Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

DOC finalizes $7 billion in semiconductor awards

The US Department of Commerce on Friday announced its awards for Samsung, Texas Instruments and Amkor Technology under the CHIPS Incentives Program, which come to more than $6.75 billion altogether. The program is meant to help expand domestic semiconductor production. Samsung was awarded up to $4.745 billion in direct funding — a smaller amount than the preliminary award of up to $6.4 billion that was announced earlier this year — while Texas Instruments was granted up to $1.61 billion and Amkor up to $407 million. Samsung plans to invest $37 billion over the next few years to ramp up chip development and production in the US, the DOC said. The company will expand its operations in Texas to include two new production facilities and a site for research and development. It also plans to expand an existing facility in Austin. Texas Instruments is working to build three new facilities — two in Texas and one in Utah — which it’s said it will invest over $18 billion in through 2029. Amkor is planning a $2 billion investment to create an advanced packaging and test facility in Peoria, Arizona. According to Reuters, it’ll be the country’s largest facility of its kind. source : engaget

IRS Says Crypto Staking is Taxable

Staking a cryptocurrency should induce a tax liability as soon as it is done, the US government says. The IRS rebuffed a suit brought by Joshua Jarrett, a cryptocurrency investor who has sued in the US District Court for the Middle District of Tennessee source : bloomberg

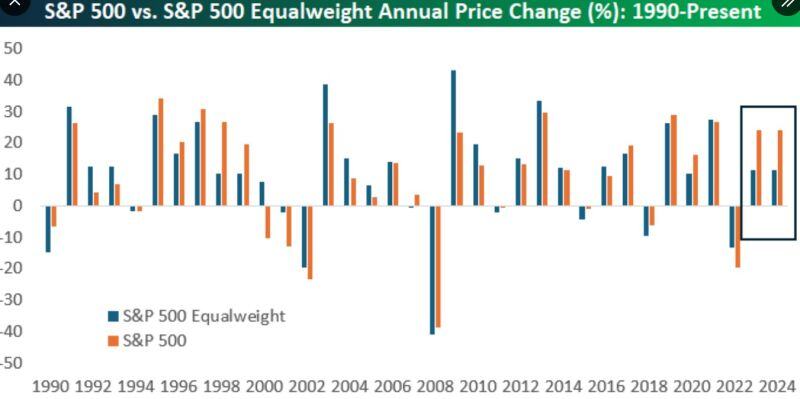

The S&P 500 and S&P 500 Equalweight are on track to have roughly the same price gain in 2024 as they did in 2023.

Equalweight in 2023: +11.56 Equalweight in 2024: +11.47 Cap-weighted in 2023: +24.23% Cap-weighted in 2024: +24.34% source : bespoke

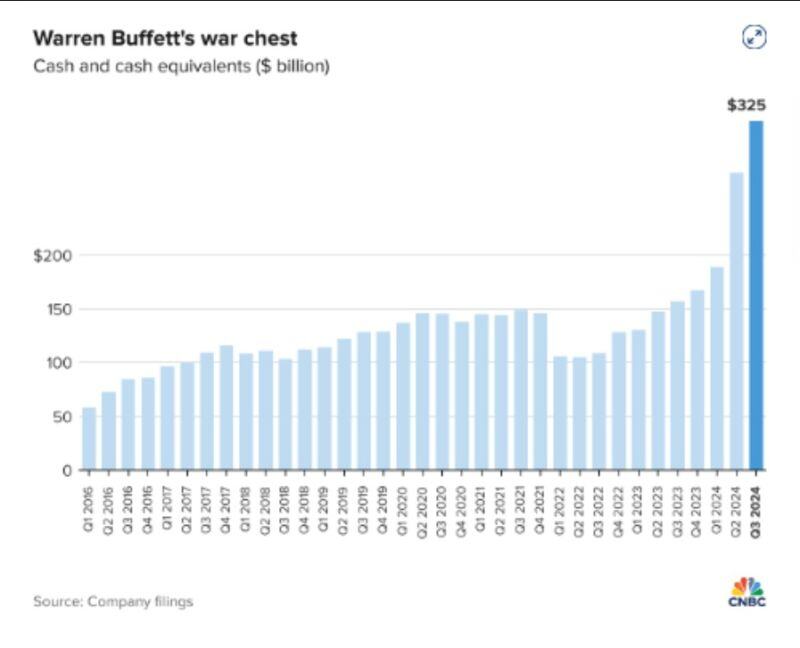

Warren Buffett's Berkshire Hathaway has a cash position of $325 Billion

or 30% of its total AUM, which is Buffett's largest allocation to cash since in 35 years. source : barchart

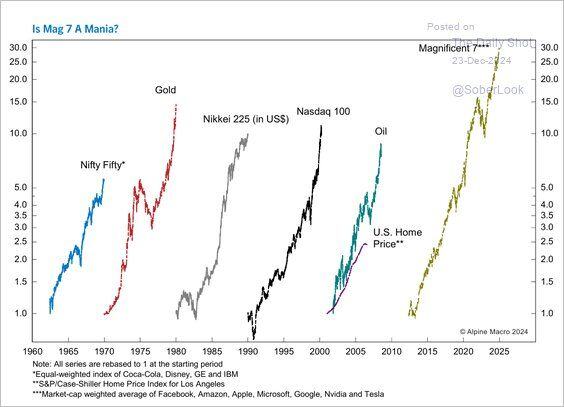

A brief history of asset bubbles.

Source: @thedailyshot, Lance Roberts @LanceRoberts

Historical Bitcoin prices on Christmas Eve

2013 - $666 2014 - $323 2015 - $455 2016 - $899 2017 - $13,926 2018 - $4,079 2019 - $7,323 2020 - $23,736 2021 - $50,822 2022 - $16,822 2023 - $43,665 2024 - $98,400 Source: Bitcoin magazine

What has happened in Poland is nothing short of an economic miracle. Hard work and entrepreneurial spirit pay off.

30 years ago Poles were emigrating due to economic reasons. Today many Poles buy real estate in places like Marbella. Source: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks