Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

MicroStrategy just unveiled its bold new "21/21 Plan" to raise $42 billion in capital over the next 3 years.

The strategy includes $21 billion from equity and $21 billion from fixed income. With this capital injection, MicroStrategy aims to boost its Bitcoin holdings and enhance BTC yield, solidifying its commitment to Bitcoin as a core treasury reserve asset.

The share of US consumers expecting higher stock prices over the next 12 months hit 51.4%, the highest on record.

This is even higher than the previous records seen in 2018 and 2000 before the Dot-Com bubble peaked. The percentage has more than DOUBLED over the last 2 years as the stock market has seen one of the largest gains this century. The S&P 500 is now up 40% over the last 12 months marking its 4th best performance since 2000. Stock market sentiment has never been so euphoric. Source: The Kobeissi letter

"Buy Waste Management first thing in the morning"

Source: Not Jerome Powell on X

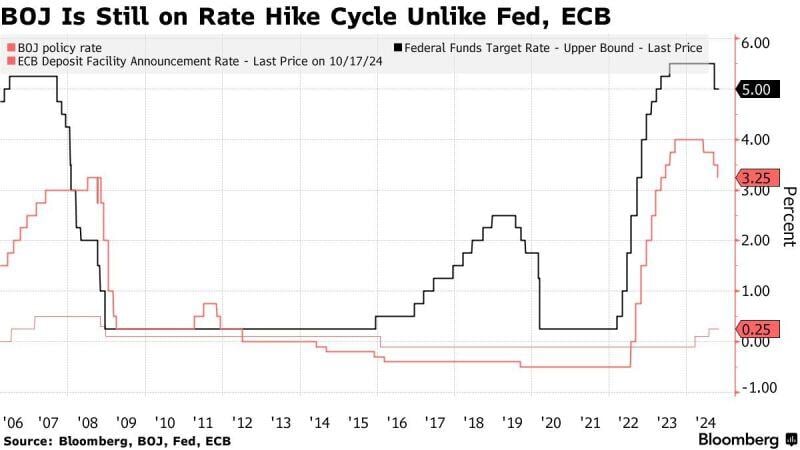

The BOJ kept interest rates steady on Thursday

The BOJ roughly maintained its forecast that inflation will hover near its 2% inflation target in coming years, signaling its readiness to continue rolling back its massive monetary stimulus. The Yen climbed as much as 0.9% on Ueda comments.

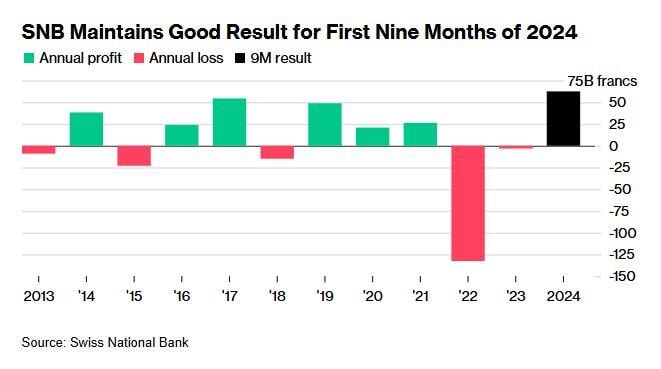

The Swiss National Bank made a solid nine-month profit on rising equities, bonds and gold prices, increasing the chances for a restart of profit distributions after a two-year break.

Switzerland’s central bank notched up a gain of 62.5 billion francs ($72 billion) for the first nine months of the year, it said on Thursday. Although the strong franc ate into the results, the SNB extended its profit during the July-September period. Source: Bloomberg

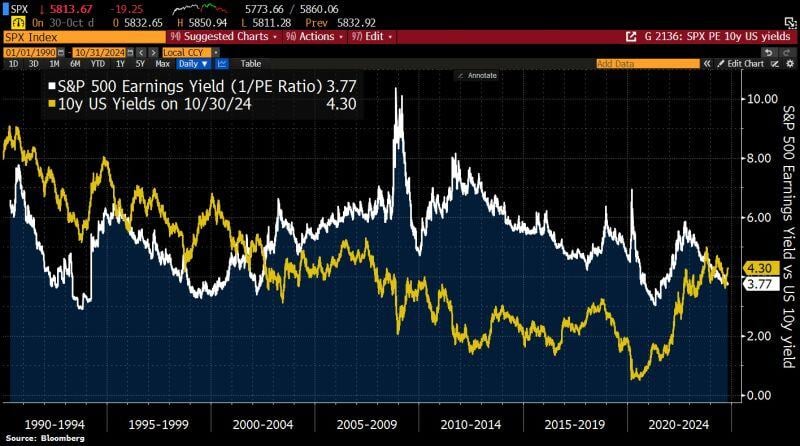

It seems the stock markets haven’t yet recognized that equity risk premiums have turned negative.

The yield on the 10y US bond is now higher than the earnings yield of the S&P 500... Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks