Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

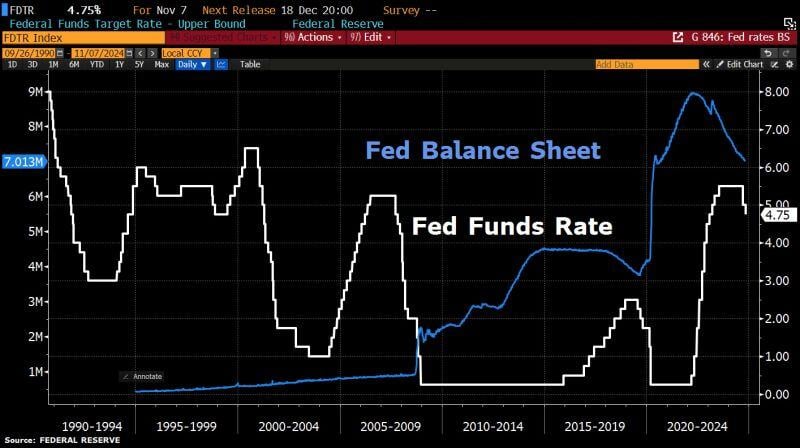

TRUMP LIKELY TO LET POWELL TO SERVE OUT TERM UNTIL MAY 2026

Source: CNN

Fed cuts rates by 25bps in unanimous decision as expected. So what did the Fed do?

👉 FED LOWERS BENCHMARK RATE 25 BPS TO 4.5%-4.75% RANGE 👉 FED SAYS RISKS TO GOALS REMAIN 'ROUGHLY IN BALANCE’ 👉 FED: LABOR MARKET CONDITIONS HAVE 'GENERALLY EASED' No dissent on this rate-cut decision. 🚨 Key changes: - Most notably, removing language that Fed has "gained greater confidence that inflation is moving sustainable toward 2 percent". - Adding that labor market conditions have "generally eased" since earlier in the year, replacing "job gains have slowed". Source: Bloomberg, www.zerohedge.com

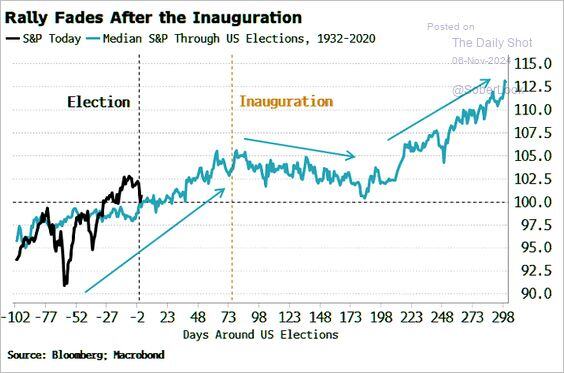

Following the election, the SP500 typically rallies through inauguration day before moderating.

Source: Bloomberg, Macrobond, Mike Zaccardi, CFA, CMT, MBA, The Daily Shot

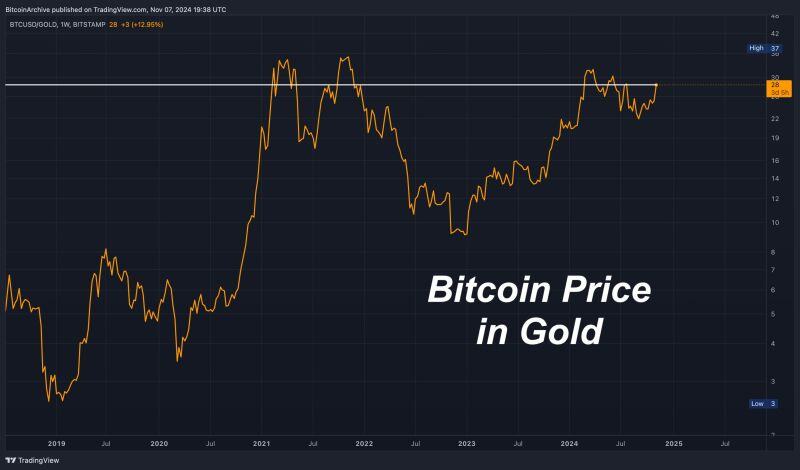

2 months before the bear-market bottom, the Wall Street Journal felt safe enough to kick Saylor with this WRONG headline.

There were ignorant calls on 𝕏 that MicroStrategy would be liquidated, even though there were no margin calls on the debt, which were mostly long duration 5-6 year terms. Source: Bitcoin Archive

Investing with intelligence

Our latest research, commentary and market outlooks