Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

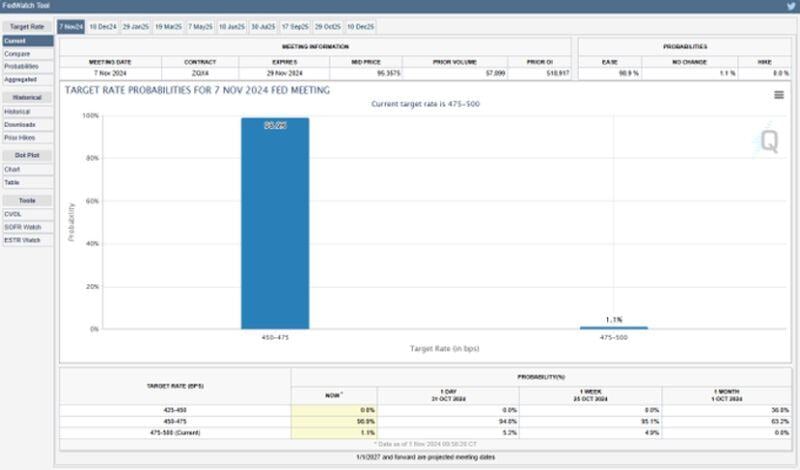

🚨 There is now a 99% chance of a 25 bps interest rate cut at next week's FOMC Meeting 🚨

Source: Barchart

Pennsylvania is the key state to watch. The winner there might takes it all.

Volatility on this state in betting websites is huge and should not be overread. A few hours ago Trump is back on top (Polymarkets). That could flip again today.

📢THE MOST IMPORTANT WEEK OF THE YEAR...

👉 In the US U.S. Presidential Election – Tuesday ISM Services PMI – Tuesday Initial Jobless Claims – Thursday Fed Rate Decision – Thursday U.S. Consumer Sentiment - Friday 👉 In the rest of the world BoE on Thursday In China, the NPC Standing Committee meeting will be closely watched for stimulus signals. 👉Earnings Notable earnings reports include Berkshire Hathaway (was Saturday), Palantir, Qualcomm and Novo Nordisk.

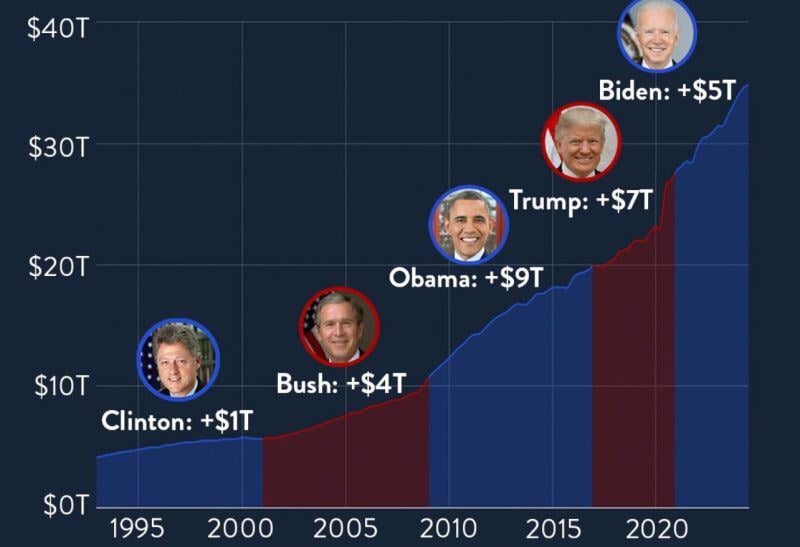

It doesn’t matter who becomes president. The trend is clear:

More debt creation, more money printing Source: Seek Wiser, Quinten | 048.eth

The biggest driver of US equity demand has been buybacks, with $5.5T of purchases since 2000

Source: Markets & Mayhem, Bloomberg

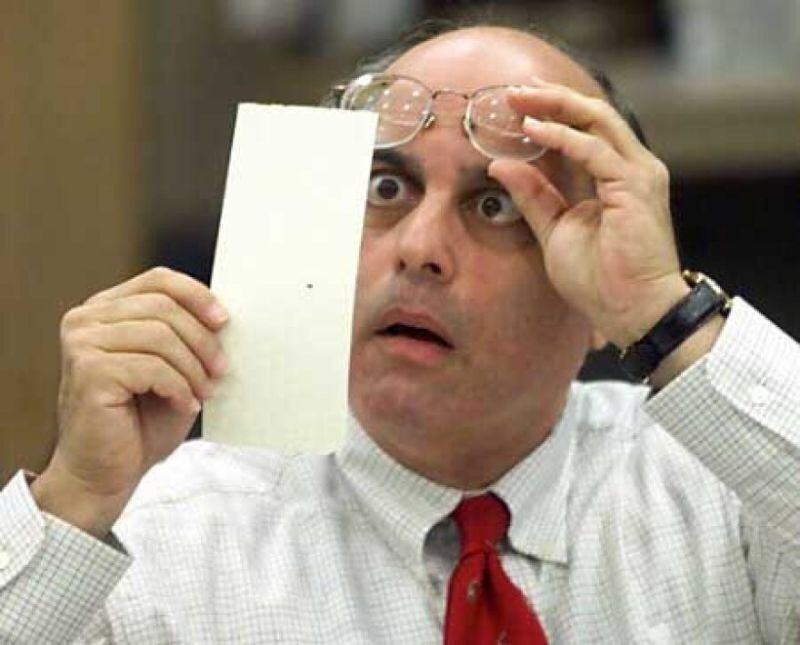

Most likely the biggest market fear:

A redux of 2000 elections with no result being known before days or weeks...

Countries with voters ID... Why isn't the US on this list?

Source. The Rabbit Hole, Elon Musk on X, Fox

🏇 The race to $4 Trillion...

Apple $AAPL $3,369,000,000,000 NVIDIA $NVDA $3,320,000,000,000 Microsoft $MSFT $3,051,000,000,000 Who will be the first to hit $4 trillion market cap? Source: Trendspider

Investing with intelligence

Our latest research, commentary and market outlooks