Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

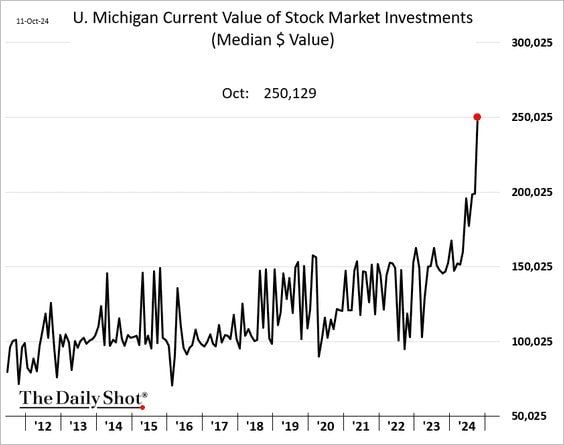

😱 The shocking chart of the day >>> The median value of US households’ stock portfolios has surged to $250k this month... 😱

This is twice as much as in early 2023... Middle to high income households enjoy a very strong "wealth effect" as both real estate and stock prices hit all time highs... Source: Stocktwits

"The first rule of compounding is to never interrupt it unnecessarily." - Charlie Munger

Source: Charlie Bilello

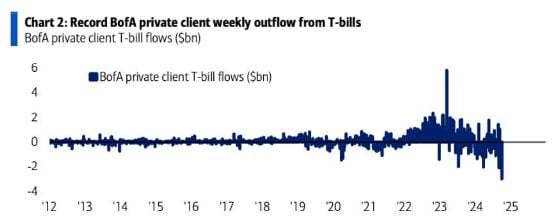

Investors sold the most amount of Treasury Bills in history this week

Source: Bank of America

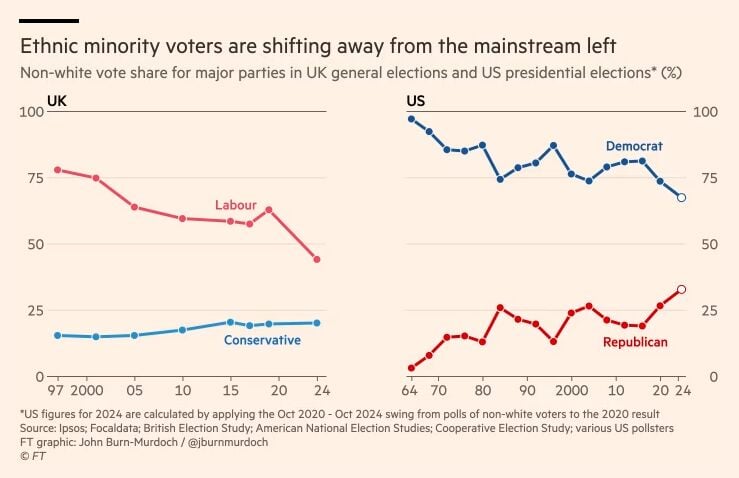

The left is losing its grip on ethnic minority voters.

Here's why politicians of all stripes would be wise to start listening to what different ethnic minority voters actually want https://on.ft.com/3U3JEIB

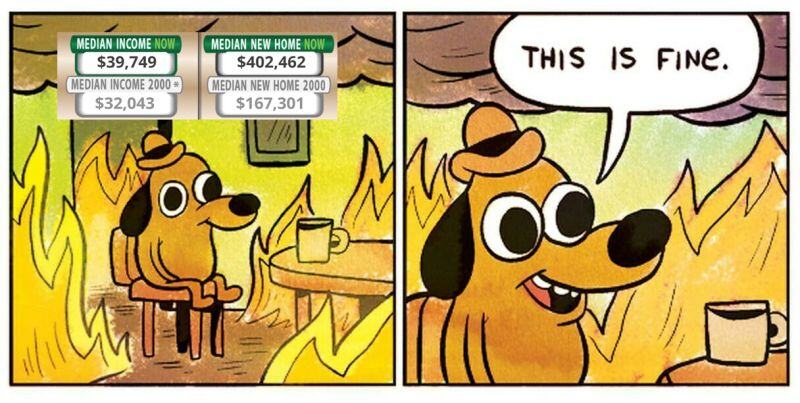

Between 2000 and 2024:

US Income +24% US House prices +140% Source: Trend Spider

Investing with intelligence

Our latest research, commentary and market outlooks