Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

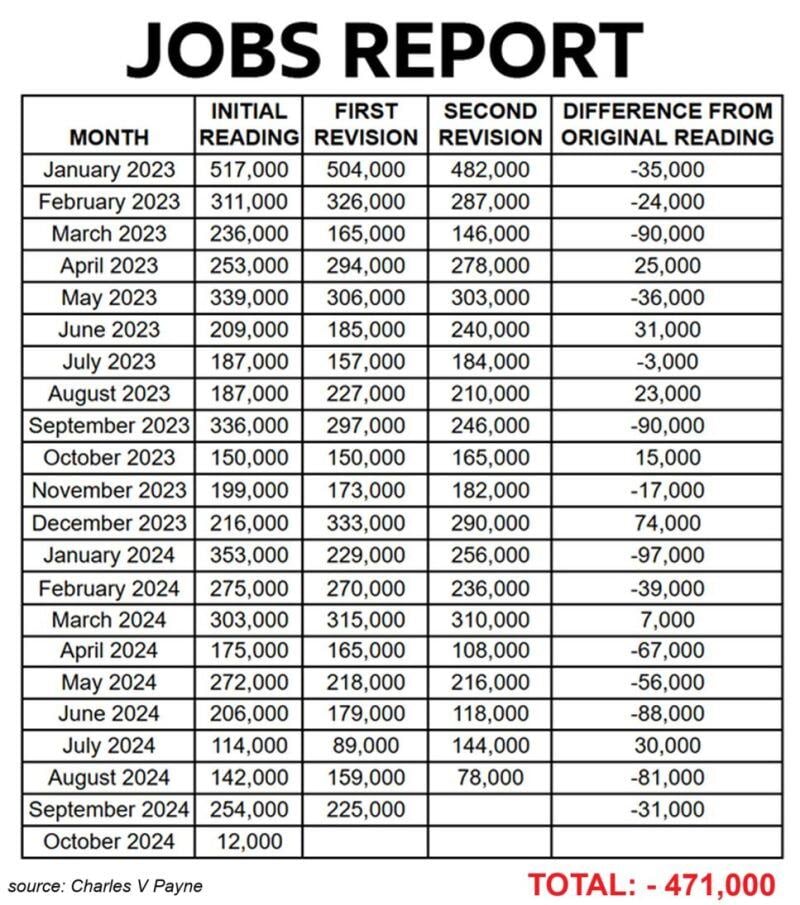

😱 US JOB MARKET IS MUCH WEAKER THAN IT SEEMS 😱

Since January 2023, the number of jobs have been revised DOWN by A MASSIVE 471,000, the most since the 2008 Financial Crisis. Monthly nonfarm payrolls have been revised DOWNWARD in 14 out of the last 21 months. Source: Global Markets Investor

Halloween Day Massacre $SPY

$953 BILLION was wiped out from the US stock market yesterday. Bloomberg, WallStreetbets

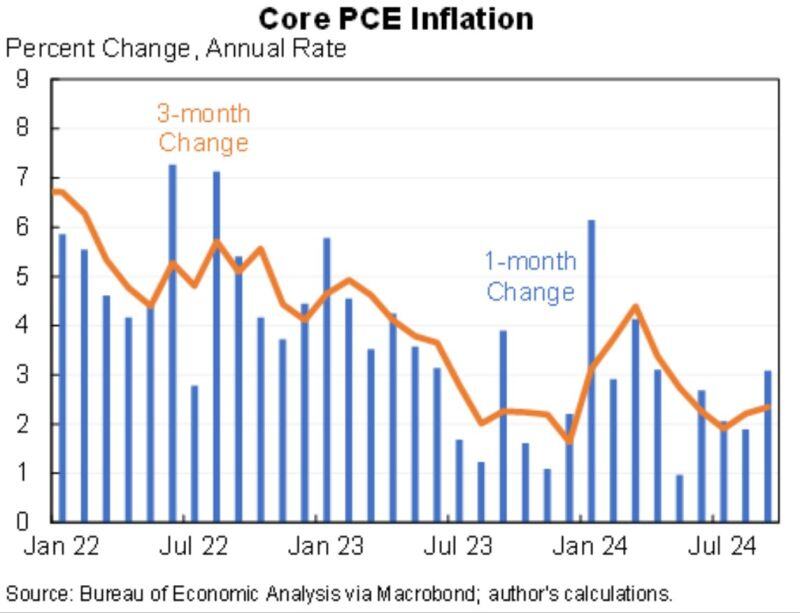

Core PCE is closer to 3 than 2

And ticked UP in the last month Source: Amy Niyom

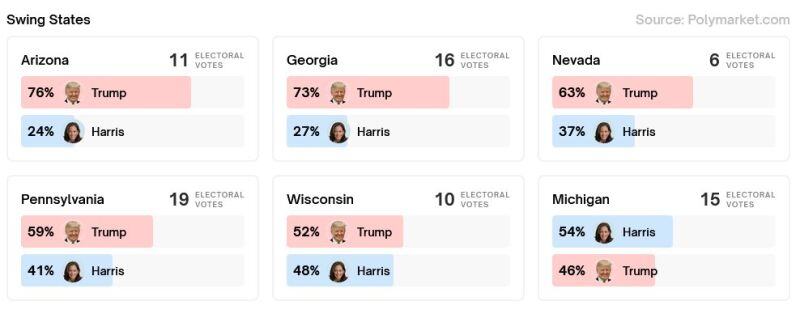

🚨 US ELECTION UPDATE >>> The "Trump trade" took a hit yesterdy (see bitcoin now trading below $70k).

One of the reasons could be this: Yesterday saw a big jump in Kamala's Michigan odds where she is again back on top; Wisconsin is also on the cusp of going back blue. After Trump had a comfortable lead in all swing states over the past week (he still leads comfortably in AZ, NC, PA, NV, GA) there has been a reversal in MI and WI. Thuis makes the race tighter hence some profit taking. Source: zerohedge

UK borrowing costs hit highest level this year as gilt sell-off intensifies.

This should not come as a surprise, Eurizon SLJ Research's Stephen Jen says: When the debt stock is 99% of GDP, and the govt imposes the largest tax hike post-WWII and the largest increase in spending in multi-decades, why should one be surprised that the bond market shows signs of indigestion? Source: HolgerZ, FT

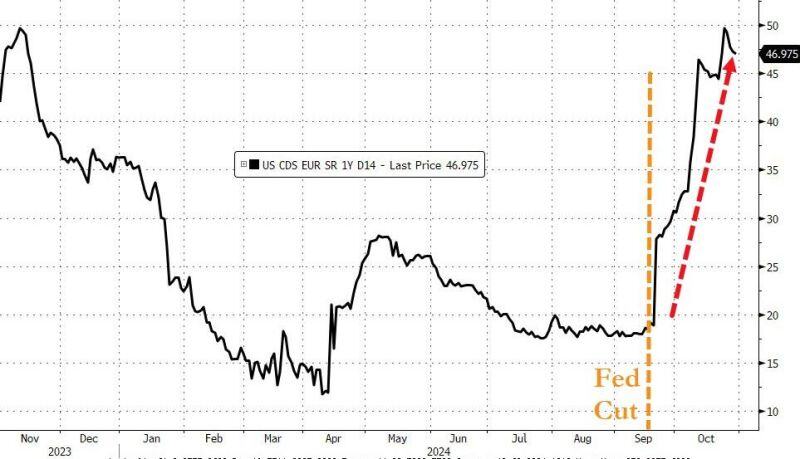

Since The Fed cut rates, USA Sovereign risk has exploded higher...

Source: www.zerohedge.com, Bloomberg

Why is it happening?

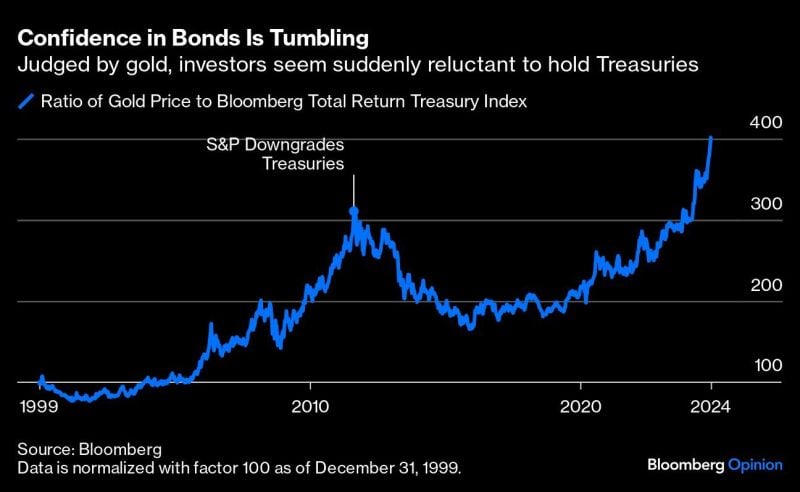

With Interest Expense soaring and US debt/GDP at 125% & rising, the only way the US can keep USTs nominally money good are via negative real rates. hence the gold outperformance. Source: Bloomberg, Luke Gromen

Investing with intelligence

Our latest research, commentary and market outlooks