Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

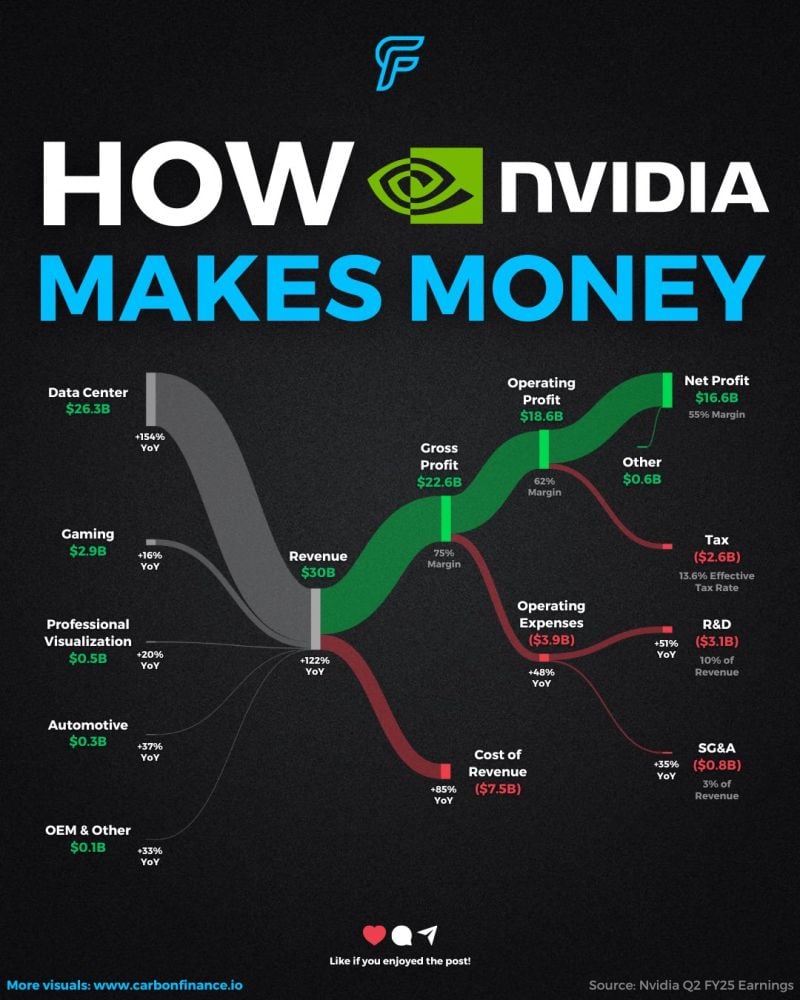

How Nvidia $NVDA makes money

🙈 The stock is up nearly 200% YTD Source: Carbon Finance

A reminder by Lawrence McDonald that palladium bull markets can be quite brutal.

Despite recent price fluctuations, the long-term demand for palladium remains robust, driven by stringent environmental regulations and the rise of the hydrogen economy. Meanwhile, supply concerns persist due to the unreliability of major producers like Russia and South Africa.

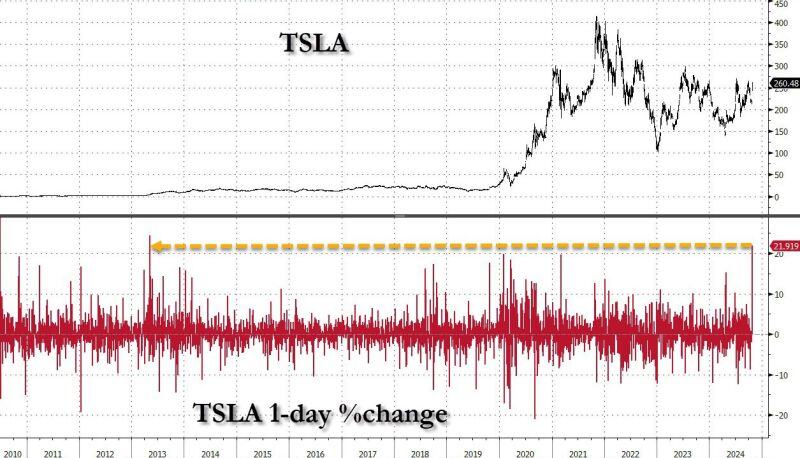

Yesterday was the second biggest jump in Tesla $TSLA stock on record (+22%)

Only May 9, 2013 was bigger: that's when Tesla reported its first ever quarterly profit. Elon added $26BN to his net worth. Source: Bloomberg, zerohedge

Shorts estimated to be $1.3 Billion underwater on silver. Which five banks are at risk??

"Silver prices have experienced a significant increase, rising over 6% to exceed $33.6 per ounce. This unexpected surge has put five U.S. banks at risk of substantial financial losses due to their large short positions in the metal. This amounts to approximately 707.9 million ounces, nearly equaling a year’s global silver production". Source: Yahoo Finance, @kshaughnessy2 on X

Polymarket has identified “Fredi9999”, the user who has bet ~$45 million on Trump.

He’s a french national with “extensive trading experience” and is not “manipulating” the market. He is just truly accumulating a massive position. Source: Geiger Capital

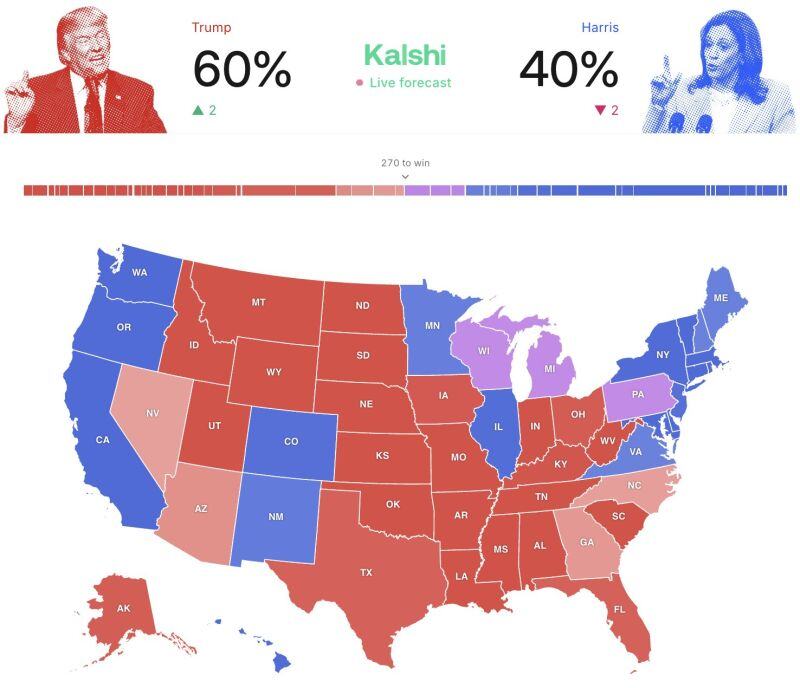

BREAKING: Donald Trump now leads in all swing states in the 2024 election with a 60% chance of winning the election.

With over $100 million traded on Kalshi, election markets continue to suggest Trump's lead is widening. The election is now 11 days away. Source: The Kobeissi Letter

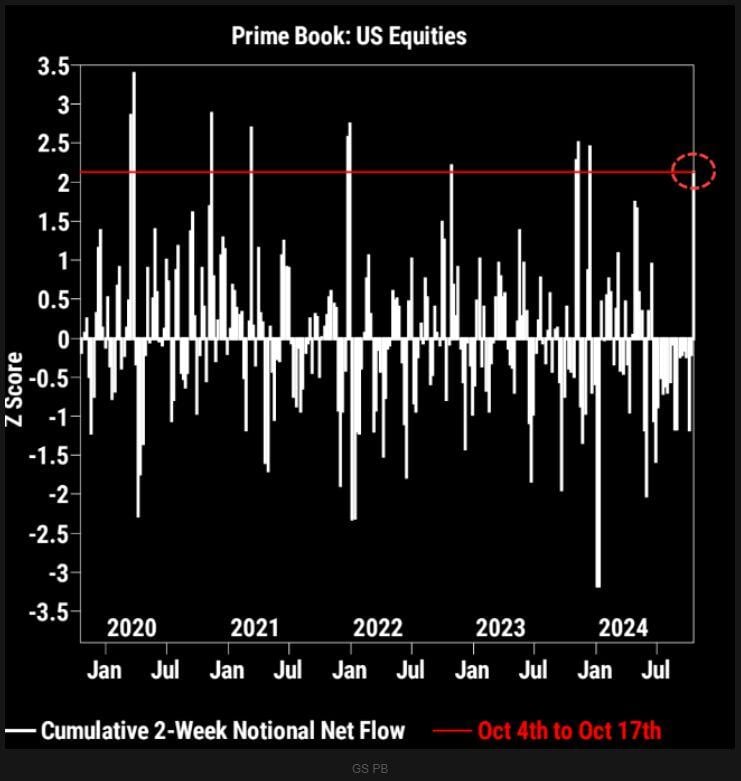

Hedge Funds are buying U.S. Stocks at the fastest pace this year 🚨

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks