Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

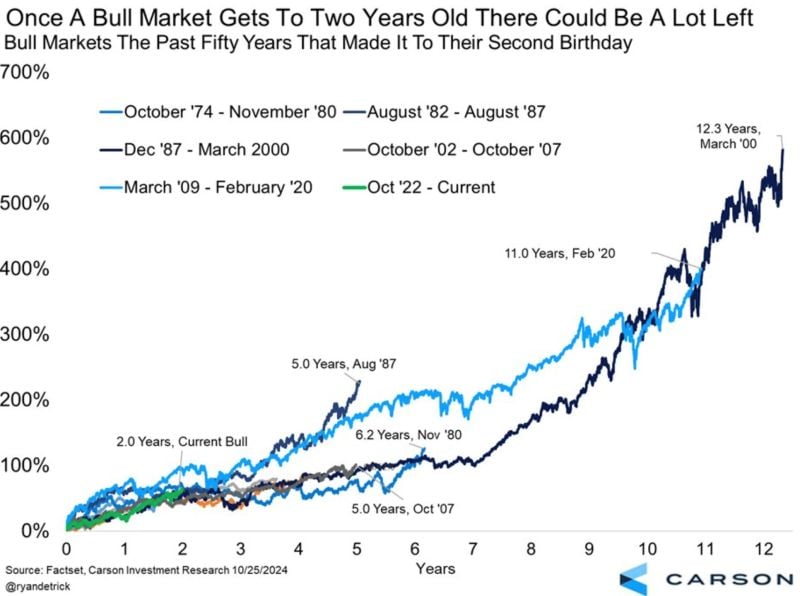

US equities Bull markets go on longer than many of us think they will.

Source: Carson, RBC

Just in 🔉 Reuters sources: China's leading legislative body weighs approval of new fiscal package exceeding 10 trillion yuan ($1.4 trillion dollars) on November 8

Sources: China intends to approve raising new 10 trillion yuan debt through special treasury and local government bonds in upcoming years. fiscal plan to allocate 6 trillion yuan for local government debt and up to 4 trillion yuan for idle land and property acquisition. China could unveil enhanced fiscal measures if trump secures U.S. presidency.

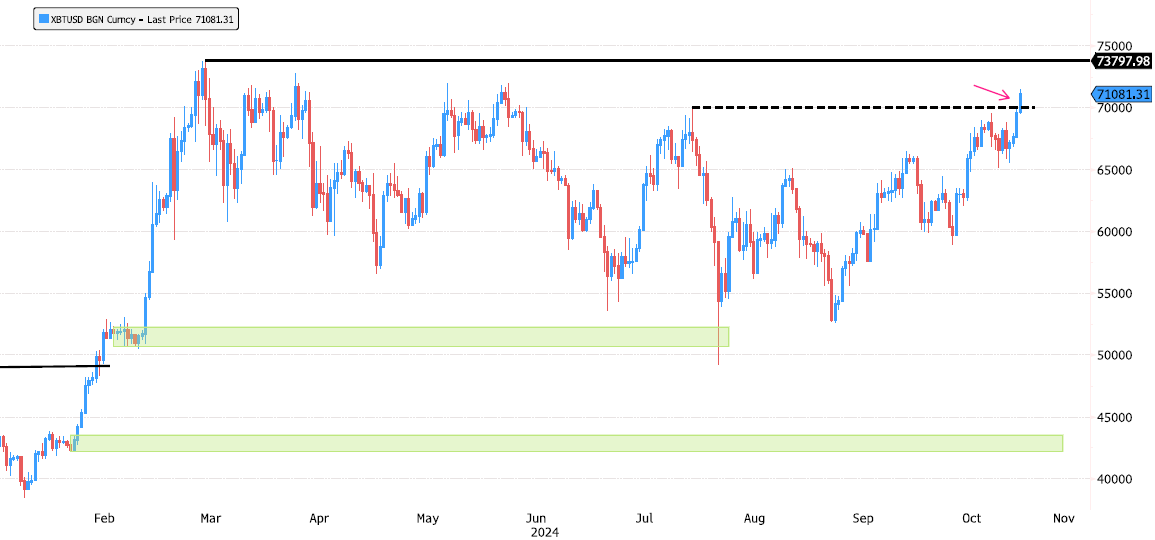

Bitcoin Breaking 1st Important Resistance

Bitcoin (XBTUSD) is breaking the 70,000 resistance level! This marks the first confirmation of the end of a 7-month consolidation phase. Next level to keep an eye on is 73,798. Source: Bloomberg

An image is worth 10,000 words...

The Trump trade visual (Republican basket index in red, Democrats basket in blue) Source: Bloomberg, GS, RBC

Investing with intelligence

Our latest research, commentary and market outlooks