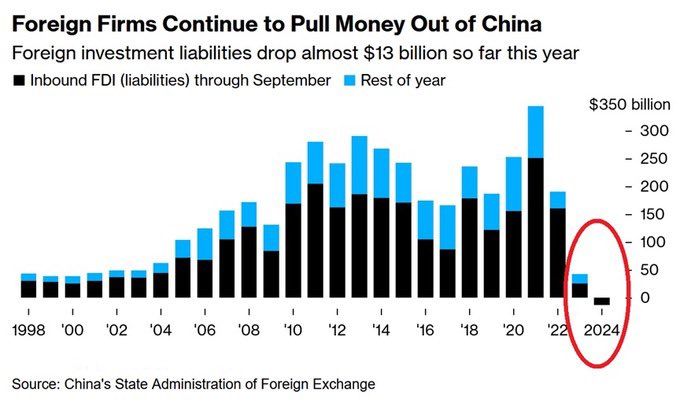

Foreign firms are concerned about China. Global Investors have withdrawn$12.8 billion from China this year, the most since at least 1998.

Source: Bloomberg

BREAKING: There is now a 77% chance of at least one Magnificent 7 company buying Bitcoin in 2025.

The odds of a Magnificent 7 company buying Bitcoin before 2026 have jumped from 49% to 77%, according to @Kalshi .This comes as Michael Saylor has called on Microsoft, $MSFT, and other technology giants to buy Bitcoin. Prediction markets see more Bitcoin adoption ahead. Source: The Kobeissi Letter

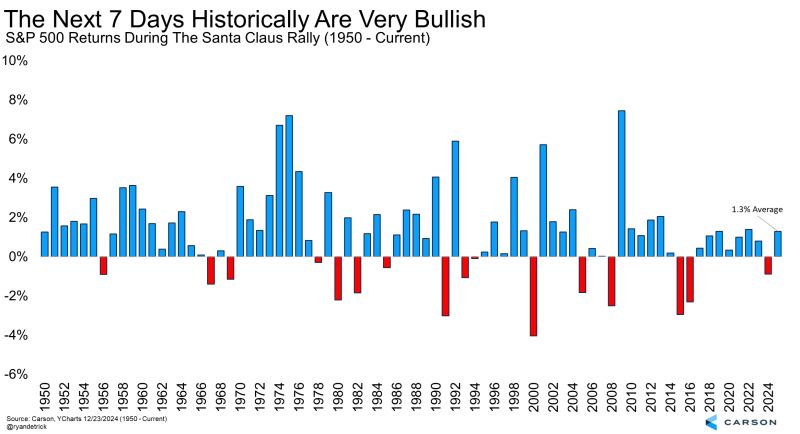

The next 7 days are officially the Santa Claus Rally period.

Down last year, but down back-to-back years only twice since 1950. Source: Ryan Detrick, CMT @RyanDetrick

Investing with intelligence

Our latest research, commentary and market outlooks