Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

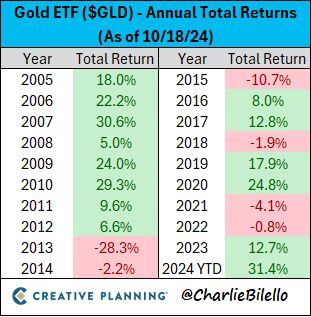

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

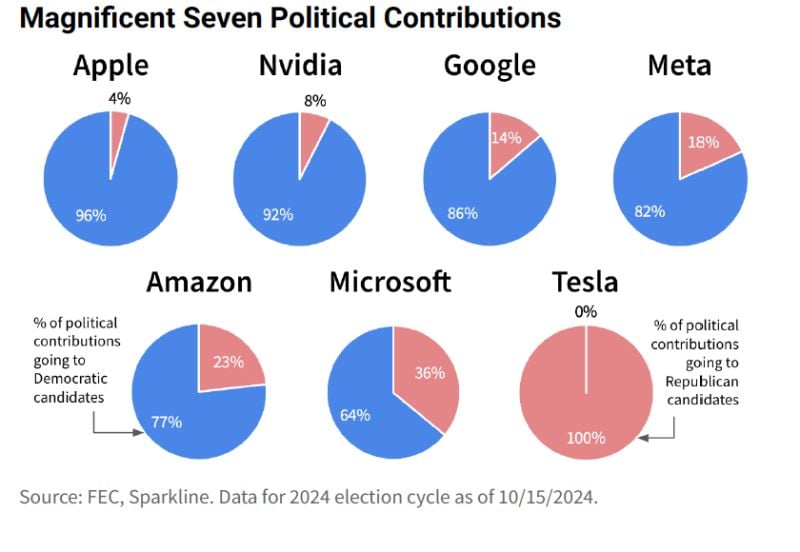

😱 The shocking chart of the day >>> Mag 7 political donations....one of these is not like the others...😱

Source: Meb Faber on X

“Discipline or regret: the choice is yours”

Source: Nigel D'Souza @Nigel__DSouza

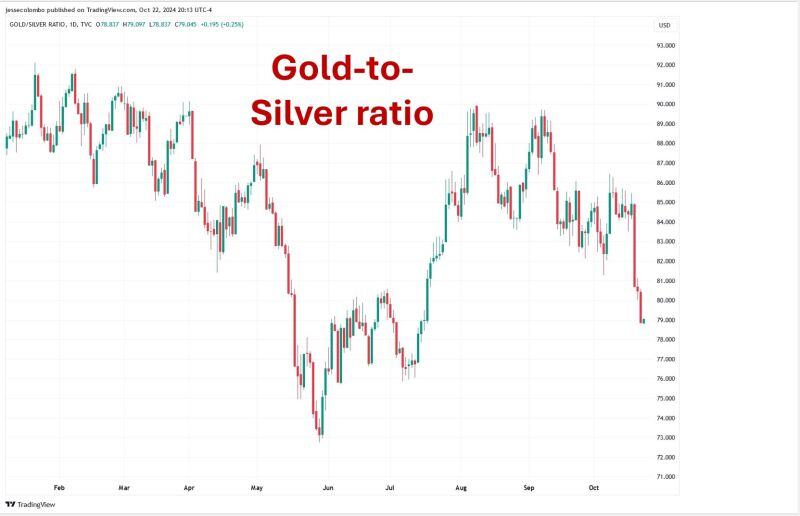

JUST IN 🚨: Silver is going parabolic as it jumps to highest price in more than 12 years

Source: Barchart

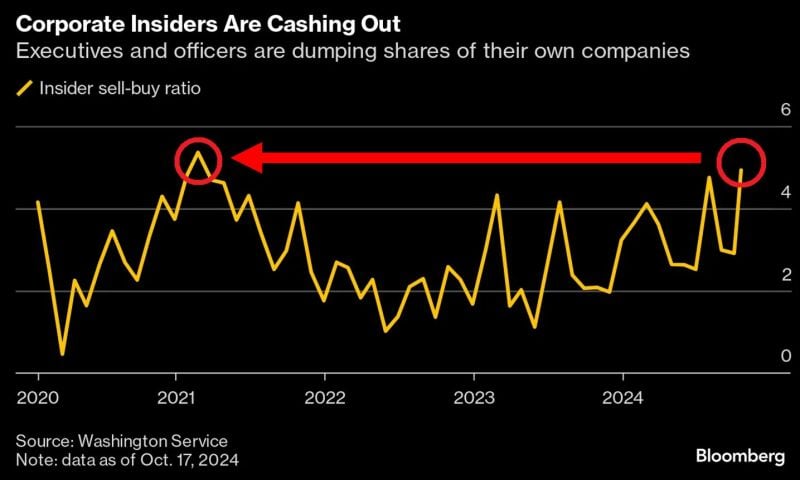

😱 US EXECUTIVES ARE SELLING STOCKS 😱

The insider sell-to-buy ratio jumped to the highest level since 2021. Source: Global Markets Investor, Bloomberg

*AMAZON $AMZN PREPARES FOR LAUNCH OF LOW-COST, TEMU-RIVAL DISCOUNT STORE $PDD

As initially reported back in June, Amazon is preparing for the launch of its new discount online storefront which will compete directly with Chinese e-Commerce rival 'Temu'. Strict "price caps" will be set for merchants, with shockingly low price limits, such as $8 for jewlery and $20 for sofas. Source: Stock Talk on X

The gold-silver ratio continues to plummet, which adds further credence to this silver breakout and bull market.

Source: Jesse Colombo @TheBubbleBubble

Investing with intelligence

Our latest research, commentary and market outlooks