Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

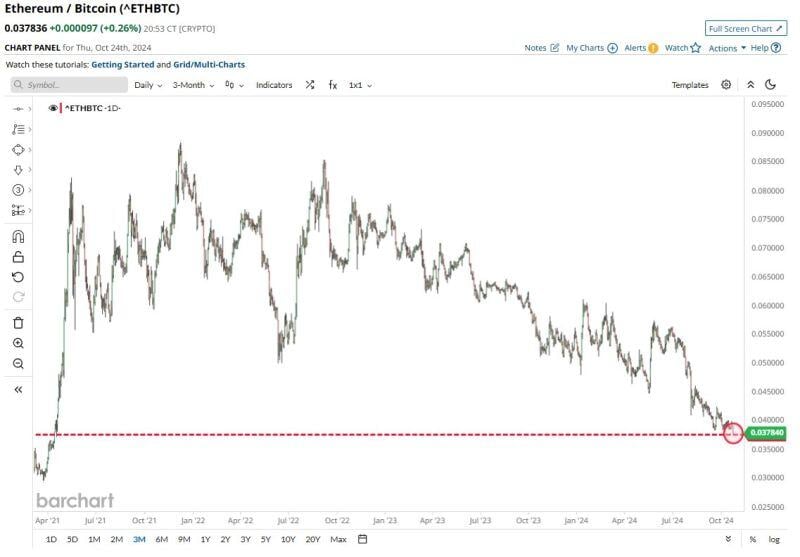

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

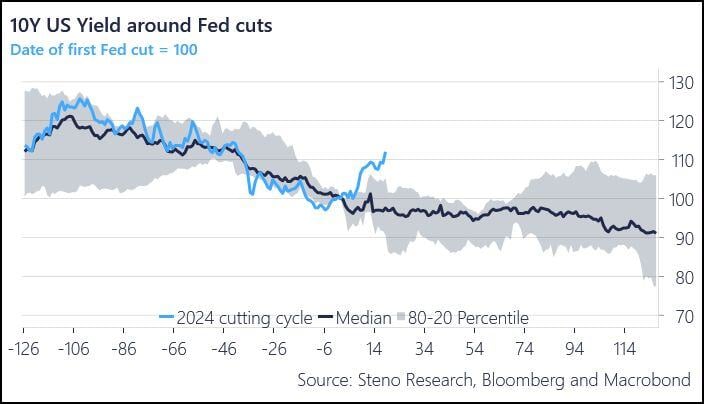

The move in bond yields after the 50bp cut is very out of the ordinary.

Source: Andreas Steno Larsen @AndreasSteno on X

Finally some red on the S&P 500 index heat map...

US stocks plummeted yesterday as 10-year treasury yields and us dollar have risen for the last couple of weeks. Gold and Silver dropped sharply as well. Performance today: S&P 500 -0.9% Nasdaq -1.6% Russell 2000 -0.9% Dow Jones -1.0% Bitcoin -1.6% Bank Index +0.3% VIX +6%, front mth futures VIX +5% Gold -1.1% Silver -3.5% WTI Crude Oil -1.0% Source: Global Markets investor

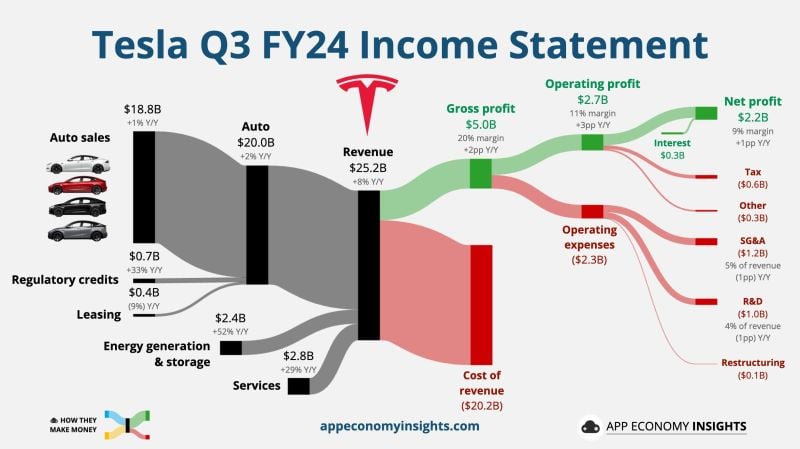

𝗧𝗲𝘀𝗹𝗮 𝗤𝟯 𝟮𝟬𝟮𝟰 𝗘𝗮𝗿𝗻𝗶𝗻𝗴𝘀 $TSLA

EPS: $0.72 vs $0.60 est. (beat) Revenue: $25.18B vs $25.67B est. (miss) Gross margin: 19.6% vs 16.8% est. (beat) Free Cash Flow: $2.74B vs $1.61B est. (beat) Outlook 2024: - Slight growth in vehicle deliveries - Doubling of energy storage Outlook 2025: - New vehicles start production with more affordable models leveraging current and next-gen platforms - Over 50% growth in vehicle production compared to 2023 Shares: +6.6% after hours Source: App Economy Insights, The Future Investors

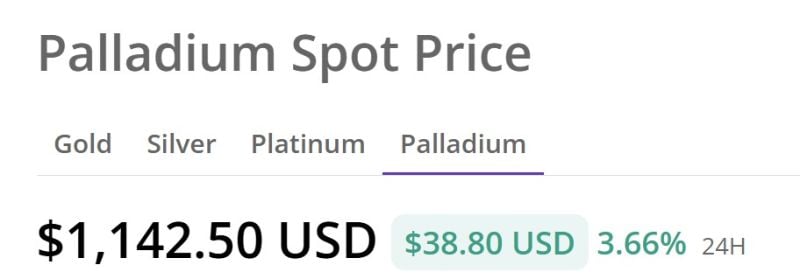

US ASKS G-7 TO CONSIDER SANCTIONS ON RUSSIAN PALLADIUM, TITANIUM

Palladium will soar if this goes through: Russia makes 40% of the world's palladium

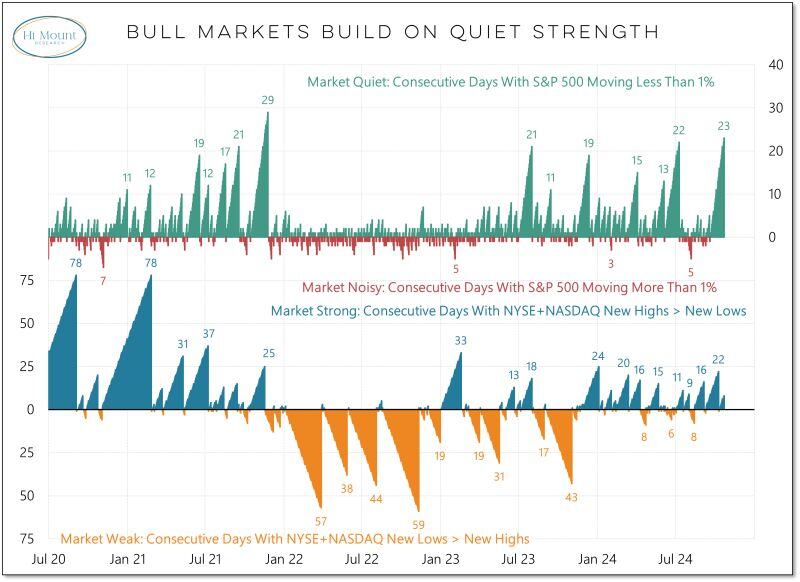

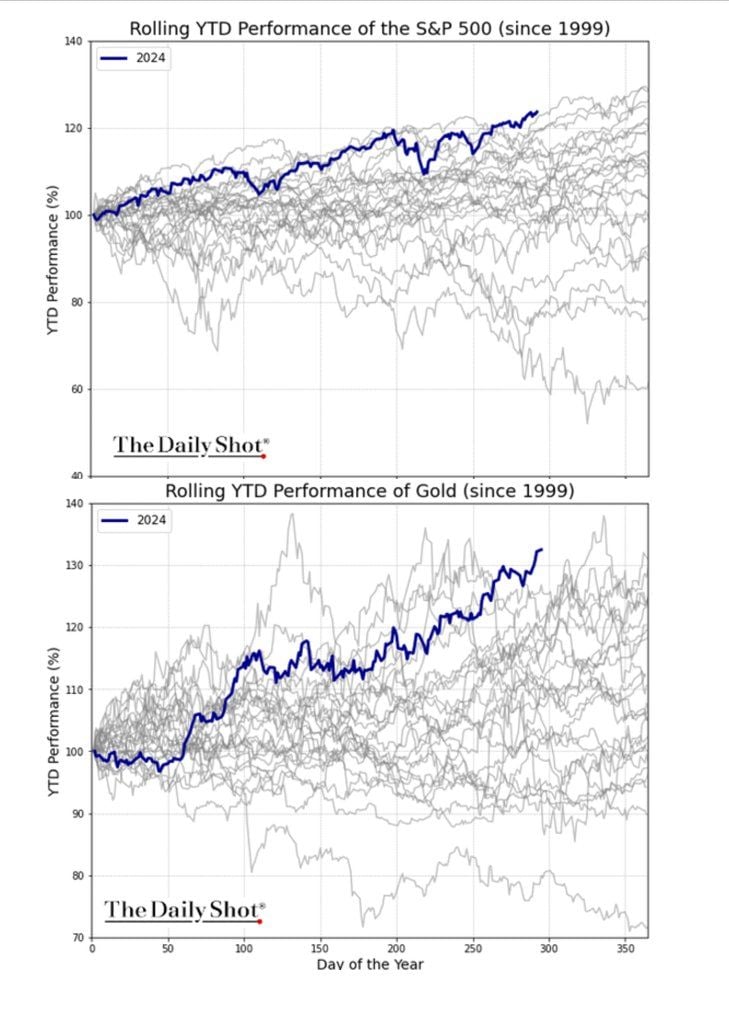

Gold and stocks *both* with their best YTD performance in 25yrs this year.

Not really the sort of market action that is aligned with an aggressive easing cycle... h/t @thedailyshot thru Bob Elliott on X

Emancipation from the West and the quest for multipolarity is one one of the megatrend we are currently following.

The BRICS Summit in Kazan is one illustration of this trend. Narandra Modi on X: "With fellow BRICS leaders at the Summit in Kazan, Russia. This Summit is special because we welcomed the new BRICS members. This forum has immense potential to make our planet better and more sustainable". The “BRICspansion” is part of a plan to “reshape global governance into a ‘multipolar’ world order that puts voices of the Global South at the center of the world agenda. This megatrend have important consequences on the geopolitocal, macro and markets side. Among them: - De-dollarization and lower demand for US Treasuries - Reshoring, friendshoring, nearshoring - From "just-in-time" inventory to "just-in-case" inventory - Higher demand for commodities including precious metals - Structurally higher inflation

Investing with intelligence

Our latest research, commentary and market outlooks