Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

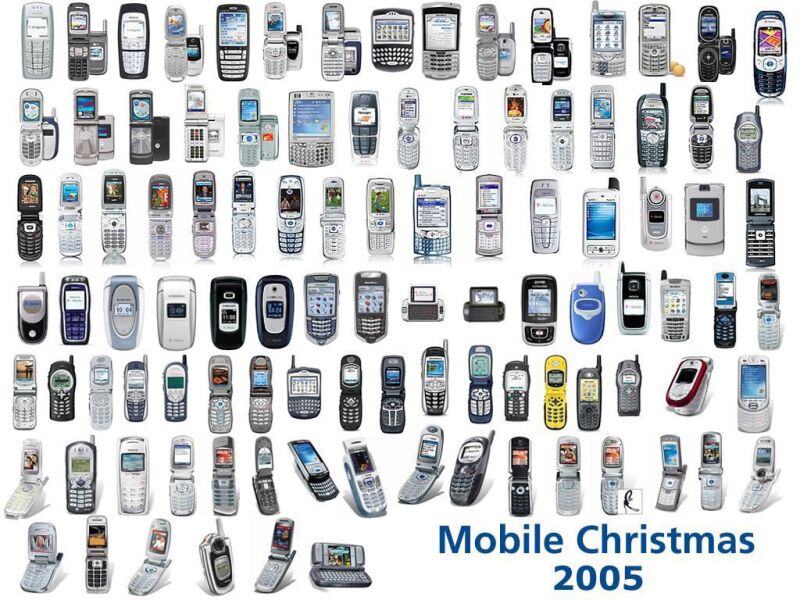

Phones used 20 years ago.

Source: Jon Erlichman @JonErlichman

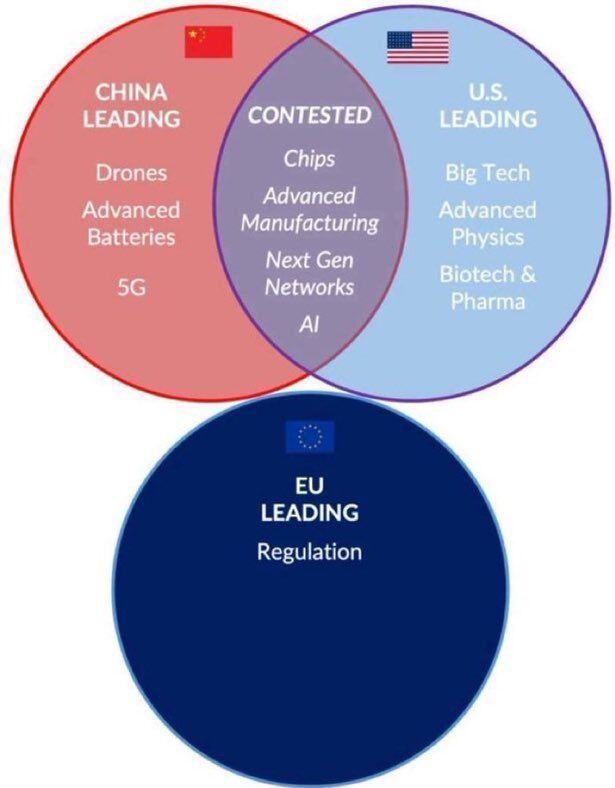

As mentioned by Michel A. Arouet on X: If it wasn’t so sad, it would be quite funny

Source: Michel A. Arouet on X

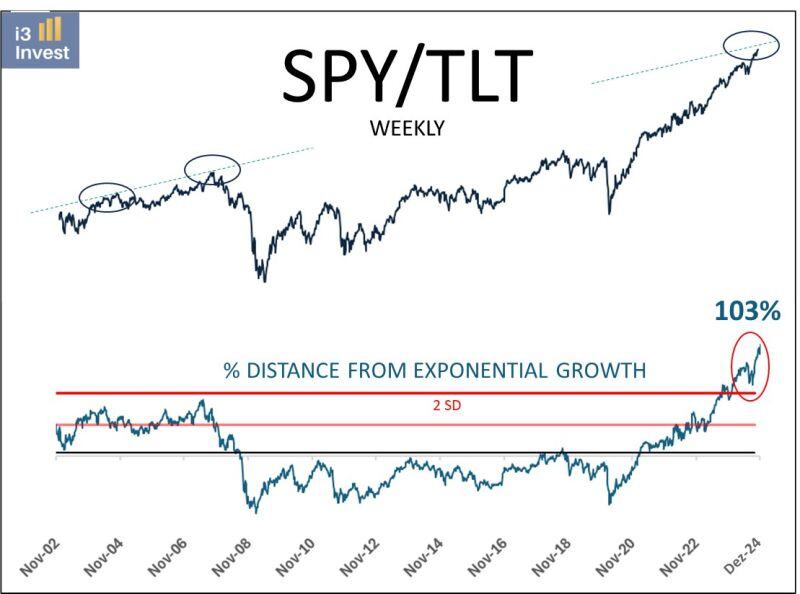

The long S&P500 ($SPY) / short US treasuries 20y+ ($TLT) makes a lot of sense from a macro perspective but is very consensual and looks very extended

See ratio below "In the end, trees don't grow to the sky, and few things go to zero." Howard Marks Source: Guilherme Tavares @i3_invest

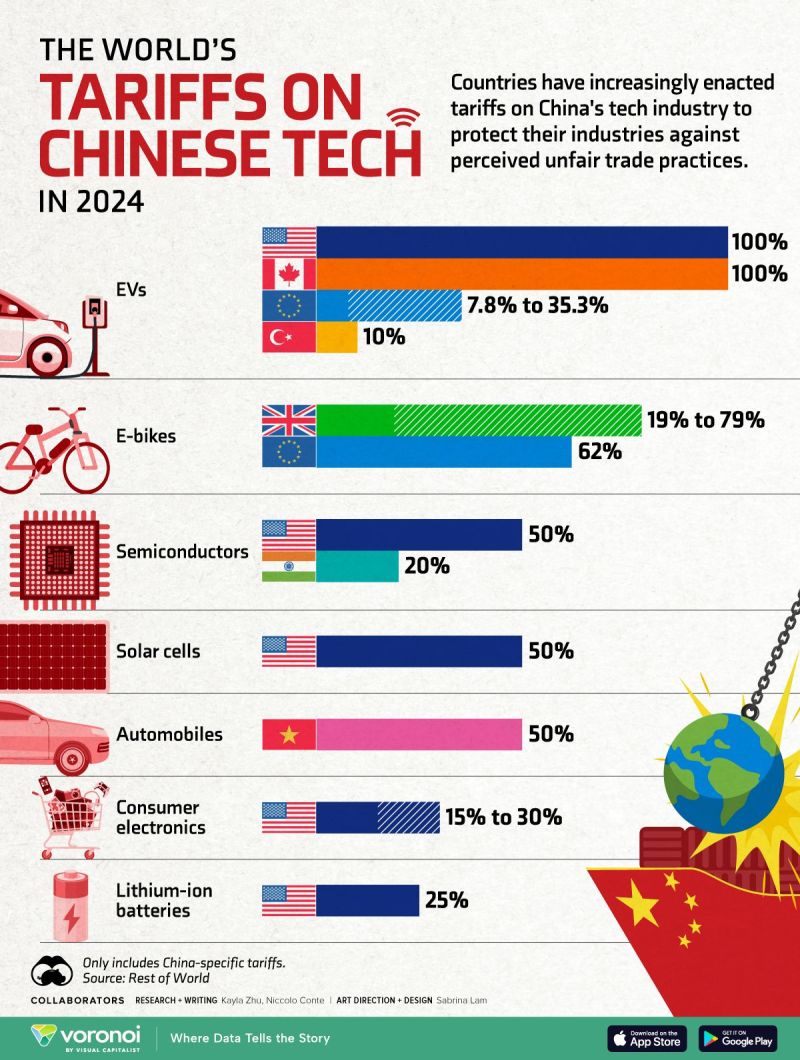

Which countries are putting tariffs on China tech ?

Source: Visual Capitalist

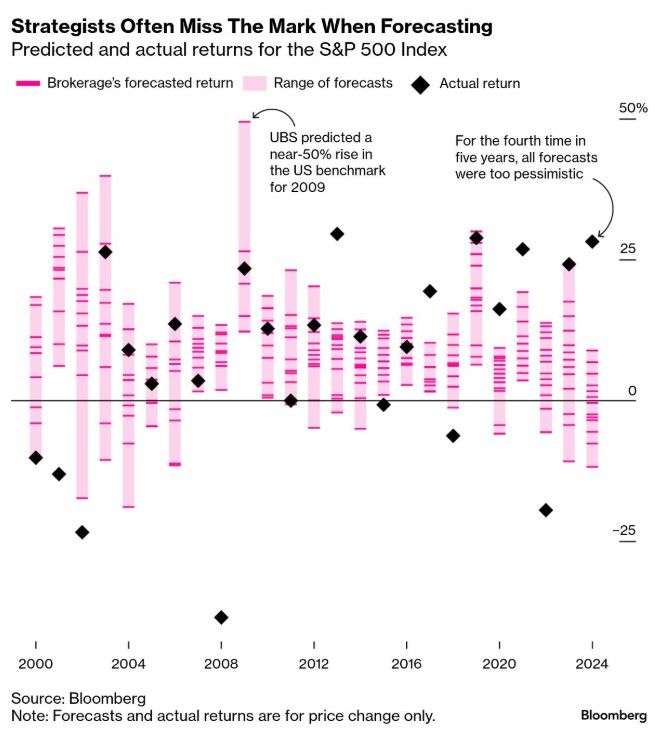

Can Wall Street Get It Right?

The annual tradition of predicting where the S&P 500 will land at year-end has once again raised eyebrows. As Wall Street strategists share their projections for 2025, historical missteps in forecasting cast doubt on their accuracy. 2022: A challenging year where the S&P 500 fell by 19.4%, far worse than predictions. 2023: Despite experts forecasting a modest gain of 6.2%, the index surprised with a remarkable rise of 24.2%. 2024: A consensus estimate of 3% growth was dwarfed by an actual gain of nearly 24% by mid-December. For 2025, the consensus now points to a 9.6% price gain, translating to an 11%+ total return with dividends. source :bloomberg, economicstime

Is Apple ringing the doorbell of smart home innovation?

According to Bloomberg, Apple might be working on a smart doorbell featuring its renowned FaceID technology. The concept? As you approach the door, the doorbell scans your face, communicates with a connected deadbolt lock, and unlocks seamlessly for residents. While still in early development and not expected before late 2025, the product could either integrate with HomeKit-compatible locks or involve a partnership with a specific lock maker. This move could position Apple as a competitor to Amazon's Ring, but also exposes the brand to unique challenges. For instance, concerns around security breaches or misuse of the system could spark debates on privacy and reliability. source : techcrunch

France Adds First Nuclear Reactor in 25 Years to the Grid

France connected the Flamanville 3 nuclear reactor to its grid on Saturday morning, state-run operator EDF announced. This marks the first addition to the country's nuclear power network in 25 years. The reactor, which began operating in September before being connected to the grid, is coming online 12 years later than originally planned and at a cost of approximately 13 billion euros—four times the initial budget. EDF is planning to construct six additional reactors to meet a 2022 pledge made by President Emmanuel Macron as part of France's energy transition plans. However, questions remain regarding the funding and timeline for these new projects. source : reuters

Investing with intelligence

Our latest research, commentary and market outlooks