Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

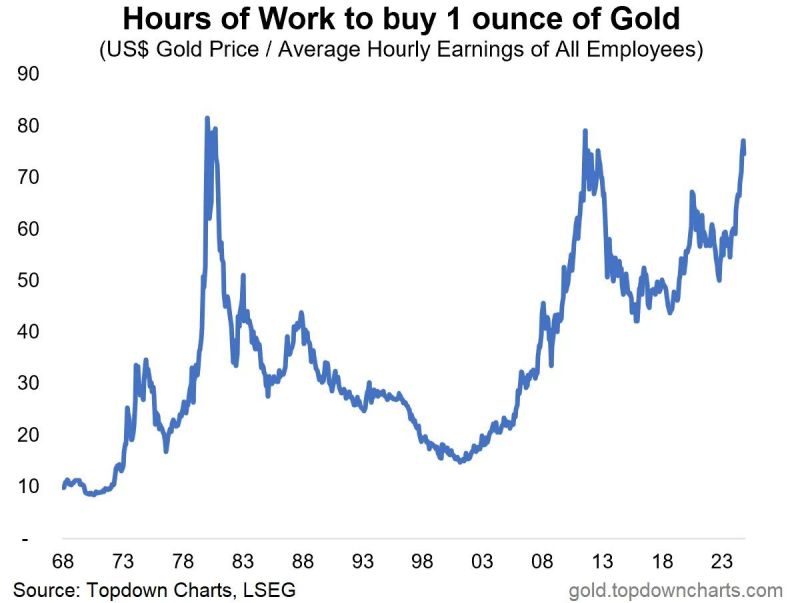

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

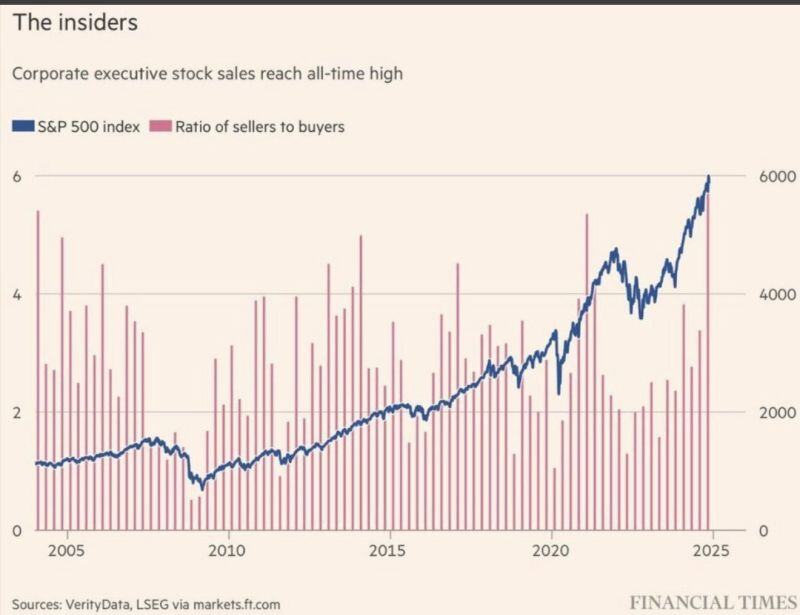

BREAKING: Corporate executives are now selling their stock at record levels, with the ratio of sellers to buyers hitting 6x.

Why are insiders cashing out? Source. The Kobeissi Letter, FT

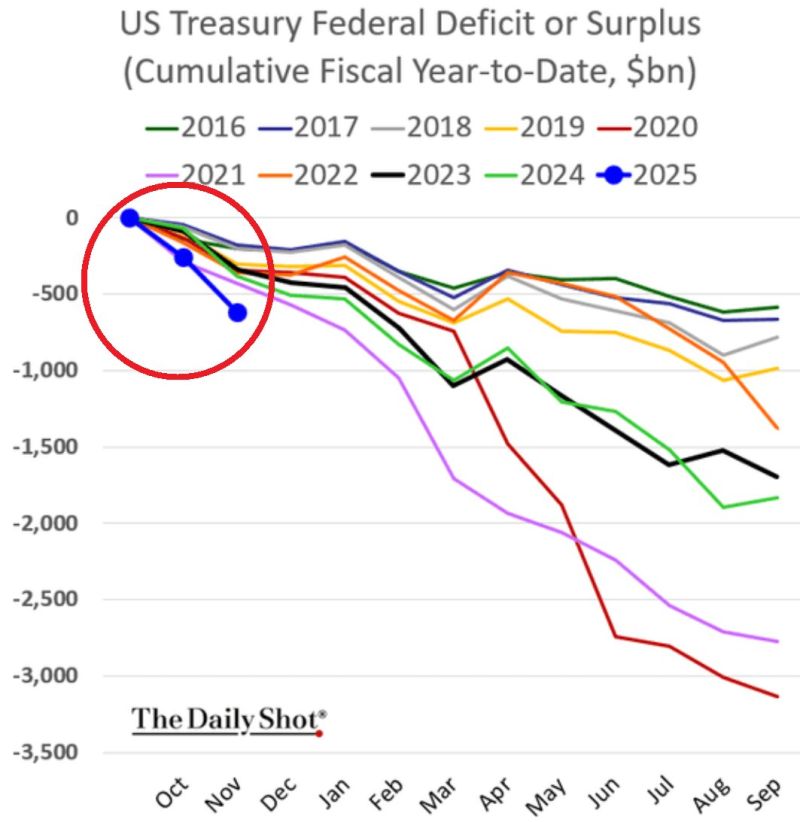

‼️ US budget deficit hit a GIGANTIC $367 BILLION in November 2024.

This puts the total deficit for the first 2 months of the Fiscal Year 2025 to a TREMENDOUS $624 BILLION, the highest EVER. This has even surpassed the 2020 CRISIS LEVELS. Source: Global Markets Investor, The Daily Shot

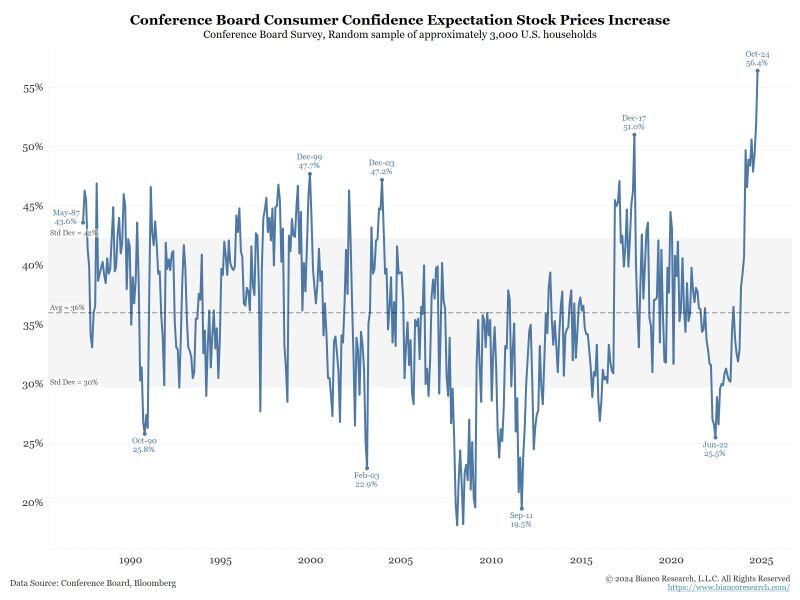

The percentage of respondents that expect stock prices to rise over the next 12 months.

The survey began in May 1987. Source: Bianco Research

President Elect Donald Trump will be ringing the opening bell at the NYSE today following TIME Magazine naming him Person of the Year for 2024

Source: Evan

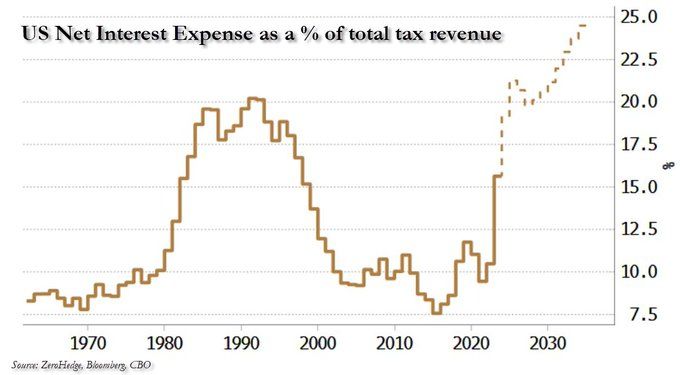

US net interest expense is 15% of tax revenue, it will rise to 25% in 2035 according to the CBO...

It will get there much faster if the Fed starts hiking rates again Source: zerohedge

🚨 JUST IN: CANADA SLASHES RATES BY 50 BPS

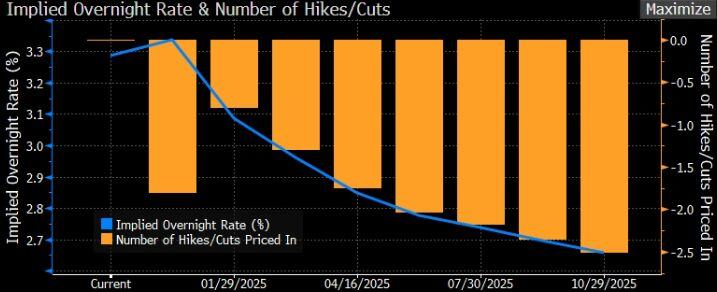

Fifth cut in a row... Dropping the policy rate from 5% to 3.25% in 2024—150 bps total. But it’s not working fast enough: -Unemployment: 6.8% (highest in 8 years). -GDP per capita: Down 6 straight quarters. -Canadian Dollar $CAD at 4.5-year low -Former BOC Governor says “We’re already in a recession.” Market is pricing in another ~50bps of cuts by July 2025 ➡️ 2.75% overnight rate. Source: Genevieve Roch-Decter, CFA, Bloomberg

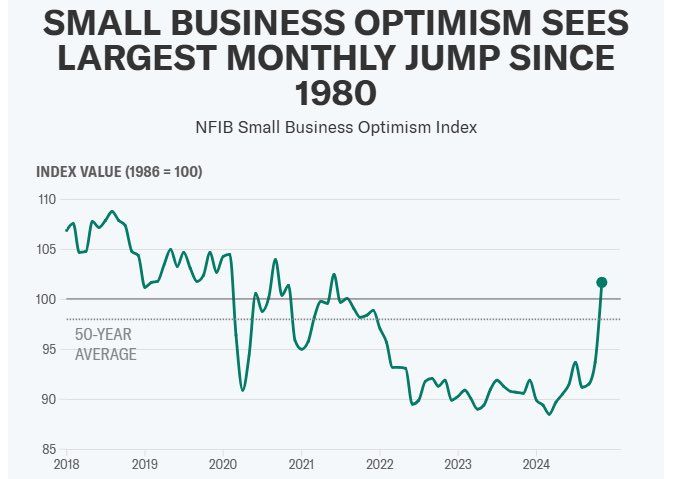

What can wonder what happened in the US last month?

Source: NFIB

Investing with intelligence

Our latest research, commentary and market outlooks