Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

JUST IN: MicroStrategy breaks $50 BILLION market cap and is now worth more than Ford Motor Company.

Ford has lost ~60% of its market cap since 2022 and holds $26 BILLION in cash, about 65% of its total market cap! The "melting ice cube" of cash holdings, eroded by inflation year after year. This is what Michael Saylor feared for his company when he decided to buy Bitcoin in 2020. MicroStrategy's market cap is UP ~45x since then. Source:

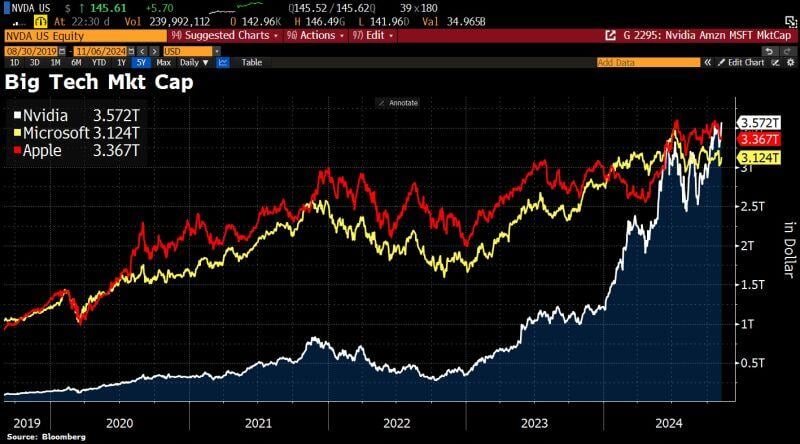

Nvidia is once again the most valuable company in the world.

Surpassing Apple and underscoring just how dominant AI has become on Wall Street. Nvidia's largest customers reported last week and explicitly stated that supply, not demand, remains a constraining factor. Source: HolgerZ, Bloomberg

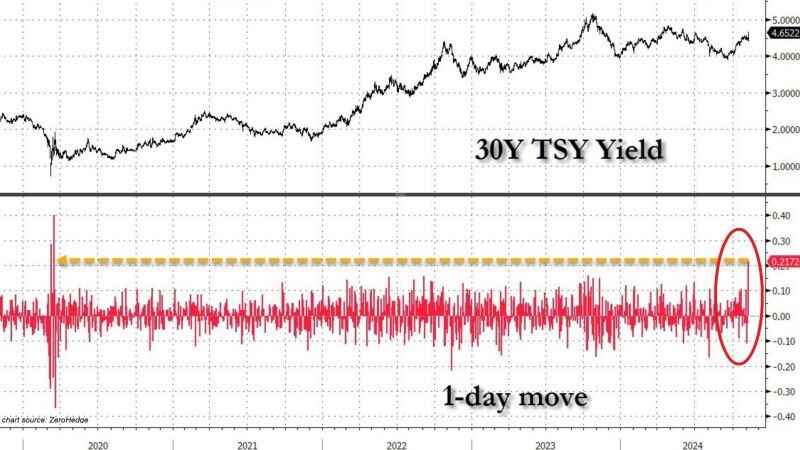

THIS IS AN ABSOLUTELY WILD MOVE >>>

The 30-year US Treasury jumped by a massive 22 basis points, the biggest spike since the COVID CRISIS. At the same time, the 10-year yield jumped by 16 basis points, to the highest since July. Meanwhile, the Fed is going to cut today.... Source: Global Markets Investor

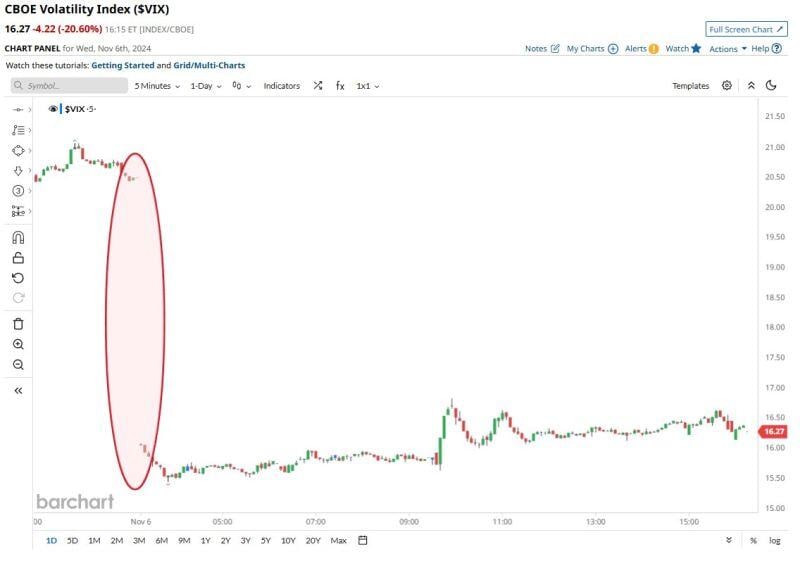

CBOE Volatility Index $VIX drops more than 20%, one of the largest declines in the last 2 decades

Source: Barchart

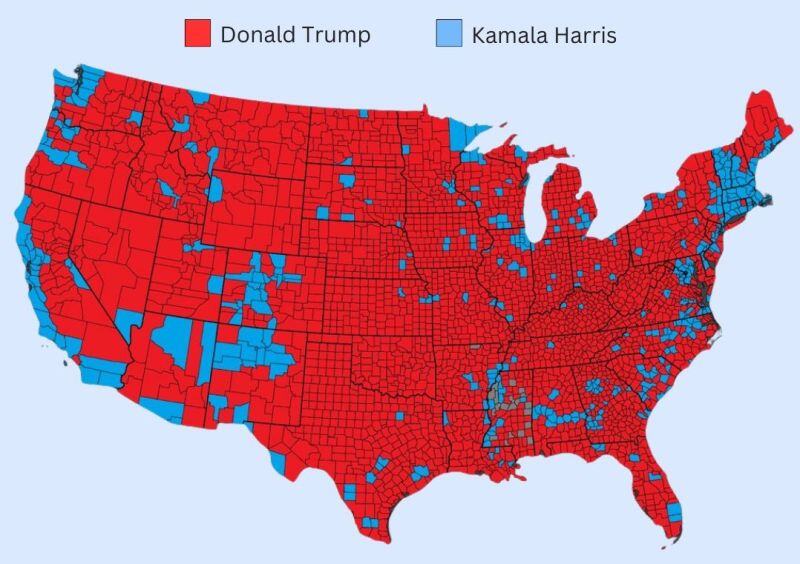

Political risk is in Europe, not in the US

The three-year-old union between Scholz’s Social Democratic Party (SPD), the Greens and Lindner’s Free Democratic Party (FDP) had been on shaky ground for some time. Chancellor Olaf Scholz said he would call for a confidence vote on Jan. 15, raising the possibility of elections earlier than scheduled in March. Source: FT, CNBC

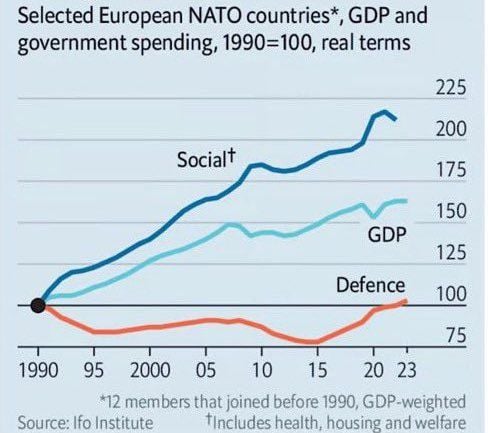

A double-whammy for Europe: tariffs on US exports + increased defence spending...

Source: The Economist

Investing with intelligence

Our latest research, commentary and market outlooks