Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

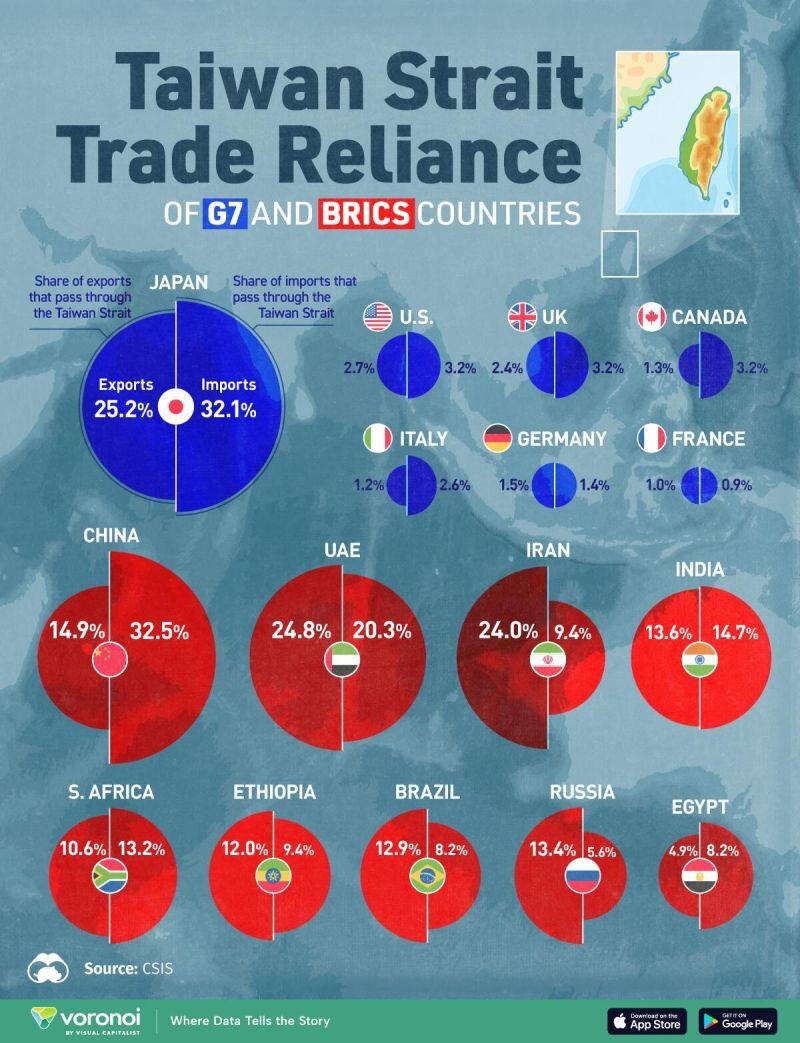

This graphic, via Visual Capitalist's Kayla Zhu, visualizes the share of exports and imports that move through the Taiwan Strait, broken down by the G7 and BRICS countries.

With China continuing to conduct military drills near Taiwan, as well as recently reaffirming that use of force will always remain an option to bring Taiwan under its control, concerns have grown over how potential Chinese actions in the region could impact global trade through the Taiwan Strait.BRICS countries overall are more exposed to disruptions to trade routes in the Taiwan Strait, specifically China, the United Arab Emirates, and Iran. The latter two have 24% or more of its exports pass through the strait. China and Japan are the most reliant on the Taiwan Strait for both imports and exports, specifically imports. Almost a third of both countries’ imports pass through the Taiwan Strait. Source: Visual Capitalist, www.zerohedge.com

Nestle Showing Bullish Signs on Intraday Chart

Nestle (NESN SW) has consolidated 37% since January 2022 and recently reached a major swing support zone at 83.37-86.91. The intraday chart is starting to show bullish signs, though it’s still a bit early to confirm a trend reversal. Stay alert for further signals! Source: Bloomberg

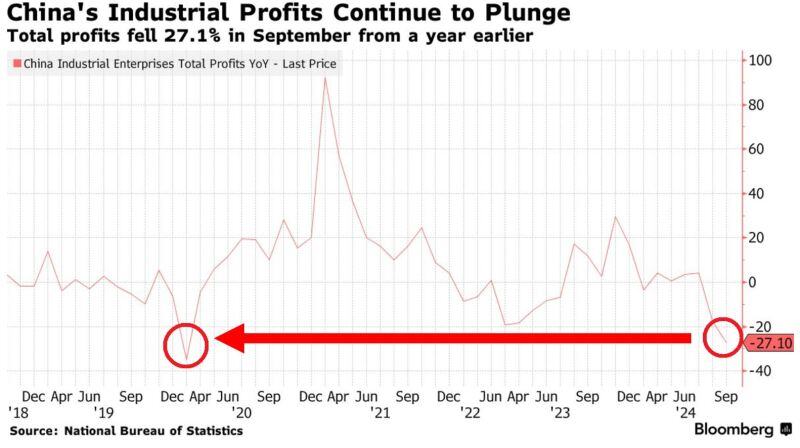

CHINA'S INDUSTRIAL PROFITS FELL TO THE LOWEST SINCE THE COVID CRISIS

Industrial profits at large Chinese companies PLUMMETED 27.1% year-over-year in September, the most since the COVID CRISIS. This is after they FELL 17.8% in August. China is in deep economic trouble. Source: Global Markets Investor, Bloomberg

Strong momentum for Solana $SOL and poor momentum for Ethereum $ETH

Source: SolanaFloor

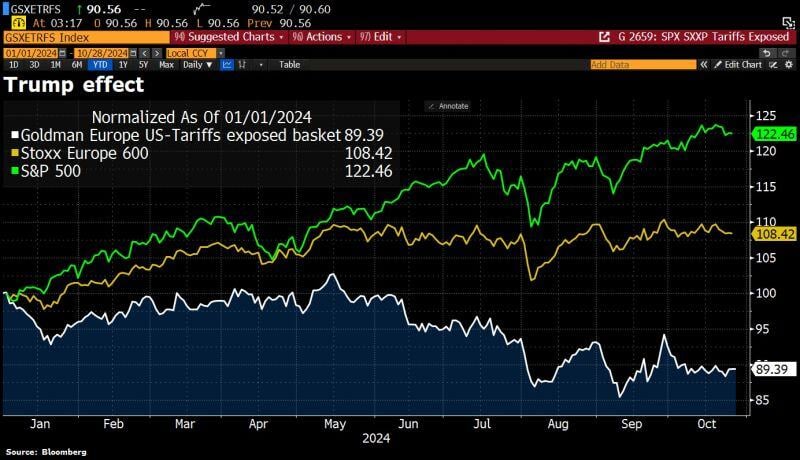

European stocks are hit by a ‘Trump effect’ as odds tilt towards Republican win.

A basket of 22 European stocks exposed to US tariffs compiled by Goldman Sachs has tumbled 5% since late September as the former president’s odds of an election victory shorten. The basket, which includes Diageo, Porsche, Mercedes, Adidas or Moller Maersk is now down 11% this year, compared with an 8% rise for the broader European stock market and 22.5% for the S&P500. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks